Introduction

Robotic Process Automation (RPA) is rapidly transforming the financial sector, providing essential tools for economic efficiency. In this article, we will explore the benefits and applications of RPA in finance, delve into a case study of Deutsche Bank's implementation of intelligent automation, and discuss how RPA is unlocking efficiency and enhancing compliance and security.

Finally, we will look at the future of RPA in finance and its potential to redefine the industry through the integration of artificial intelligence and machine learning. Join us as we explore the transformative power of RPA in the financial landscape.

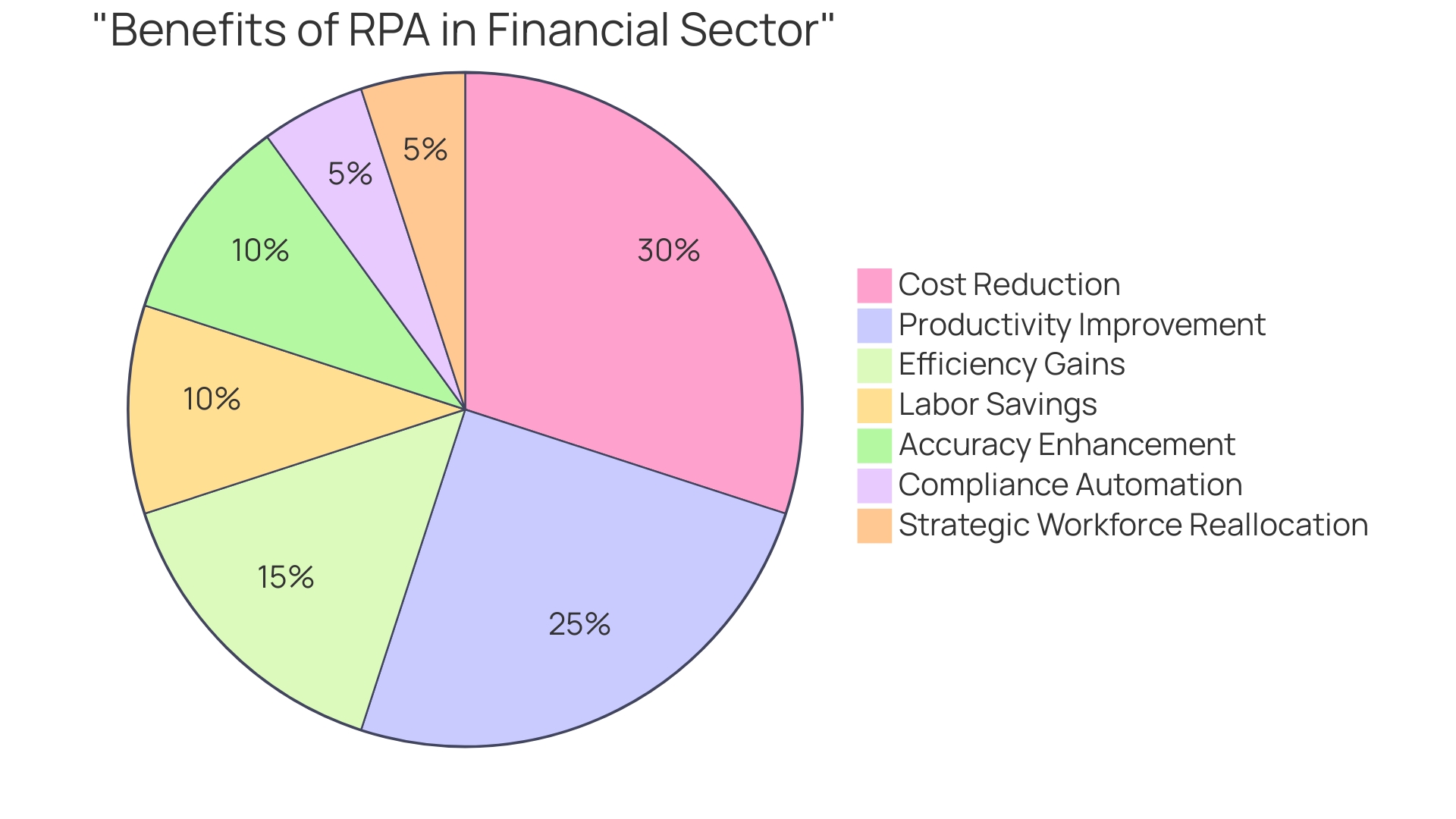

Benefits of RPA in Finance

Robotic Process Automation (RPA) is rapidly transforming the financial landscape, offering an essential tool for economic efficiency. By taking over tedious, rule-driven tasks, RPA not only cuts operational expenses but significantly elevates productivity. For instance, a strategic deployment of RPA led to a staggering AED 210 million in savings, underscoring its financial impact.

A notable success story comes from reallocating relationship managers, an administrative-intensive task that once took seven days but now, thanks to RPA, is accomplished in just one. This shift has marked an 88% surge in efficiency and saved 840 hours annually, a clear indication of RPA's transformative power. Small businesses, in particular, find RPA invaluable for reducing labor costs, as it can tirelessly perform round-the-clock without the need for overtime compensation or additional hires.

Moreover, the accuracy of RPA systems minimizes costly human errors in critical tasks, such as data entry and report generation, thereby preserving customer trust and financial integrity. With the ability to expedite processes by 60%, RPA enables businesses to redirect their workforce towards more strategic initiatives, fostering growth and innovation. In the realm of compliance, RPA stands as a formidable ally.

As regulations become more intricate, RPA offers a streamlined approach to ensure adherence, reducing the risk of costly legal penalties. The potential of machine-readable regulations opens new horizons for automating compliance tasks, further solidifying RPA's role in the modern financial sector. By 2025, the workflow automation market is projected to burgeon to $18.45 billion, a testament to RPA's expanding influence and the growing recognition of its strategic advantages in business process optimization.

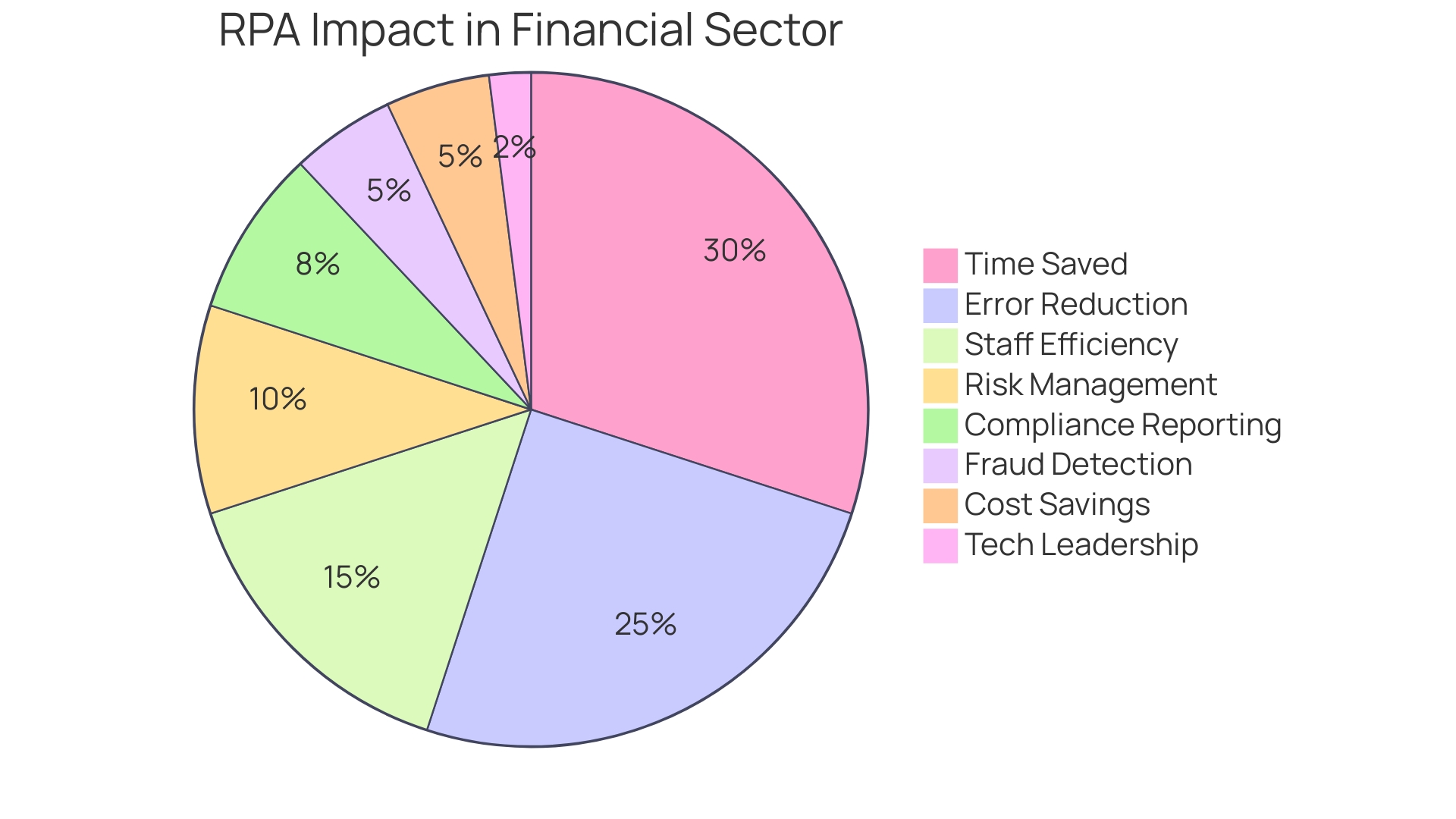

Applications of RPA in Finance

Robotic Process Automation (RPA) is transforming the financial sector by automating routine tasks, leading to significant efficiency gains and cost savings. A striking example is the automation of data entry and reconciliation tasks, where RPA systems can swiftly extract information from various sources, validate data, and update records on the fly.

This not only reduces the time required for these processes but also minimizes the scope for human error. In accounts payable and receivable, RPA streamlines invoice processing, payment reconciliation, and credit control, freeing up staff for more strategic initiatives.

A case in point is a program that reduced a seven-day task of reallocating relationship managers to just one day, achieving an 88% increase in efficiency and saving 840 hours annually. Moreover, RPA plays a crucial role in enhancing risk management, fraud detection, and compliance reporting.

One notable instance is MasterCard's AI-powered tool that aids banks in detecting fraudulent transactions, a critical advance as financial institutions gear up for regulations mandating customer compensation for certain types of fraud. The integration of RPA into existing IT infrastructures negates the need for costly upgrades, allowing seamless interaction with diverse software systems. This capability has delivered staffing and cost savings of over AED 210 million, underscoring the transformative potential of RPA in finance. Additionally, firms with directors having relevant technological expertise are more likely to adopt these emerging technologies profitably, emphasizing the importance of tech-savvy leadership in leveraging AI and RPA for competitive advantage.

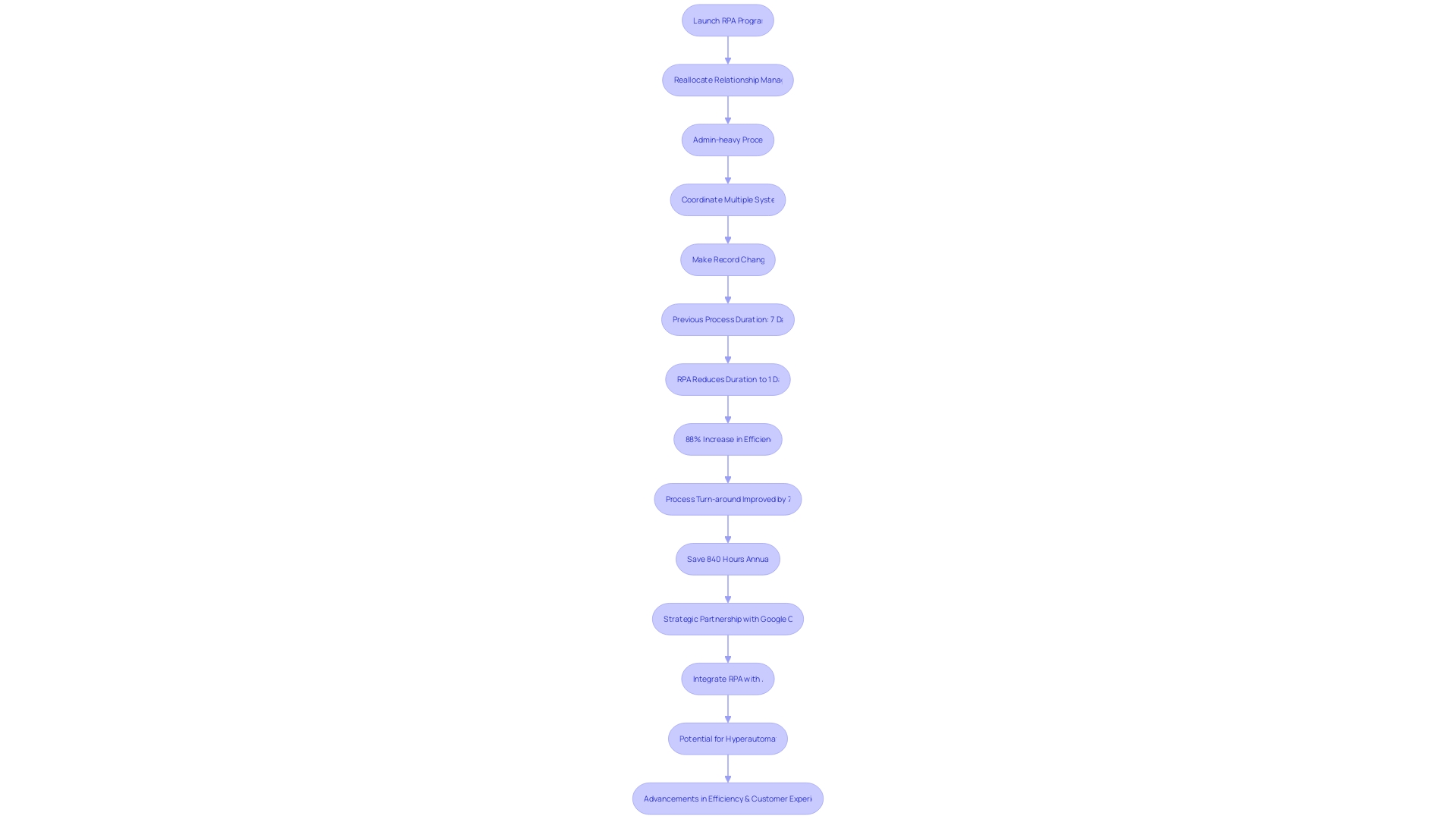

Case Study: Deutsche Bank’s Implementation of Intelligent Automation

At the forefront of financial innovation, Deutsche Bank has harnessed the transformative power of Robotic Process Automation (RPA) to enhance operational efficiency and revolutionize customer service. A standout example is the overhaul of their relationship manager reallocation process.

Historically laborious, involving the coordination of multiple systems and thousands of records, the process was prone to delays and errors. By deploying RPA, Deutsche Bank slashed the week-long task to a mere day, boosting efficiency by a staggering 88% and saving 840 hours each year.

This initial success story was part of an estimated AED 210 million in cost savings attributed to RPA's deployment across the bank. Moreover, the bank's strategic partnership with Google Cloud is set to further its technological advancement, leveraging AI and data analytics to rapidly innovate and meet client demands. As Deutsche Bank continues to integrate RPA with AI, the era of hyperautomation begins, promising even greater strides in efficiency and customer experience.

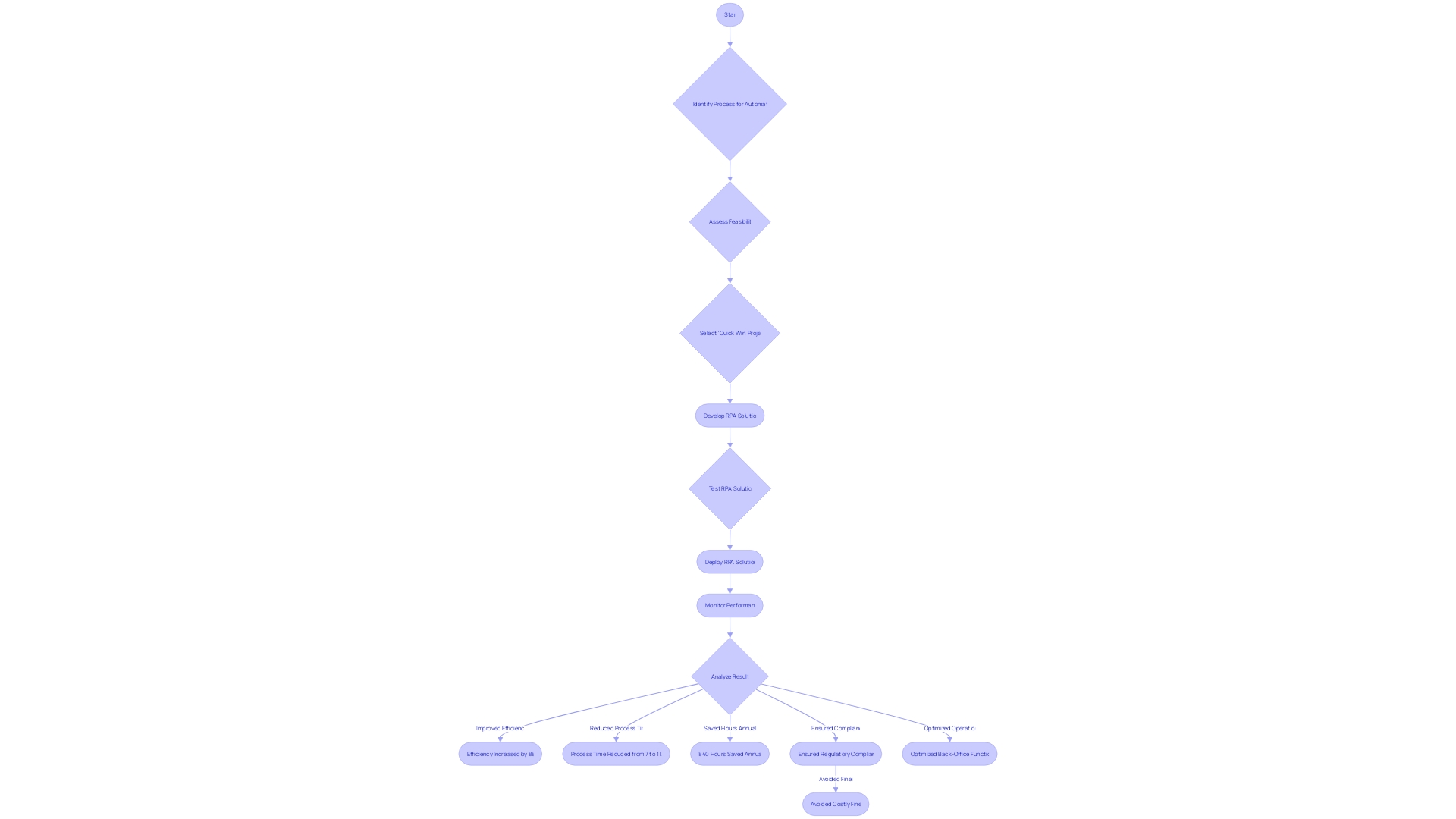

Unlocking Efficiency: Automating Repetitive Tasks

Deutsche Bank, a financial institution with a substantial presence, has leveraged Robotic Process Automation (RPA) to significantly enhance operational efficiency. The automation of routine and labor-intensive tasks such as data entry, validation, and report generation has been a game-changer.

Notably, RPA has transformed the financial reconciliation process, which was traditionally time-consuming and susceptible to human error. By deploying bots, the bank has condensed the reconciliation time from a matter of days to mere minutes, exemplifying the profound impact of RPA in streamlining banking operations.

Moreover, this technological leap has not only expedited procedures but also fortified data accuracy, contributing to the bank's strategic goal of optimizing back-office functions to realize cost savings and elevate service quality. The successful implementation of RPA at Deutsche Bank underscores the potential for machine-readable regulations to revolutionize compliance tasks, rendering them more consistent and efficient. This innovation aligns perfectly with the bank's forward-looking statements, emphasizing their commitment to ongoing technological advancements and the anticipation of future trends in the banking sector.

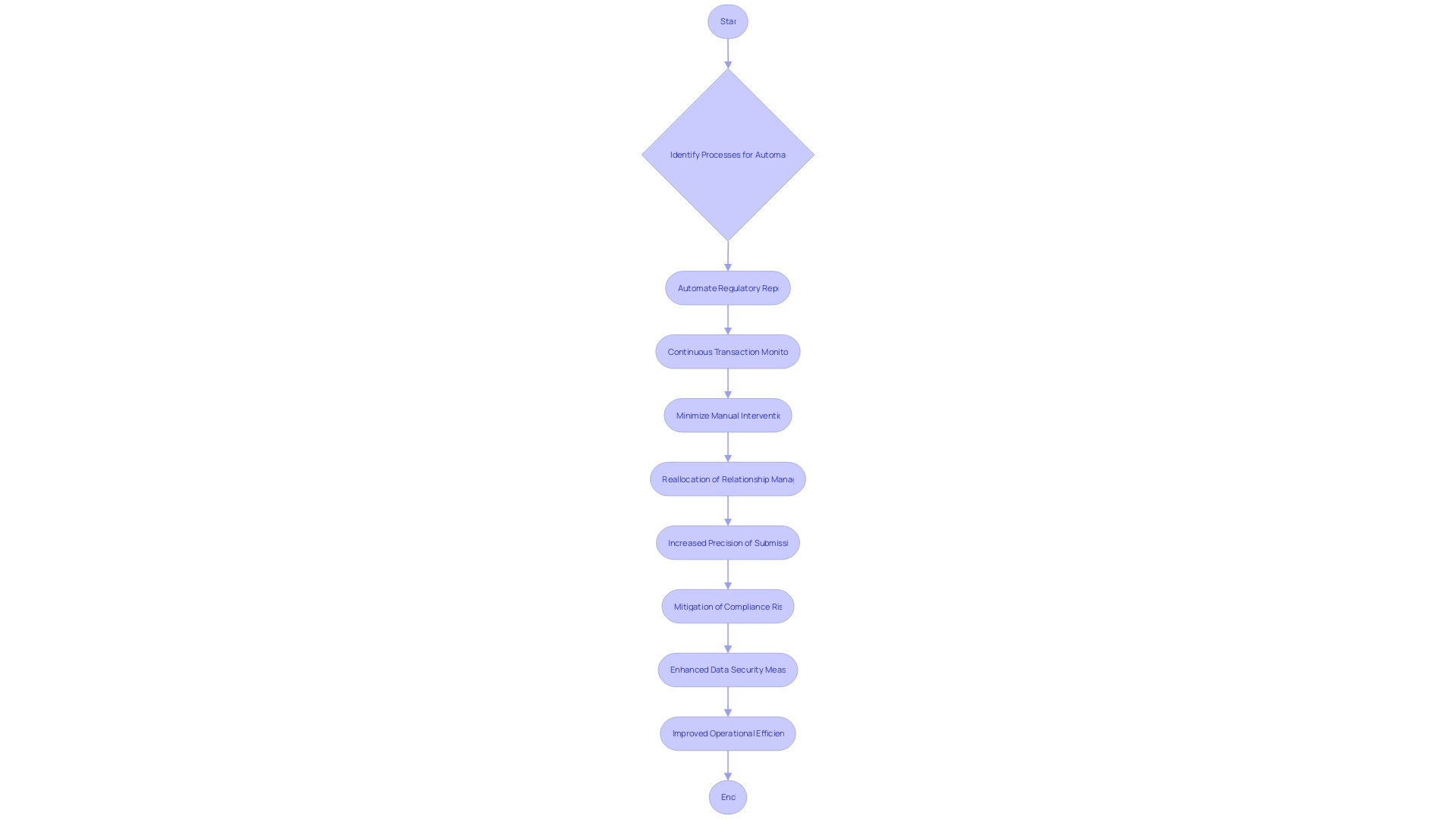

Enhancing Compliance and Security

At Deutsche Bank, the deployment of Robotic Process Automation (RPA) has revolutionized the way compliance and security protocols are managed. The automation of regulatory reports has markedly increased the precision and punctuality of submissions, mitigating risks associated with non-compliance and the threat of financial penalties.

RPA's continuous transaction monitoring capabilities have proven essential in identifying and addressing potential fraudulent activities. Moreover, by minimizing manual intervention in the handling of sensitive data, RPA has significantly bolstered the bank's data security measures.

The transformative impact of RPA at Deutsche Bank is evidenced by the reallocation of relationship managers—a procedure that previously required a full week to coordinate across multiple systems and update thousands of records. With RPA, this time-intensive process was condensed to a mere day, enhancing efficiency by 88% and saving over 840 hours annually. These advancements are indicative of a broader trend in the RPA industry, where machine-readable regulations are paving the way for more streamlined and error-proof compliance operations.

The Future of RPA in Finance

Robotic Process Automation (RPA) is rapidly transforming the financial sector, and its trajectory is one of significant evolution and impact. By intertwining RPA with artificial intelligence and machine learning, the technology is set to redefine the handling of unstructured data, enabling sophisticated decision-making and advanced analytics.

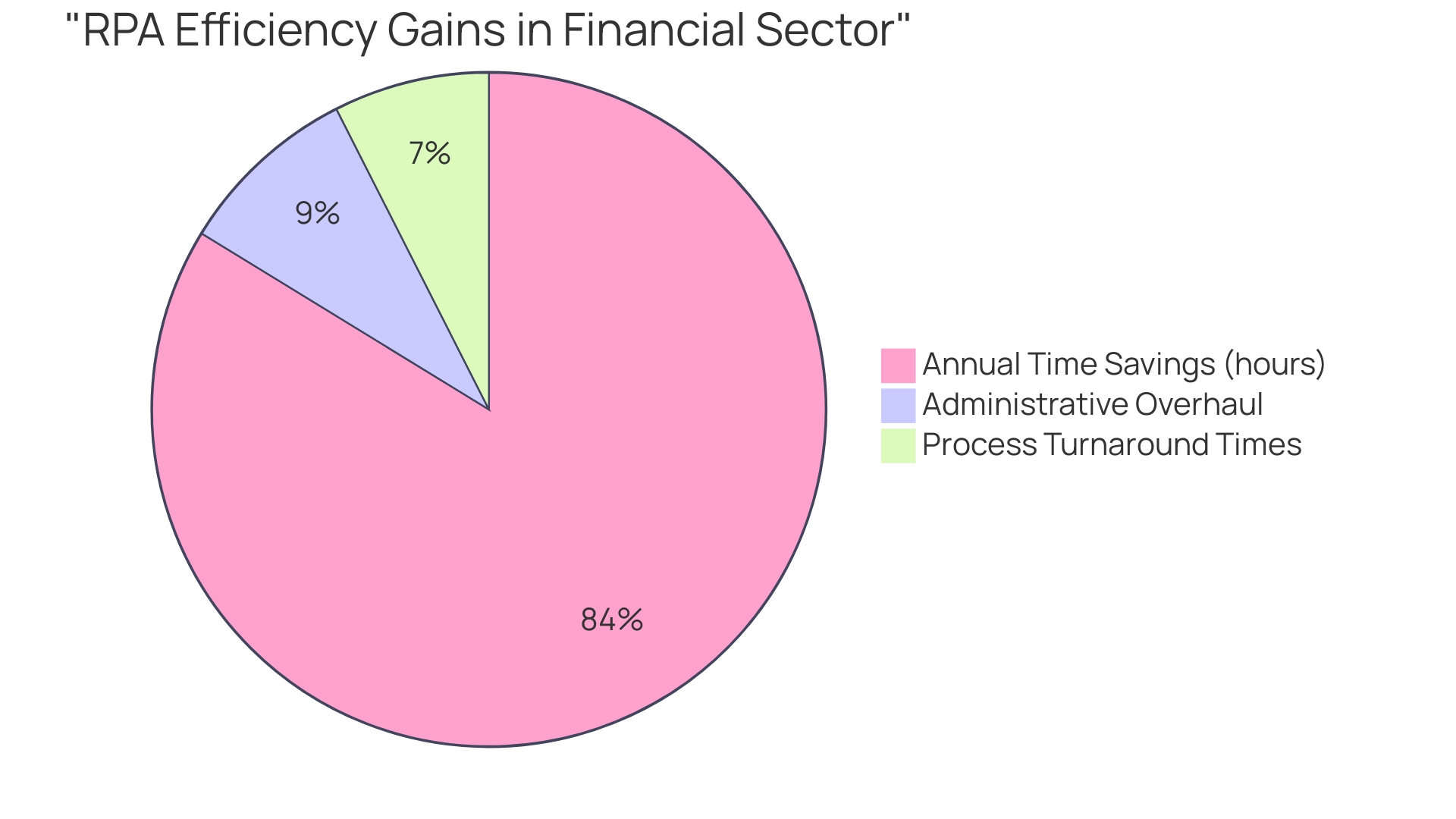

This is not just theoretical; the real-world implications are staggering. For instance, consider the administrative overhaul when reallocating relationship managers, which previously took a week and was fraught with errors.

With RPA, this process now takes just one day, an 88% surge in efficiency. Moreover, annual time savings of 840 hours have been realized, with process turnaround times improved by 75%.

Such case studies exemplify the profound efficiency gains and customer service enhancements achievable through RPA. Collaboration across organizational functions is key to this transformation, with interoperability being a cornerstone.

It ensures accurate data management and streamlined sharing between institutions and regulators, ultimately fostering more effective regulatory processes. This is evident in the work of the Financial Services Regulatory Authority of Ontario, which showcases the agility of RPA in adapting to commercial and consumer demands. As quoted by industry experts, firms leveraging automation can deliver faster, more accurate services at reduced costs, thereby enhancing their client offerings and competitiveness. With the finance gap for MSMEs in developing countries estimated at around $5 trillion, FinTech firms are leveraging RPA to meet these substantial needs, indicating a significant market shift. By 2028, FinTech revenue share in emerging markets is expected to rise to 29%, highlighting the potential of RPA in these rapidly evolving sectors. As RPA continues to mature, it promises not only to streamline operations but also to foster innovation and growth in the financial landscape.

Conclusion

In conclusion, Robotic Process Automation (RPA) is revolutionizing the financial sector by offering significant benefits and applications. RPA cuts operational expenses, elevates productivity, and saves costs through labor reduction.

It streamlines processes, enhances compliance, and minimizes human errors, preserving customer trust and financial integrity. The case study of Deutsche Bank's implementation of intelligent automation showcases the transformative power of RPA in enhancing operational efficiency and customer service.

RPA's integration with AI and machine learning is set to redefine the industry by enabling sophisticated decision-making and advanced analytics. The future of RPA in finance holds immense potential for efficiency gains, customer service enhancements, and growth.

Collaboration across organizational functions and interoperability are crucial for realizing the full benefits of RPA. As RPA continues to mature, it promises to streamline operations, foster innovation, and drive growth in the financial landscape.

With its expanding influence and strategic advantages, RPA is reshaping the industry and positioning organizations for success. Embracing RPA will be essential for financial institutions to stay competitive in this rapidly evolving sector. The transformative power of RPA is undeniable, making it an essential tool for economic efficiency in the financial sector. By adopting RPA technology, organizations can unlock efficiency gains, enhance compliance and security measures, and position themselves as leaders in a rapidly changing industry. The future of finance lies in harnessing the power of RPA to drive innovation, growth, and superior customer experiences.