Introduction

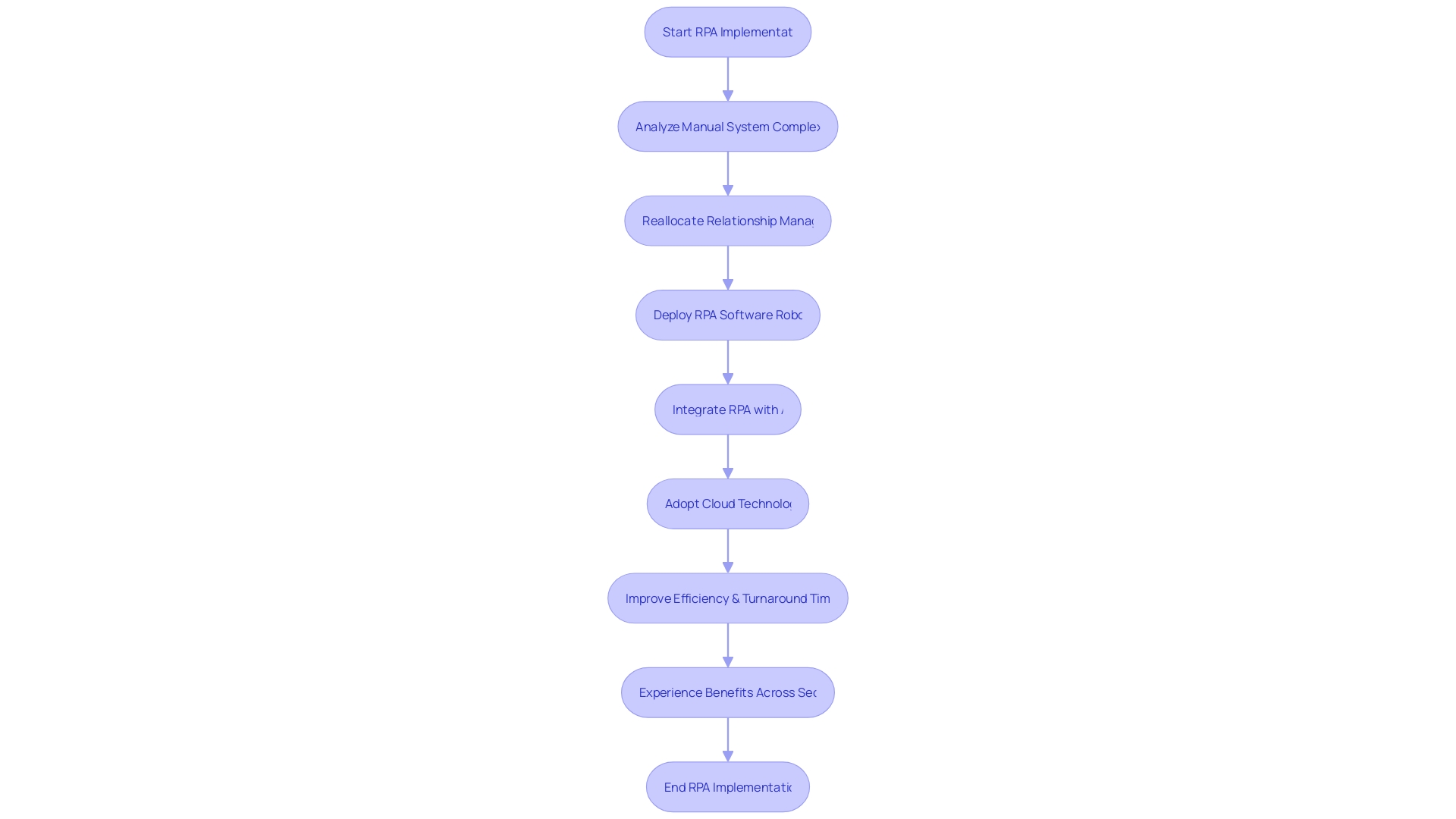

With the accelerating pace of digitalization in the banking sector, ABC Bank recognized the necessity of upgrading its approach to data management and transaction processing. The bank looked towards Robotic Process Automation (RPA) to streamline operations and enhance customer service.

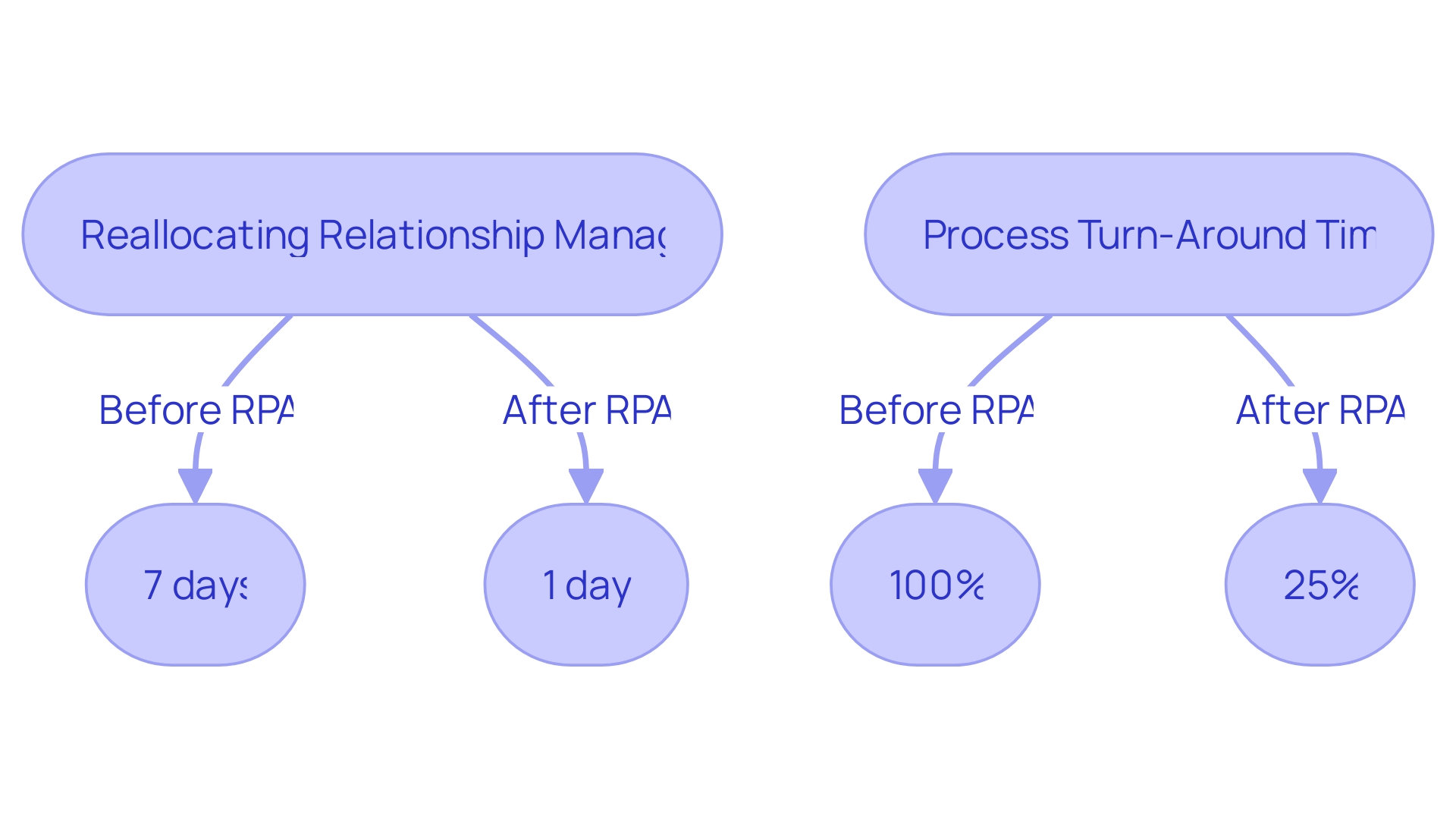

This strategic move was inspired by the transformative outcomes RPA has brought to the industry, with one notable instance being the reallocation of relationship managers—a task that once took seven days but was cut down to one, marking an 88% leap in efficiency. In this article, we will explore how ABC Bank identified RPA use cases, implemented RPA solutions, and the benefits and challenges they encountered along the way. We will also discuss the broader trend of leveraging RPA in the banking sector and its impact on operational efficiency.

Background of the Company

With the accelerating pace of digitalization in the banking sector, ABC Bank recognized the necessity of upgrading its approach to data management and transaction processing. The bank looked towards Robotic Process Automation (RPA) to streamline operations and enhance customer service.

This strategic move was inspired by the transformative outcomes RPA has brought to the industry, with one notable instance being the reallocation of relationship managers—a task that once took seven days but was cut down to one, marking an 88% leap in efficiency. This administrative overhaul not only saved 840 hours annually but also translated into substantial cost savings, estimated at over AED 210 million.

The bank's initiative parallels the successful implementation of RPA in similar scenarios, where it has been instrumental in reducing process turnaround times by 75%. Additionally, the bank is considering the use of synthetic data to test new solutions for predicting customer vulnerability, reflecting a commitment to security and data minimization. This approach aligns with the broader trend of financial institutions leveraging big data to unlock customer insights, despite the fact that historically less than 0.5% of the collected data is analyzed. ABC Bank's adoption of RPA is a proactive response to the surging demand for efficient, reliable banking services and represents a significant step towards matching the performance levels set by emerging financial technologies and platforms.

Identifying RPA Use Cases

In a strategic move, ABC Bank leveraged Robotic Process Automation (RPA) to significantly enhance operational efficiency, particularly in reallocating relationship managers—a task historically fraught with administrative burdens and prone to human error. The transformative power of automation was evident as the bank's RPA deployment reduced a week-long process to a mere day, an astounding 88% increase in efficiency, and saved 840 hours annually.

The meticulous selection of processes for automation, such as the verification of customer identities, previously a labor-intensive task, was revolutionized by the introduction of software robots. These robots not only saved 80,000 hours of labor each year but also fortified regulatory compliance, circumventing potential fines.

The bank's strategy involved prioritizing high-impact opportunities and securing early victories to build momentum. Additionally, by employing synthetic data, the bank tested the effectiveness of third-party solutions without compromising customer privacy, thereby adhering to data minimization principles. The adoption of RPA has not only delivered substantial cost savings estimated at over AED 210 million but has also set a precedent for the future of compliance with machine-readable regulations, paving the way for more streamlined and error-free regulatory processes.

Implementing RPA Solution

In a landmark initiative, ABC Bank has partnered with a preeminent RPA provider to deploy sophisticated software robots, engineered to replicate human tasks with unparalleled precision and efficiency. This transformative move was catalyzed by a strategic 'quick win'—the reallocation of relationship managers—a task previously mired in administrative burden and customer impact.

The former manual system necessitated navigating through a labyrinth of systems, altering thousands of records, a process fraught with slowness and susceptibility to errors. With the robotic intervention, what once took an arduous seven days now unfolds within a mere 24 hours, marking an astounding 88% leap in efficiency and a 75% improvement in process turnaround times, culminating in an annual saving of 840 hours.

The ripple effects of this automation journey are staggering. For instance, TBC Bank's ambitions to burgeon internationally, morph into a digital powerhouse, and cement its reputation as a top employer in Georgia found a pathway through agile transformation.

Yet, the complexity of daily operations and technical debt remained stumbling blocks until RPA paved the way for enhanced speed and customer satisfaction. Moreover, the banking sector is leveraging cloud technology to stay agile amidst market flux, fostering innovation, and addressing customer needs more adeptly, all while safeguarding against disruptions and security threats.

The integration of RPA and AI not only streamlines operations but also elevates the human element. Ally Financial's adoption of Azure OpenAI Service is a testament to this, as it liberates customer service associates from the mundane, allowing them to devote undivided attention to customers, thus enhancing the overall experience. The operational metamorphosis through RPA is palpable across sectors. Surgery Partners' adoption of RPA has yielded savings in excess of $150,000 annually by eradicating manual data entry errors and liberating employees to engage in more rewarding work. As organizations embrace RPA, they are advised to focus on tasks that are logical, redundant, and time-consuming, thereby augmenting the quality of output and ensuring staff embrace rather than bypass these technological advancements.

Benefits of RPA Implementation

Leveraging Robotic Process Automation (RPA) has led to groundbreaking improvements in operational efficiency and data management. For instance, a strategic deployment of RPA in reallocating relationship managers saw administrative tasks that once took an entire week now completed in a single day, marking an 88% leap in efficiency. This not only optimizes staff allocation but also enhances customer engagement by streamlining the process.

Moreover, the implementation of RPA has been instrumental in saving 840 hours annually, echoing a 75% improvement in turnaround times for recurring tasks. In a broader context, companies like Surgery Partners have reported annual savings of over $150,000 by eliminating the need for repetitive, manual data entry, thus allowing their workforce to engage in more intellectually stimulating and rewarding activities. This shift resonates with the sentiment expressed by workers in a survey that revealed a staggering 47% find digital administration tedious and a misallocation of their skills.

It's clear that automation not only refines the workflow but also reinvigorates the workplace environment. By addressing the core issues of manual, labor-intensive processes, RPA emerges as a solution that not only enhances the accuracy of data but also contributes to a significant reduction in operational costs. This dual impact, coupled with the technology's ability to integrate across multiple systems, positions RPA as a game-changer in driving organizational ROI, while fostering a culture of productivity and employee satisfaction.

Challenges and Lessons Learned

In the face of escalating cybersecurity threats and the need for regulatory compliance, ABC Bank has implemented a transformative approach to managing data security and compliance through the use of Robotic Process Automation (RPA). By automating the reallocation of relationship managers, a process that was previously manual, time-consuming, and fraught with the potential for error, the bank has achieved an 88% increase in efficiency.

This strategic change reduced the turnaround time from an entire week to just a single day, saving 840 hours annually. With the integration of RPA, ABC Bank has not only streamlined its operations but has also fortified its stance against cyber threats.

In a recent development, New York's financial regulator has mandated stringent cybersecurity measures, including multifactor authentication and prompt reporting of ransom payments, which align with ABC Bank's commitment to robust cybersecurity practices. The bank's initiative is in step with industry trends that see regulatory technology (RegTech) as a critical tool in enhancing data security and compliance management.

Leveraging AI and machine learning, RegTech is poised to revolutionize the financial industry by making regulations machine-readable, thereby reducing human error and inefficiencies. The KPMG report emphasizes the growing importance of domains such as cybersecurity and privacy in the RegTech landscape. Moreover, the 2023 IBM report underscores the high cost of data breaches and the effectiveness of AI and automation in mitigating these risks. As financial institutions grapple with the dual challenges of data breaches and compliance, the experience of ABC Bank serves as a compelling case study in the successful adoption of technology to secure client information and streamline compliance workflows.

References

BigBasket, a prominent online grocery platform serving over 10 million customers, has harnessed the power of Amazon SageMaker to revolutionize their product identification process. By training a computer vision model specifically for Fast-Moving Consumer Goods (FMCG), BigBasket has impressively cut down training time by half and achieved a cost reduction of 20%.

This innovation addresses the inefficiencies faced in traditional supermarkets and physical stores across India, where manual checkouts necessitate additional manpower and often lead to customer inconvenience due to separate weighing and checkout counters. The integration of AI in e-commerce is not only enhancing operational efficiency but also reshaping the customer purchase journey, minimizing friction and improving overall satisfaction.

In the broader context of e-commerce, AI's role cannot be overstated. It's a game-changer, enabling machines to emulate human intelligence, learn from vast data sets, and make informed decisions to benefit both sellers and buyers.

A recent FactFinder survey of 300 European e-commerce decision-makers revealed a strong trend towards increased AI investment, despite economic challenges, with 86% planning to boost their AI budgets. The survey highlighted Ai's positive impact on customer support, search and recommendations, and automation, with 62% of decision-makers anticipating AI to expand their e-commerce teams. These advancements in AI, including the progression of Large Language Models (LLM), are anticipated to permeate the entire e-commerce value chain, from customer acquisition to fulfilment. The case of BigBasket exemplifies the transformative potential of AI in e-commerce, promising a future where personalized shopping experiences become the norm, leading to heightened customer satisfaction and loyalty.

Conclusion

In conclusion, ABC Bank's adoption of Robotic Process Automation (RPA) has significantly enhanced operational efficiency and customer service. By implementing RPA, the bank achieved an 88% increase in efficiency by reallocating relationship managers, resulting in substantial cost savings of over AED 210 million.

The strategic selection of processes for automation, such as customer identity verification, revolutionized labor-intensive tasks and strengthened regulatory compliance. RPA implementation not only delivered cost savings but also streamlined regulatory processes.

Benefits of RPA implementation extend beyond financial savings. It optimizes staff allocation, enhances customer engagement, and improves data accuracy.

Surgery Partners reported annual savings of over $150,000 through the elimination of manual data entry. Despite challenges in cybersecurity and regulatory compliance, ABC Bank successfully integrated RPA into its operations, fortifying security measures and streamlining compliance workflows. Overall, RPA adoption in the banking sector is transforming operations and driving organizational success. It improves efficiency, accuracy, and data management while fostering productivity and employee satisfaction. ABC Bank's experience serves as a compelling case study on leveraging technology to enhance security and streamline processes in the digital era.