Introduction

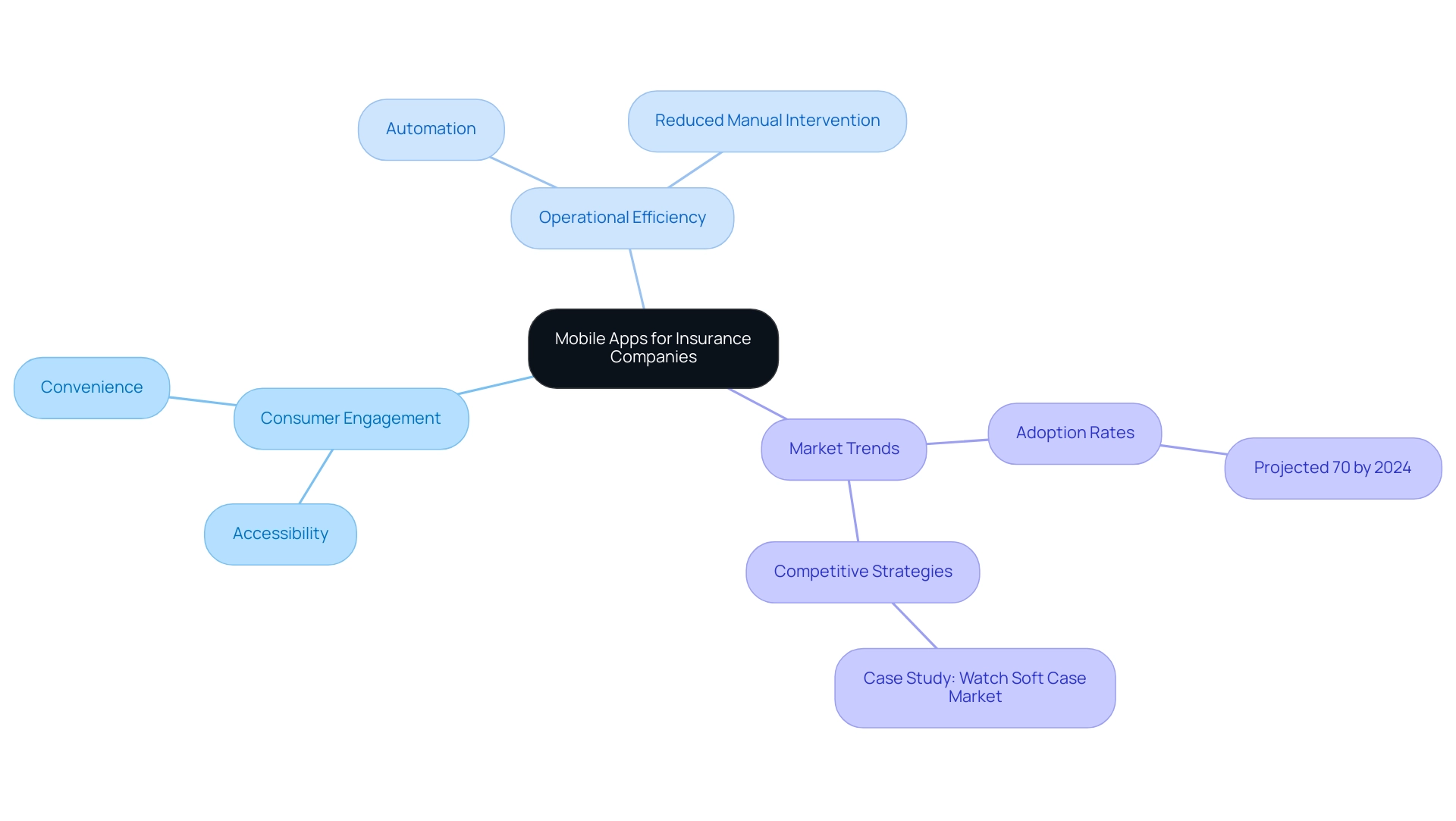

In an era where convenience and accessibility reign supreme, insurance companies are compelled to adapt to the evolving expectations of their customers. The rise of mobile applications has emerged as a game-changer in the industry, offering a seamless way for policyholders to manage their insurance needs with just a few taps on their smartphones.

As organizations strive to enhance customer engagement and streamline operations, the integration of mobile solutions is not merely a response to consumer demand; it is a strategic imperative. With projections indicating a significant surge in mobile app adoption within the insurance sector, companies that embrace this technological shift stand to gain a competitive edge.

This article delves into the necessity of mobile apps for insurance providers, exploring key features that drive user satisfaction, diverse application categories, and the myriad benefits that these digital tools bring to the table. As the landscape of insurance continues to evolve, understanding and leveraging mobile technology will be crucial for success in the coming years.

The Necessity of Mobile Apps for Insurance Companies

In the current digital era, insurance firms are under mounting pressure to meet consumer demands for accessibility and convenience. Mobile apps for insurance companies have emerged as essential tools that not only improve user engagement but also streamline operations. These platforms empower policyholders to effortlessly access vital information, submit claims, and maintain communication with their insurers.

Tajammul Pangarkar, CMO at Prudour Pvt Ltd, emphasizes that 'the integration of cellular solutions is not just a trend; it’s a fundamental shift in how insurers engage with their customers.' The increasing dependence on portable technology is emphasized by the anticipation that North America will persist in leading the application market for coverage, propelled by both the presence of top companies in the sector and elevated consumer adoption rates. According to recent statistics, the application adoption rate in the coverage sector is projected to reach 70% by 2024, highlighting the urgency for companies to adapt.

Moreover, mobile apps for insurance companies can dramatically boost operational efficiency by automating various processes, minimizing the need for manual intervention. As consumers more frequently rely on their smartphones for daily tasks, the incorporation of mobile apps for insurance companies has transitioned from a luxury to a necessity for providers eager to sustain competitiveness and significance within the sector. This trend aligns with the latest research, which indicates that organizations adopting portable solutions can significantly enhance customer satisfaction and engagement.

Moreover, examining competitive strategies, as demonstrated in the watch soft case market case study, shows that coverage providers can utilize application features to achieve a market advantage and react effectively to changing consumer demands.

Key Features of Effective Insurance Mobile Apps

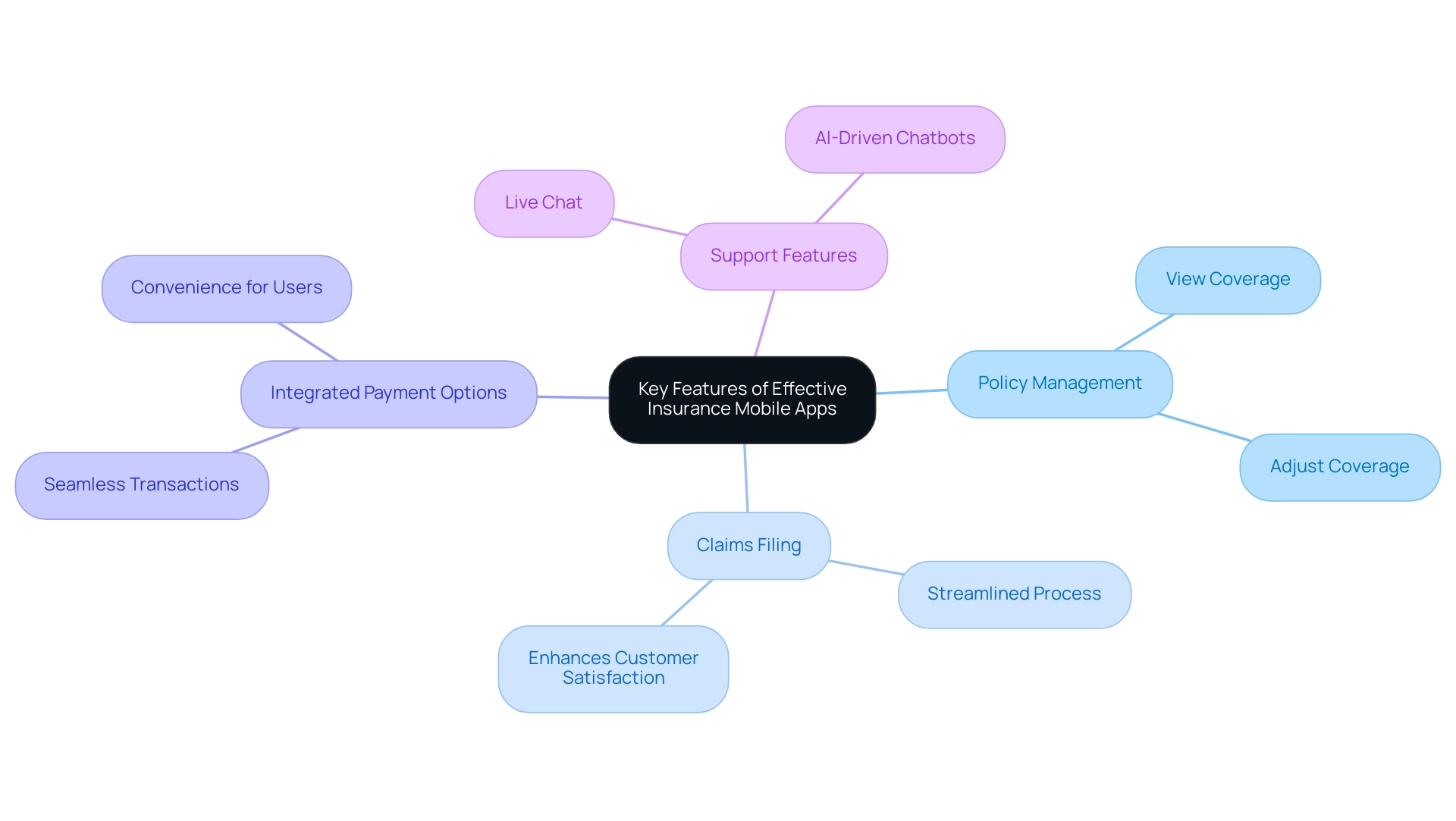

To create effective mobile apps for insurance companies, several key features must be prioritized. First, policy management capabilities are crucial; they allow users to easily view, adjust, and understand their coverage. A streamlined claims filing process is equally essential, as it can significantly enhance customer satisfaction and trust.

Recent statistics indicate that over 32% of policyholders now pay their home insurance online, illustrating a clear shift toward digital engagement. Furthermore, integrated premium payment options within the app improve user convenience, enabling seamless transactions directly from mobile devices. Robust support features, including live chat and AI-driven chatbots, provide immediate assistance, addressing user queries and concerns swiftly.

By embedding these functionalities, insurers can foster a user-centric experience that not only meets client expectations but also cultivates loyalty and engagement in an increasingly competitive market. As the worldwide coverage market is anticipated to expand at a CAGR of 52% from 2021 to 2030, reaching an estimated USD 166.7 billion, investing in mobile apps for insurance companies for coverage services is a wise decision due to the steady future demand. Additionally, consulting with industry experts can enhance client engagement and streamline operations, ensuring the app meets industry standards.

Furthermore, embedded insurance can decrease client acquisition expenses for insurers, emphasizing the significance of applications in contemporary marketing strategies. Focusing on the core features is imperative for success in 2024 and beyond.

Diverse Categories of Insurance Mobile Applications

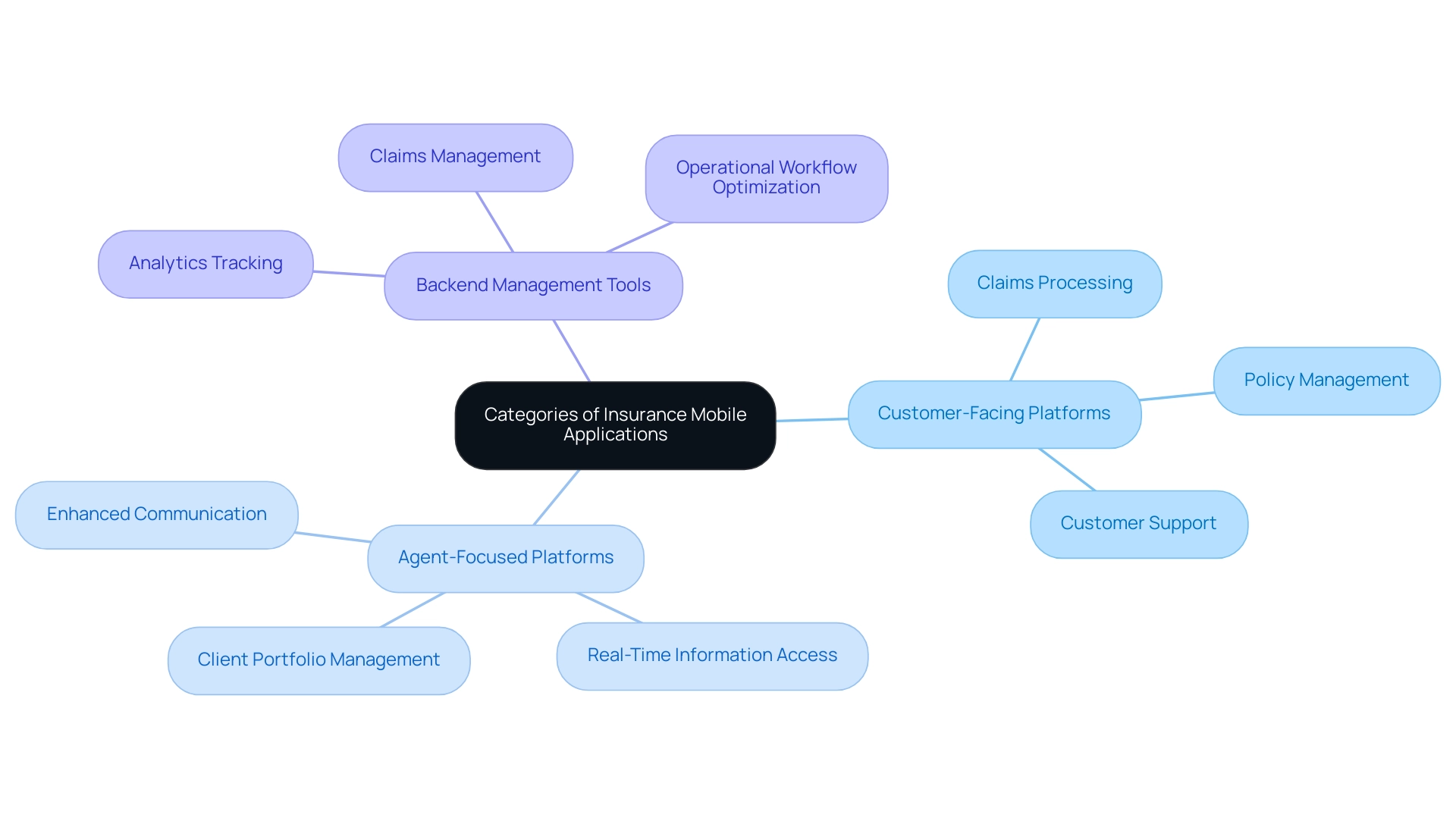

Mobile apps for insurance companies can be effectively categorized into three primary types:

- Customer-facing platforms

- Agent-focused platforms

- Backend management tools

Mobile apps for insurance companies serve policyholders with essential functionalities such as claims processing, policy management, and customer support. These applications enhance user engagement and streamline interactions, a necessity in today’s digital-first landscape.

On the other hand, mobile apps for insurance companies are designed specifically for agents in the field, providing them with tools to oversee client portfolios, access real-time information, and enhance communication with policyholders. This alignment is critical as 85% of marketers recognize that inbound calls and phone conversations are integral to a digital-first strategy.

Lastly, mobile apps for insurance companies provide essential backend management tools that play a vital role for firms by tracking analytics, managing claims, and optimizing operational workflows.

Significantly, the expense to create a coverage application ranges from $30,000 for a minimum viable product to $300,000 for intricate programs with advanced features, which is a crucial factor for investment. By grasping these categories, insurers can align their mobile apps for insurance companies development initiatives with strategic objectives, ensuring they remain competitive in a rapidly evolving market. The expected trends in 2024, including the rise of AI and omnichannel experiences, further underscore the need for insurers to embrace these technological advancements.

As mentioned, 'In this article, we will review everything essential for app development, from essential features and case studies to advantages of applications, the use of various technologies, and best practices for development.' Furthermore, the case study titled 'Trends in Marketing for 2024' emphasizes how marketers are anticipated to embrace trends such as conversation intelligence, AI, omnichannel experiences, and on-demand coverage to address changing client needs.

Benefits of Mobile Apps for Insurance Providers

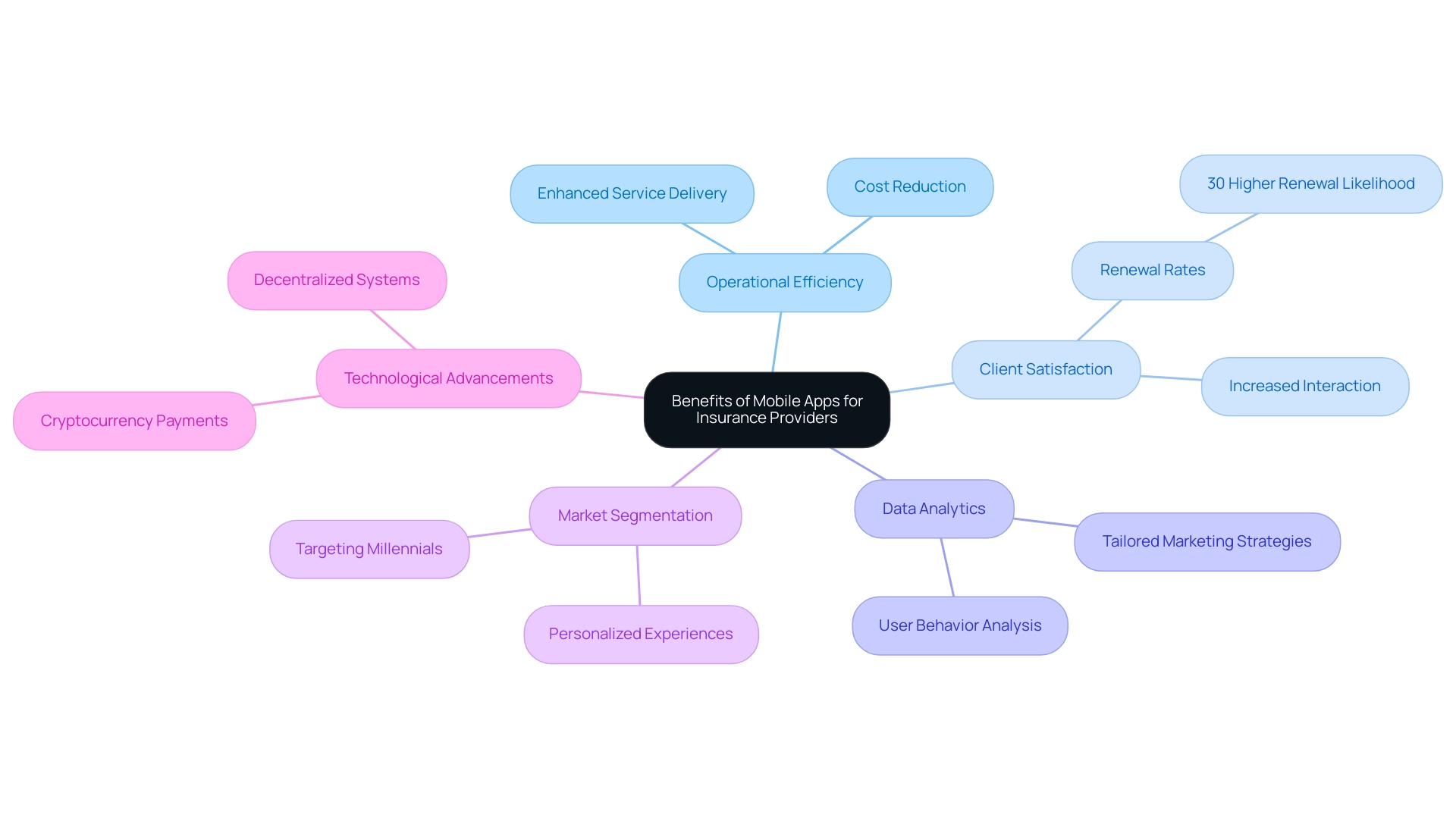

The advent of mobile apps for insurance companies is transforming the insurance industry, offering substantial benefits to providers and aligning perfectly with tailored e-commerce solutions that have enhanced KPIs over the past 20 years. As we look forward to the anticipated expansion of mobile apps for insurance companies from 2024 to 2032, it becomes increasingly evident that these digital solutions not only enhance service but also increase operational efficiency and provide valuable data analytics. By offering clients a convenient platform through mobile apps for insurance companies to access services, insurers can significantly enhance client satisfaction and retention rates.

Businesses utilizing mobile apps for insurance companies observe a significant rise in client interaction; research indicates that users of these apps are 30% more likely to renew their policies than non-users, thus directly connecting mobile app usage to improved retention rates. Furthermore, mobile apps for insurance companies enable effective data collection, allowing insurers to analyze user behavior and preferences, ultimately informing tailored marketing strategies and driving innovative product development. This is particularly pertinent through market segmentation analysis, which helps target specific client segments effectively.

Addressing the specific needs of millennials and Gen Z—who favor personalized, digital-first experiences—has become essential. A case study emphasizes how application platforms have evolved by incorporating social media and peer-to-peer coverage choices, demonstrating their significance in appealing to and keeping younger clients. Additionally, features such as in-app purchasing options and personalized offers can significantly enhance Average Order Value (AOV) and Lifetime Value (LTV) by encouraging users to make larger or more frequent purchases.

With the increasing trend of accepting cryptocurrency payments and implementing decentralized systems, companies in the sector are positioned to adopt technological advancements that address changing client needs. Ultimately, the incorporation of portable technology enables insurance firms to react flexibly to market shifts and client needs, fostering growth and profitability. As one industry expert noted,

Customized requirements of multi-dimensional, deep-level and high-quality can help our customers precisely grasp market opportunities, effortlessly confront market challenges, properly formulate market strategies, and act promptly.

This encapsulates the critical advantage that mobile apps for insurance companies offer in today's competitive landscape.

Conclusion

The integration of mobile applications into the insurance industry represents a pivotal shift towards meeting the evolving needs of consumers. As highlighted, these digital tools not only enhance customer engagement but also streamline operations, making them essential for insurance companies striving for competitiveness. The article underscores the necessity of mobile apps, showcasing key features that cater to user satisfaction, from policy management to robust customer support.

Moreover, the categorization of insurance mobile applications into:

- Customer-facing

- Agent-focused

- Backend management tools

illustrates the diverse functionalities that can be leveraged to optimize user experience and operational efficiency. With the projected growth of mobile app adoption, it is evident that insurers must invest in developing these platforms to stay relevant in a rapidly changing market.

Ultimately, the benefits of mobile applications extend beyond mere convenience; they foster deeper customer relationships and generate valuable data insights that can drive innovative strategies. As the insurance landscape continues to evolve, embracing mobile technology is not just a trend—it is a strategic imperative that will shape the future of customer engagement and operational success in the industry. Companies that prioritize mobile app development will not only enhance their service offerings but also secure a competitive edge in an increasingly digital world.