Introduction

The Role of Automation in Banking Transformation

In the banking sector, automation is reshaping operations from the ground up. Commerce Bank, acknowledged as a super community bank, has successfully integrated cutting-edge automation solutions to confront both the surge of digital solutions and the technical debt of legacy systems.

This strategic move has streamlined processes and fortified customer relationships by pairing sophisticated banking products with high-touch, high-tech delivery. Automation in banking has been recognized for its ability to conserve resources, save labor hours, and ensure regulatory compliance.

The potential of automation is vast, with a significant portion of bank employee time being affected through automation and augmentation. Financial leaders are prioritizing operations simplification through process automation, acknowledging that AI and automation could assume a significant portion of banking tasks. This paradigm shift is set to redefine the banking industry, making it more efficient, customer-centric, and compliant, while freeing up human capital to focus on strategic initiatives and customer satisfaction.

The Role of Automation in Banking Transformation

In the banking sector, the tide of automation is reshaping operations from the ground up. Acknowledged as a super community bank, Commerce Bank has successfully integrated cutting-edge automation solutions to confront both the surge of digital solutions and the technical debt of legacy systems. This strategic move has not only streamlined processes but also fortified customer relationships by pairing sophisticated banking products with high-touch, high-tech delivery.

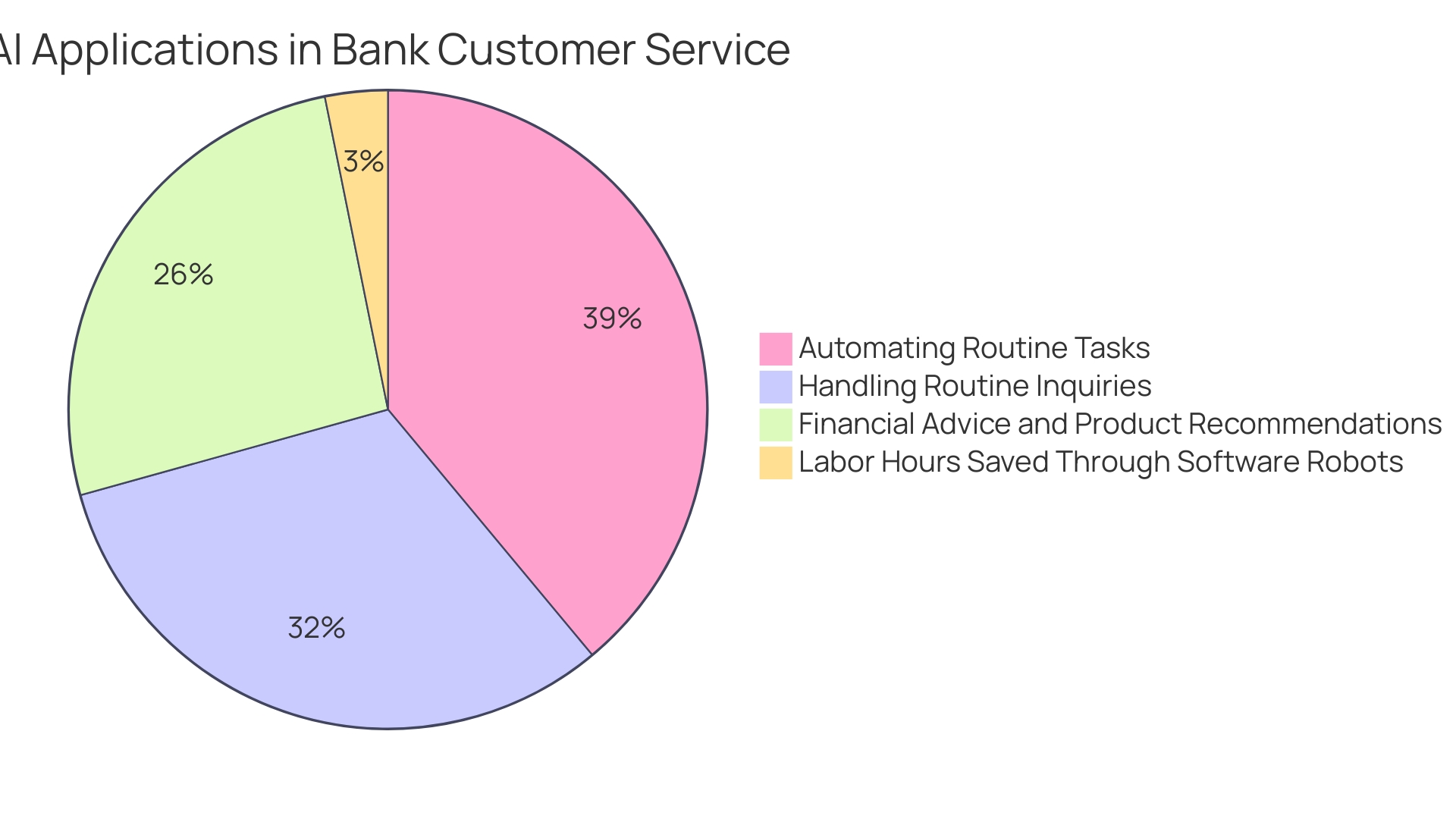

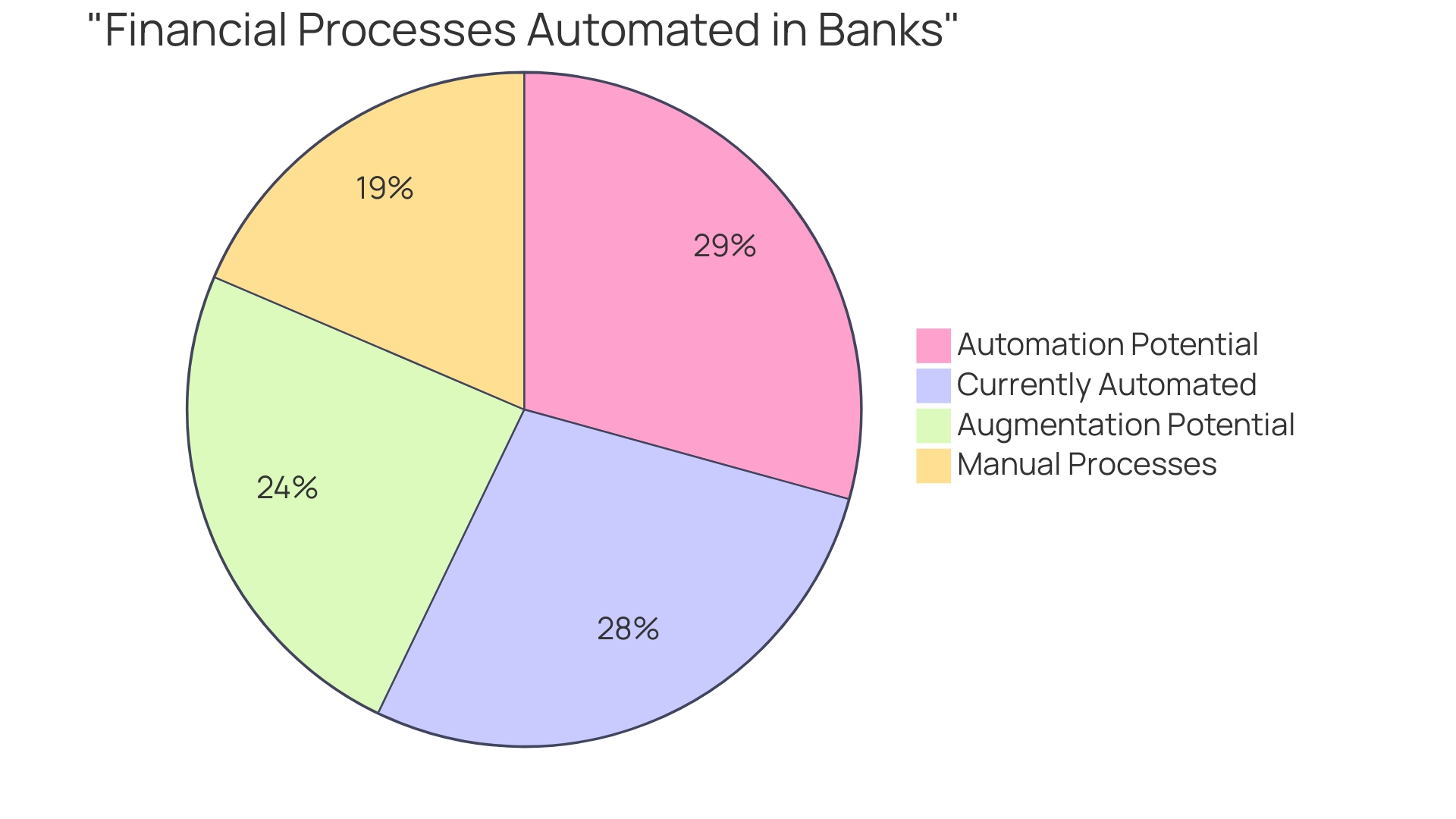

Automation in banking has been recognized for its ability to conserve resources, as seen with the deployment of software robots at Commerce Bank, which saved 80,000 hours of labor annually and ensured regulatory compliance. The potential of automation is vast, with Accenture reporting that 73% of bank employee time could be affected—39% through automation and 34% through augmentation. This encompasses a broad spectrum of roles, with tellers alone seeing 60% of their routine tasks amenable to support from generative AI.

High-touch roles like relationship managers benefit from Ai's ability to enhance meeting preparation and customer interactions. Financial leaders are taking note, with over half of banking CEOs prioritizing operations simplification through process automation, acknowledging that AI and automation could assume 10-25% of banking tasks. This paradigm shift is set to redefine the banking industry, making it more efficient, customer-centric, and compliant, while freeing up human capital to focus on strategic initiatives and customer satisfaction.

Streamlining Operational Processes

The advent of automation in the banking sector has revolutionized how financial institutions operate, leading to a notable enhancement in efficiency and productivity. Consider the case of a bank that implemented software robots to verify customer identities, a task that previously consumed 80,000 hours of labor each year.

This not only bolstered regulatory compliance but also allowed the bank to redirect efforts to more impactful activities. With tools like 'Robofit', banks can evaluate automation opportunities based on criteria such as time savings and customer impact, ensuring a strategic approach to process improvement.

Similarly, the hospitality industry has witnessed the transformative power of automation. Louvre Hotels Group, for example, experienced a remarkable efficiency boost by automating rate code maintenance, saving hundreds of hours each month.

Meanwhile, Delivery Hero tackled the frequent issue of employees being locked out of accounts by automating the recovery process, which used to take IT staff 35 minutes per incident. These initiatives are underpinned by compelling statistics: a 30% reduction in financial close times due to workflow automation and a 75% competitive advantage reported by companies using such technologies. Furthermore, financial roles like tellers, who can automate 60% of their routine data-processing tasks with AI, exemplify the transformative potential of automation in the sector. As Accenture reports, an astounding 80% of financial operations can benefit from automation, suggesting a significant shift towards strategic and customer-focused activities. This shift is crucial, as roles requiring judgment and personalization, like relationship managers, can be enhanced by AI tools, creating a more dynamic and effective banking environment.

Enhancing Customer Service

Banks are harnessing AI and machine learning to redefine customer service, making it a cornerstone for competitive differentiation. By automating routine tasks, financial institutions like Ally Financial have liberated their customer service associates from manual work, such as post-call documentation.

This strategic deployment of AI allows associates to focus on delivering a seamless and personal customer experience. Moreover, the digital banking industry, as exemplified by One Zero's AI assistant 'Ella', is moving towards a more responsive and tailored customer service model.

'Ella' has already taken on 58% of routine inquiries, with an aim to handle 80%, demonstrating the potential of AI to evolve and improve through customer interactions. AI is not just about efficiency; it's about hyper-personalization.

By analyzing customer data, AI can provide financial advice and product recommendations precisely when needed, enhancing relevancy and ROI. The First Abu Dhabi Bank's (FAB) use of software robots exemplifies this, saving 80,000 hours of labor annually and ensuring regulatory compliance.

McKinsey's Andrea Del Miglio emphasizes the importance of adding value to technology to enhance customer service in banking. However, technology should augment, not replace, human interaction. Training employees in soft skills like empathy and communication is crucial, ensuring that the human element remains at the forefront of customer experiences. Banks must communicate transparently about their digital tools, fostering trust and managing expectations. As Ally Financial's experience shows, AI can predict customer needs, but the final touch might require a human connection. The optimal path forward integrates digital innovation with human empathy, a synergy that will sustain trust and loyalty in the long term.

The Benefits of Automation in Banking

The integration of automation in the banking sector is revolutionizing the industry, streamlining operations to unprecedented levels. Consider the case of a bank that automated the verification of customer identities—a task that was once labor-intensive and prone to errors. By deploying 11 software robots that operate continuously, the bank not only saved 80,000 hours of labor annually but also fortified regulatory compliance, averting costly fines.

The strategic application of automation tools, such as 'Robofit', enables banks to evaluate proposals based on criteria like time savings, compliance, and complexity, focusing on impactful opportunities that yield early successes and foster momentum. This approach has redefined roles within the financial sector, allowing employees to dedicate more time to value-added services such as strategic initiatives and customer satisfaction. In fact, CEOs could reclaim up to 20% of their time spent on financial operations through automation, while more than half of banking CEOs are actively simplifying their operations with this technology.

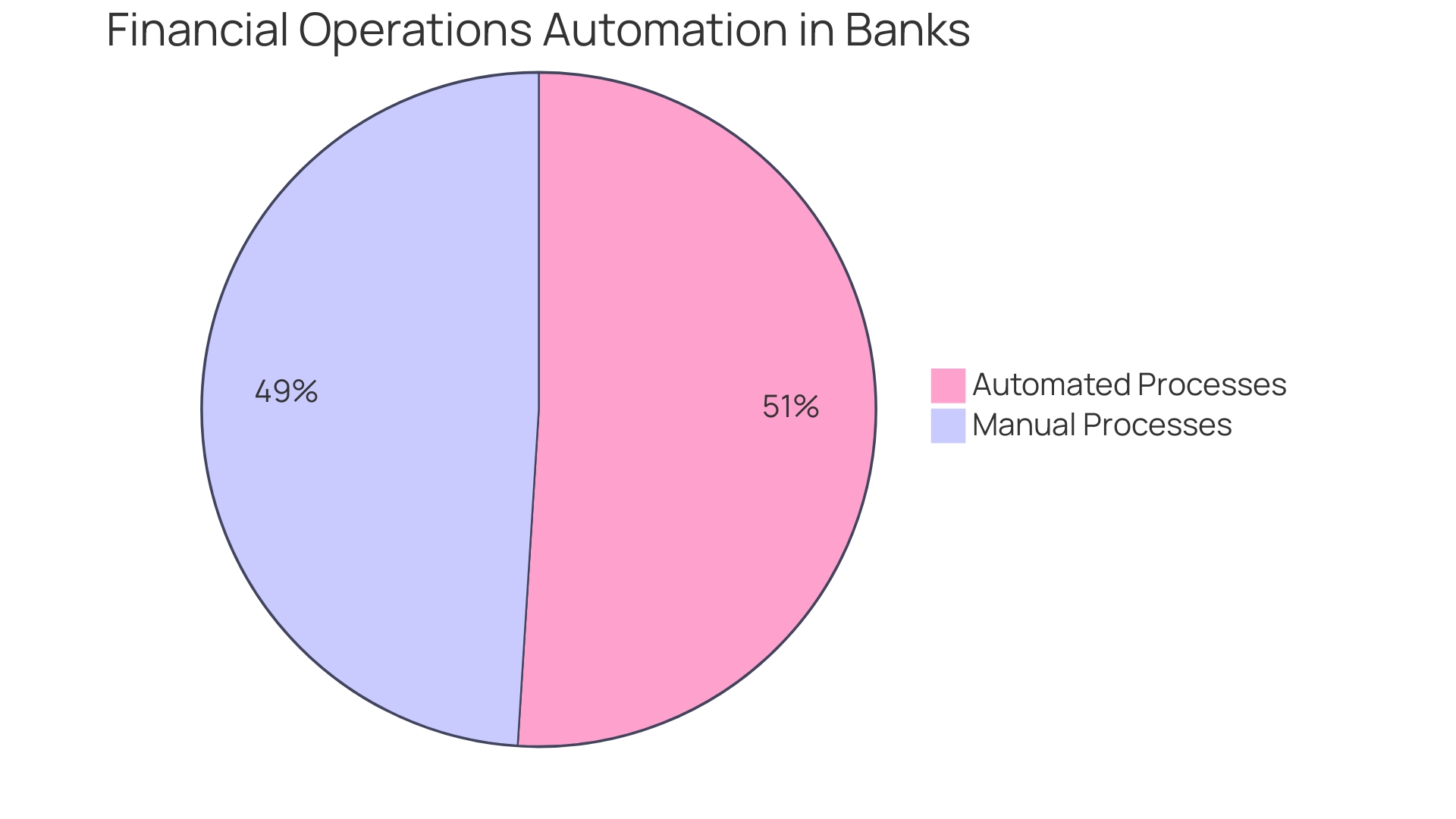

Automation and AI are expected to take over 10-25% of banking tasks, transforming the landscape of the industry. Despite the substantial potential for automation in financial operations—estimated at 80% by Accenture—nearly half of the companies remain unautomated in their financial processes. Nevertheless, with the decreasing cost and increasing availability of software solutions, the banking sector is poised to embrace the next wave of financial automation, leveraging AI and machine learning to enhance efficiency and security.

Cost Reduction

Banks are increasingly turning to automation to streamline operations and enhance customer experiences. For instance, TBC Bank's agile transformation, aimed at reducing organizational complexity, resulted in the adoption of new structures and modernized workflows, but the anticipated improvements in customer satisfaction were not immediately visible due to technical debt and operational dependencies. Similarly, Commerce Bank, recognized by Forbes as one of America's Best Banks, has faced the dual challenge of meeting customer expectations shaped by digital solutions and managing outdated systems.

To address this, they leveraged the 'super community bank' model, which combines sophisticated products with personalized service, yet the need for process automation remained critical to overcome technical debt. The potential for automation in financial operations is significant, with Accenture reporting that 80% of such operations could be automated, utilizing AI and ML to perform tasks like bookkeeping and expense management. This shift could free up employees to concentrate on strategic initiatives and customer satisfaction.

However, despite the cost of software decreasing and the variety of software available increasing, a Corcentric survey revealed that 49% of companies have yet to automate their financial processes. Implementing automation can lead to substantial cost savings and efficiency gains. For example, the use of Robotic Process Automation (RPA) at a major financial institution delivered savings of AED 210 million and increased efficiency by 88% in reallocating relationship managers, reducing a week-long process to just one day.

This showcases the transformative impact of automation on banking operations. In light of these developments, it's clear that financial institutions must conduct thorough reviews of their financial processes, considering customer feedback and cost-benefit analysis, to identify opportunities for automation that align with customer needs and anticipate future demands. As the workflow automation market is expected to reach $18.45 billion by 2025, banks that embrace automation are likely to see a return on investment within 12 months and gain a competitive edge.

Increased Efficiency

Embracing automation in banking is not just about efficiency; it's about reshaping the customer experience and addressing the needs of a modern financial landscape. Commerce Bank's approach exemplifies this by integrating sophisticated banking products with high-touch, high-tech customer service. With the rise of digital solutions and FinTech competition, banks are pressed to modernize their operations.

By deploying software robots, Commerce Bank automated the verification of passports and identities, saving 80,000 hours annually and ensuring compliance. This strategic automation aligns with Accenture's finding that 80% of financial operations could potentially be automated, freeing employees to concentrate on strategic initiatives and enhancing customer satisfaction. Despite the significant potential, nearly half of companies have yet to automate their financial processes.

Banks like Commerce Bank, recognized among America's Best Banks, are leading by example, demonstrating the high impact of automation on both internal efficiencies and customer relationships. As generative AI continues to evolve, it's estimated that 73% of the time spent by U.S. bank employees could be influenced by automation and augmentation, with tellers and data processors standing to gain the most from these advancements. Financial leaders are now tasked with identifying processes ripe for automation, aiming to not only streamline operations but also to empower their workforce to focus on high-value tasks and foster deeper customer connections.

Conclusion

In conclusion, automation is revolutionizing the banking industry by streamlining operations, improving efficiency, and enhancing customer experiences. Financial leaders are prioritizing process simplification through automation to achieve cost savings and strategic focus. By deploying cutting-edge automation solutions, banks have achieved significant cost savings, improved regulatory compliance, and freed up human capital for strategic initiatives.

Automation has also transformed customer service by automating routine tasks and allowing employees to deliver a more personalized experience. However, it's important to balance technology with human interaction. Training employees in soft skills like empathy and communication is crucial for maintaining a human connection in customer experiences.

Despite the benefits of automation, there is still room for growth in its adoption. With decreasing costs and increasing availability of software solutions, banks have the opportunity to embrace the next wave of financial automation. In summary, automation is reshaping the banking industry by making it more efficient and customer-centric.

It enables banks to streamline processes, conserve resources, and enhance customer relationships. Financial institutions must review their processes to identify opportunities for automation that align with customer needs. Embracing automation will provide a competitive edge in the evolving financial landscape while achieving cost savings and strategic focus.