Introduction

Robotic Process Automation (RPA) is reshaping the insurance industry, bringing about a strategic shift in operations. With the ability to emulate actions previously performed by humans, RPA streamlines processes and enhances efficiency. The integration of RPA in key insurance processes, such as claims adjudication and policy servicing, has resulted in impressive outcomes, including increased revenue growth and improved net present value benefit.

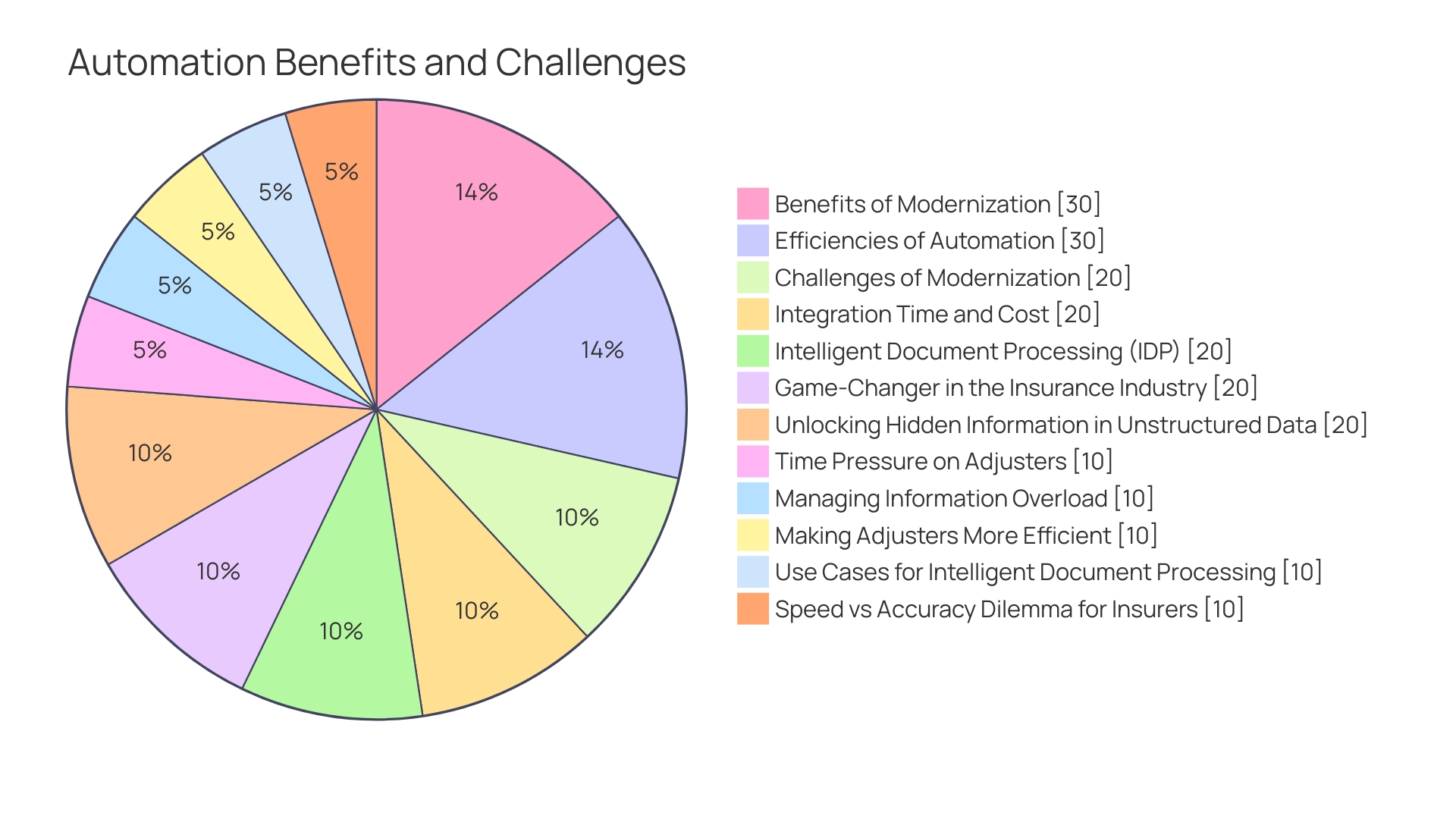

RPA offers manifold benefits, including reduced processing time, enhanced accuracy, and cost efficiency. However, implementing RPA comes with its own set of challenges, such as the complexity of integrating with existing systems and employee apprehension about job security. Nevertheless, insurance companies are embracing RPA to achieve operational excellence and provide a seamless customer experience.

Successful implementation requires a comprehensive strategy that involves assessing current processes, selecting the right vendor, and executing a well-planned pilot phase. The future of RPA in the insurance industry looks promising, with advancements in AI and the integration of advanced technologies set to streamline workflows and improve operational efficiency. The insurance industry is at an inflection point, and RPA will continue to play a central role in its transformation.

Background of Robotic Process Automation (RPA)

Leveraging Robotic Process Automation (RPA) is not merely a trend—it's a strategic shift in operations that is reshaping the insurance industry. These software bots, or 'virtual workers,' emulate actions previously performed by humans, handling mundane tasks with a level of precision that mitigates error and enhances efficiency. RPA's capabilities have been evidenced through the automation of key insurance processes: claims adjudication, policy servicing, and even direct customer interactions have been transformed, freeing personnel to tackle more nuanced, high-value undertakings.

Insurance leaders looking to modernize through RPA should approach the integration with due diligence. Identifying processes ripe for RPA, understanding the cost-to-benefit ratio, and considering the return on investment are critical steps. For instance, a Forrester Research methodology named Total Economic Impact (TEI) demonstrates how intelligent automation can catalyze revenue growth, with results such as a 73% increase in net present value benefit and a 5.4% compound annual growth rate over three years.

Real-world results affirm RPA's promise. SAP Build Process Automation reported exceptional outcomes with one company showcasing order processing efficiency gains, reducing errors and time by about 30%, while automation in invoicing cut processing time by 50%, resulting in a 25% ROI. Inventory discrepancies dropped by 40%, leading to tangible financial benefits.

These impressive figures underscore the value RPA brings when identifying and re-engineering processes that stand to gain from automation.

Understanding the interplay of RPA with existing systems is paramount. When executed well, RPA serves as the nexus for various applications, streamlining workflows in transformative ways. It's the meticulous integration of technology, leadership insight, and strategic planning that ultimately dictates the success of RPA deployments, leading to satisfied customers, operational excellence, and financial growth for insurers.

Benefits of RPA in the Insurance Industry

Robotic Process Automation (RPA) is revolutionizing the insurance industry by streamlining complex processes, thus yielding manifold benefits. By harnessing RPA, the time taken to process claims is drastically reduced. Enabling swift underwriting and more efficient customer service, RPA allows insurance companies to allocate human capital towards high-value tasks and strategic initiatives, rather than repetitive chores.

The accuracy of data is significantly enhanced with RPA, which diligently minimizes human error, ensuring the dependability of data and mitigating associated risks.

Cost efficiency is another advantage of implementing RPA, as it diminishes the necessity for manual labor. For instance, by using RPA to evaluate insurance claims, particularly in scenarios of fire damage, adjusters can rely on automated processing of visual documentation, leading to quicker claim resolution and more effective damage assessment.

Insurance firms acknowledge the escalation in efficiency due to RPA; for example, representatives now oversee an automated review process of claims. This automation allows a shift from exhaustive manual scrutiny to a swift verification for accuracy, optimizing time spent on claim assessment.

Contemplating the integration of RPA necessitates addressing key questions. Which manual processes are ripe for automation? What costs and timeframes are implicated in deploying RPA?

These inquiries are crucial for directing the path toward modernization, emphasizing the need for strategic decision-making.

The ascendancy of RPA is further supported by its representation in industry-wide discussions and research, such as the forthcoming findings by the EAIC, which promise to elucidate the responsible application of AI and RPA within insurance practices.

With commendations from users of intelligent automation technologies like SAP Build Process Automation, reaping benefits of enhanced efficiency and an impressive ROI, the ripple effects of RPA on the insurance industry are undeniably profound. Statistics and expert forecasts reflect growing trends in the integration of AI and RPA, projecting a robust competitive edge for companies that effectively harness these technologies for customer servicing and improved insurance management processes.

Challenges of Implementing RPA in Insurance

Implementing Robotic Process Automation (RPA) indeed brings a plethora of advantages to the insurance industry; however, it is equally important to recognize the challenges that accompany such a digital transformation. One of the pressing issues is the integration complexity of RPA with established systems and processes. Many insurance firms are tethered to legacy systems, and retrofitting them with contemporary RPA solutions demands meticulous strategy and bespoke tailoring.

Another significant hurdle is the apprehension among employees about job security. Crafting a transparent change management strategy and establishing open communication lines are key to illustrate the supportive role of RPA, demonstrating its aim to enhance, not eclipse, their roles. Conducting a thorough audit to identify specific manual tasks for automation, pinpoint inefficiencies, and estimate the integration time and cost of RPA software is a critical first step.

As the industry evolves, with new regulations like the EU's upcoming Artificial Intelligence Act shaping the landscape, maintaining compliance and staying abreast of legal implications is paramount. Data, whether trapped in rigid relational schemas or available in structured JSON format, must be meticulously assessed and judiciously processed to maximize the benefits of RPA whilst minimizing disruption during the transition. By addressing these challenges proactively, insurance companies can wield RPA to achieve greater efficiency, precision, and value in their operations.

Case Study: RPA in Insurance Claims Processing

Insurance companies are increasingly harnessing Robotic Process Automation (RPA) to enhance their claims processing systems. As a multifaceted approach, RPA streamlines data handling, claim document verification, and validation processes. The integration of this technology directly addresses time and cost-related challenges, paving the way for significant advancements in efficiency and accuracy.

To elucidate, consider the transformation within the claims department of a prestigious insurance provider. Upon adopting RPA technology, the company witnessed a substantial 50% reduction in claims processing time coupled with a remarkable 30% decrease in error incidences. This achievement illustrates the efficacy of RPA in refining the laborious and error-prone traditional manual methods of claims processing.

Leaders in the insurance sector must not only acknowledge the myriad benefits of RPA but also mindfully examine potential challenges. Choosing which processes to automate demands a strategic approach that includes assessing current inefficiencies and integration costs, as well as projecting the potential return-on-investment.

It is essential to reflect upon the complexities of the existing framework, as highlighted by a recent study published in Expert Systems with Applications. It portrays traditional vehicle insurance claims management as a complicated puzzle, hampered by the need for significant human intervention, which often leads to preventable missteps and sluggishness.

Innovations such as blockchain technology and Generative AI (Gen AI) are also emerging as game-changers, with the latter particularly beneficial in refining the claims process. Gen AI has demonstrated prowess in extracting insights, classifying information, and improving customer interactions by accelerating policy coverage assessment and identifying crucial data during the First Notice of Loss intake. This denotes a substantial shift towards a user-oriented and efficient claims management paradigm.

In accordance with the statistical highlights of administrative burdens in the healthcare sector, it's crucial for insurance leaders to embrace process patterns conducive to successful RPA implementation. This strategy not only ensures a smoother transition towards modernization but also aligns with the overarching goal of mitigating operational overheads, as evidenced by the extraordinary billing costs burdening primary care physicians.

By focusing on strategic process integration and the utilization of transformative technologies, insurance companies can expect to not only improve their operational performance but also provide an enhanced experience for their clients.

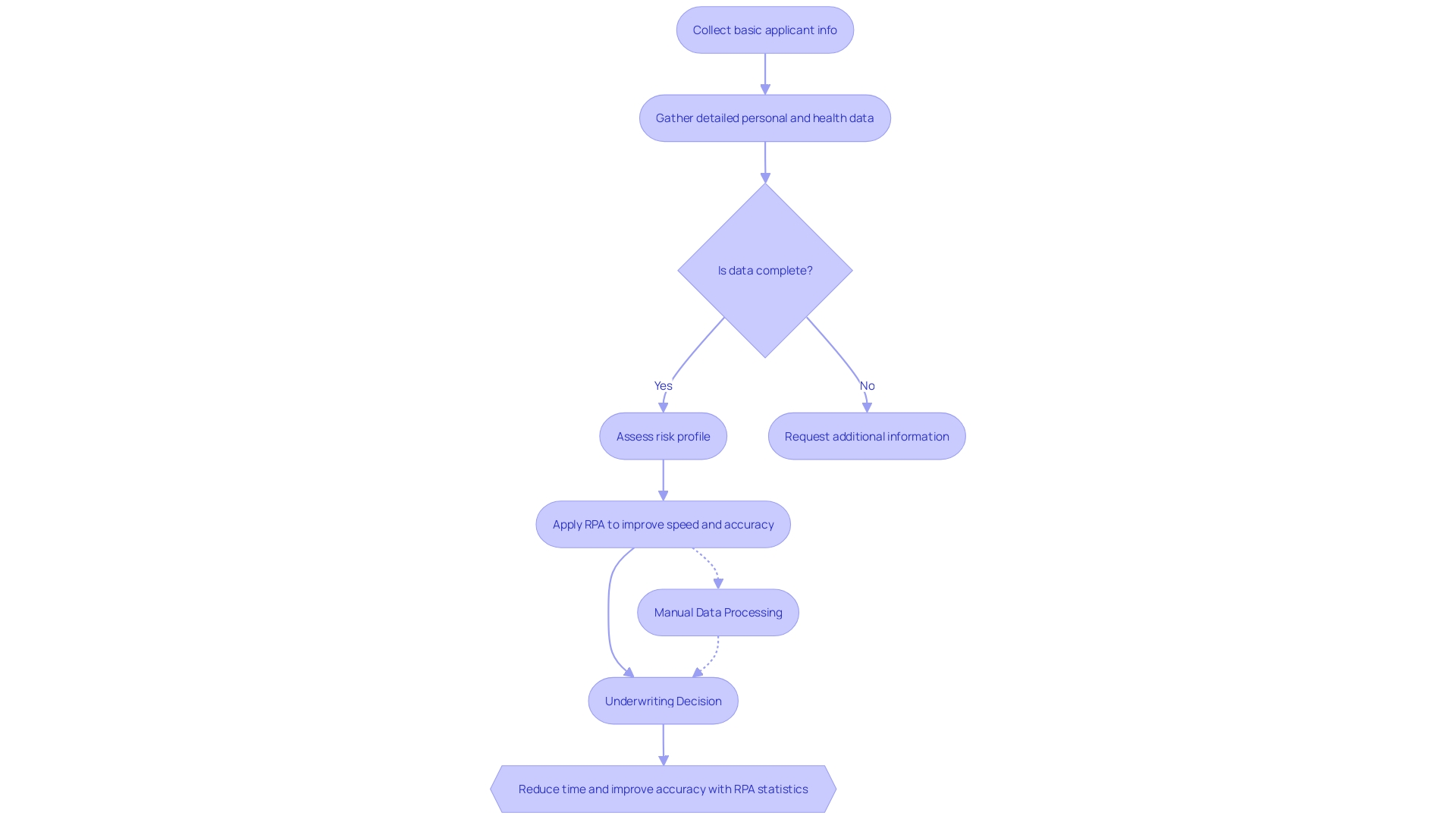

Case Study: RPA in Insurance Underwriting

Robotics Process Automation (RPA) continues to make significant strides in streamlining the insurance underwriting process, an essential yet intricate task of assessing risks and defining the insurability of clients. By effectively automating the compulsory data accumulation and assessment, insurers see marked gains in speed and accuracy. A real-world application demonstrates the compelling impact RPA has on the industry: an insurance firm utilized RPA to bolster its underwriting operations, which led to a dramatic 40% cut in the time it took to issue underwriting decisions, and honed the accuracy of these decisions by 20%.

Crucially, this increased throughput does not sacrifice precision, evidencing that technological advancements can simultaneously elevate efficiency and service quality, to the benefit of both the insurer and insured. RPA's prowess in processing vast pools of data — ranging from personal details to intricate health information — mitigates the likelihood of human error, a common pitfall of manual underwriting. Its impact is not solely on the number crunching side; it also guides insurers in navigating various challenges tied to internal modernization.

Leaders in the field, before leaping into the automation overhaul, must evaluate the fit of such technology within their workflow, scrutinizing which manual actions are ripe for RPA advancement, and estimating both the time and capital investment required. The decision to implement RPA must be backed by a robust business case, anticipating a tangible return on investment. Beyond just operational metrics, the use of RPA aligns with broader regulatory trends.

The provisional agreement on the EU's Artificial Intelligence Act underscores an elevated focus on the regulation of AI applications, from prohibiting emotion recognition in the workplace to placing restraints on the use of biometric identification by law enforcement. Within the realm of insurance, this raises the question of how AI and RPA technologies will adapt to new legislative landscapes and underscores the strategic importance of not just leveraging technology, but doing so in a compliant and sustainable way. As insurance professionals consider how best to apply these technologies, they also continue to witness their transformative effects across various sectors, with claims adjustment being one particularly notable area.

Here, AI aids adjusters by providing comprehensive visual documentation of incidents, thereby streamlining claims reviews and enhancing accuracy — a boon for both the efficiency of the insurance process and the satisfaction of clients. This mirrors the broader role AI and RPA play in revolutionizing the insurance industry, where the focus is not only on internal efficiencies but also, importantly, on elevating the customer experience and ensuring timely, precise, and fair insurance outcomes.

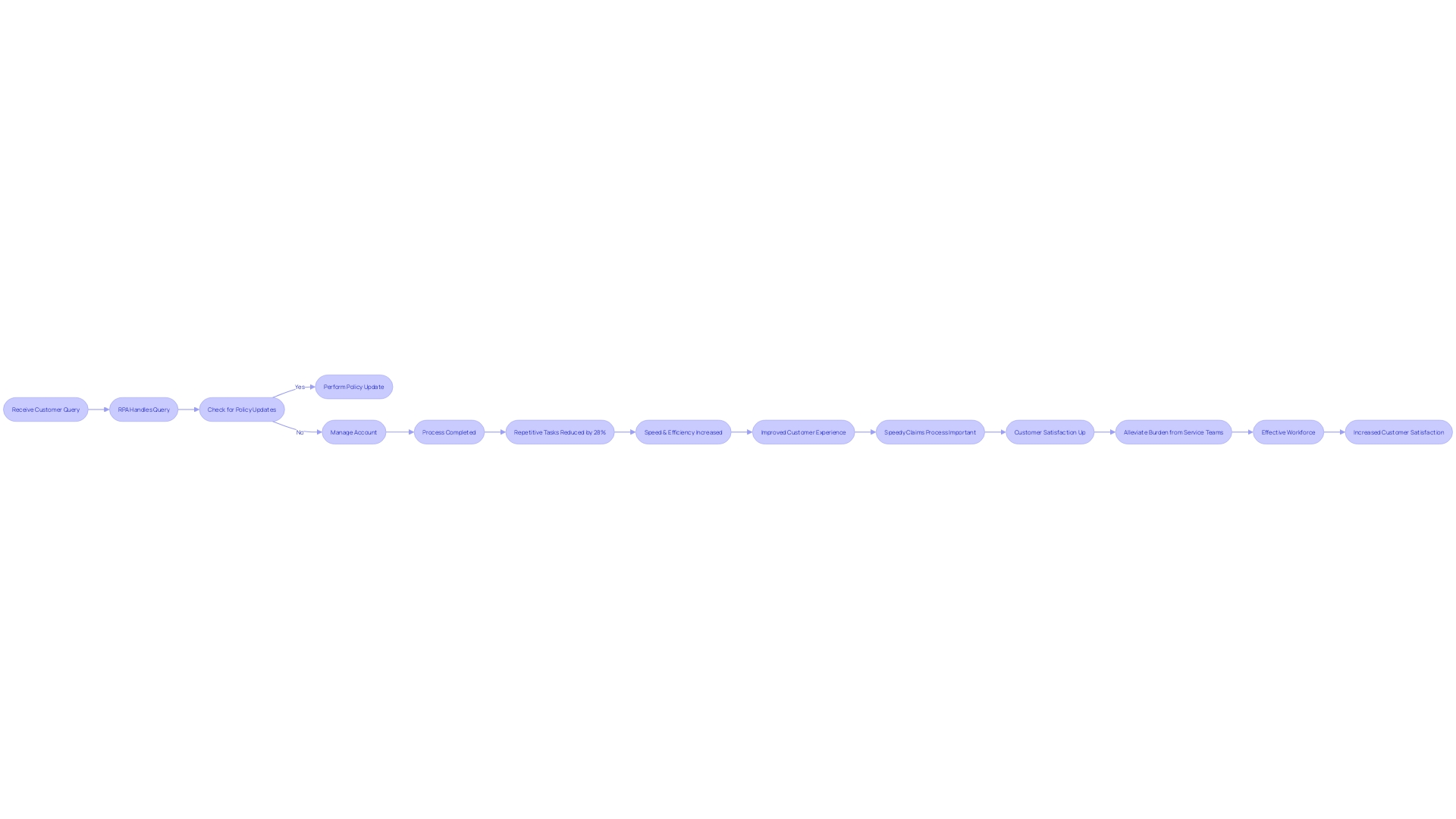

Case Study: RPA in Insurance Customer Service

Robotic Process Automation (RPA) has ushered in a renaissance of customer service in the insurance sector. For companies like Hiscox, embracing RPA has been a game-changer, allowing the firm to handle customer queries, policy updates, and account management with increased speed and efficiency. By implementing smart automation, Hiscox reduced its repetitive tasks by 28%, enabling their customer service to respond with unprecedented swiftness.

The competitive insurance landscape hinges on ability to quickly respond to customers—critical for Hiscox, which aims to sustain growth while keeping operating costs stable. Guilherme Batista, Process and Operations Manager at Hiscox, noted the importance of automating to improve efficiency without scaling up expenses. Through RPA, customer experiences are enhanced significantly.

According to recent statistics by Sollers Consulting and Ipsos, a speedy claims process is paramount for customers, with 63% in the UK citing it among their top three expectations following a claim. This trend is not confined to claims alone but is a broader expectation across customer service channels.

The insurance industry's drive for automation is fueled by such customer preferences, but it's also about lifting the burden from service teams, paving the way for both increased customer satisfaction and a more effective workforce.

Implementation Steps for RPA in Insurance

Embarking on the RPA journey within the insurance sector necessitates a comprehensive strategy that empowers you to reap the various benefits RPA has to offer. The foundation of a successful RPA implementation is in the thorough examination of current operational processes. Start by pinpointing the manual tasks most amenable to automation, addressing inefficiencies that RPA can streamline, and calculating both the time and costs associated with integrating RPA solutions.

After a meticulous selection of suitable processes—like those bogged down with manual interventions during claims handling—comes the selection of the appropriate RPA vendor. A strategic fit is crucial, ensuring the chosen RPA solution not only addresses the specific needs identified but also has the capacity to enrich and accelerate the claims process, consequently refining the customer journey. This is underscored by industry sentiments, acknowledging that while claims representatives tackle verification, RPA considerably diminishes the previously taxing manual review of every single claim and form.

The rollout should then proceed with a well-planned pilot phase. This should incorporate a 'small steps' approach, beginning with the automation of less complex tasks and leading up to the broader workflows. Such incremental implementation is bolstered by a continuous feedback mechanism that monitors the RPA’s performance against expected outcomes and collates learnings for future efforts.

An enlightening example stems from the utilization of gen AI within RPA systems. Gen AI—a subset of AI technology—improves the claims process by producing and classifying content, which aids in damage assessment and provides documentation necessary for a seamless claims experience. This capability of RPA systems to scan inventory lists and suggest the most cost-effective items exemplifies how insurance companies can also better manage their internal resource allocation.

Moreover, turning to intelligence automation means learning to harness the synergy between RPA and AI. A blend of both can propel companies toward digital transformation, enhancing efficiency across various processes such as risk exposure identification and evaluation—key facets as highlighted by Munich Re and ERGO's Tech Trend Radar 2024, which emphasizes the maturity and readiness of industry trends.

To conclude, insurance companies must utilize a cohesive, well-pondered modernization roadmap that methodically identifies, selects, and tests automated processes. This ensures RPA implementations are robust, relevant, and truly transformative—a smart pathway that dips into the pool of intelligent automation's vast potential in the insurance landscape.

Future of RPA in the Insurance Industry

Robotic Process Automation (RPA) continues to be a driving force in reshaping the insurance industry. With the integration of RPA with advanced technologies such as artificial intelligence (AI) and natural language processing, we're witnessing the dawn of a new era where insurance workflows are streamlined to unprecedented levels. Tasks that once consumed significant time and resources, like fraud detection and risk assessment, are now being automated, improving both accuracy and efficiency.

A noteworthy example of RPA's transformative impact is in the realm of insurance adjustment, specifically in processing claims related to incidents like fires. Through the deployment of RPA, images which serve as critical evidence and validation tools can now be processed and analyzed at much faster rates. This advancement not only alleviates the time pressure on adjusters but also enables them to concentrate on more analytical aspects of claim resolutions.

Current trends emphasize the importance of informed decision-making before implementing RPA. Questions like which processes to automate and how to address their inefficiencies using this technology are central to a modernized approach. According to the recent Tech Trend Radar 2024 report, it's essential for insurers to scrutinize potential RPA applications and their integration timelines to maximize the benefits while minimizing disruptions.

Moreover, with legislation like the upcoming AI Act in the European Union—which calls for more stringent regulations on AI applications—it is also important for insurers to ensure their technology is compliant and ethically aligned with principles such as transparency and fairness.

In light of these developments, we see that an astonishing 99% of global insurance organizations are gearing up to replace their core technology systems, addressing concerns with data quality, privacy, and scalability. As they adapt, insurers also realize the need to enhance the customer experience, turning to AI to refine and expedite the claims process. With the insurance industry at an inflection point, one thing is clear: RPA will continue to be central to its transformation, promising not only increased operational efficiency but also an improved journey for customers.

Conclusion

In conclusion, Robotic Process Automation (RPA) is revolutionizing the insurance industry. By streamlining processes and enhancing efficiency, RPA offers manifold benefits, including reduced processing time, enhanced accuracy, and cost efficiency.

Implementing RPA comes with challenges, such as integrating with existing systems and addressing employee apprehension about job security. However, insurance companies are embracing RPA to achieve operational excellence and provide a seamless customer experience.

To successfully implement RPA, insurance companies must adopt a comprehensive strategy. This involves assessing current processes, selecting the right vendor, and executing a well-planned pilot phase. Despite the challenges, the future of RPA in the insurance industry looks promising.

Advancements in AI and the integration of advanced technologies will further streamline workflows and improve operational efficiency. Insurance companies must embrace a cohesive, well-pondered modernization roadmap to identify, select, and test automated processes. This ensures robust and transformative RPA implementations.

As an industry expert, it is clear that RPA will continue to play a central role in reshaping the insurance industry. With its benefits and the potential for advancements in AI, RPA enables insurance companies to achieve increased operational efficiency and enhance the customer experience.

To thrive in the evolving landscape, insurance companies must harness the power of RPA and leverage AI advancements. By doing so, they can stay competitive, provide excellent service, and position themselves for success in the future of the insurance industry.

Experience the power of RPA and transform your insurance business today!