Introduction

Robotic Process Automation (RPA) has emerged as a game-changer in the financial services industry, offering significant cost savings and efficiency gains. By automating repetitive tasks and streamlining processes, RPA has the potential to revolutionize the sector.

In this article, we will explore the benefits of RPA in financial services, the current status of RPA adoption, key steps for implementing RPA, case studies of successful RPA implementation, and the challenges and considerations that come with RPA adoption. Join us as we delve into the transformative power of RPA and its potential to reshape the financial landscape.

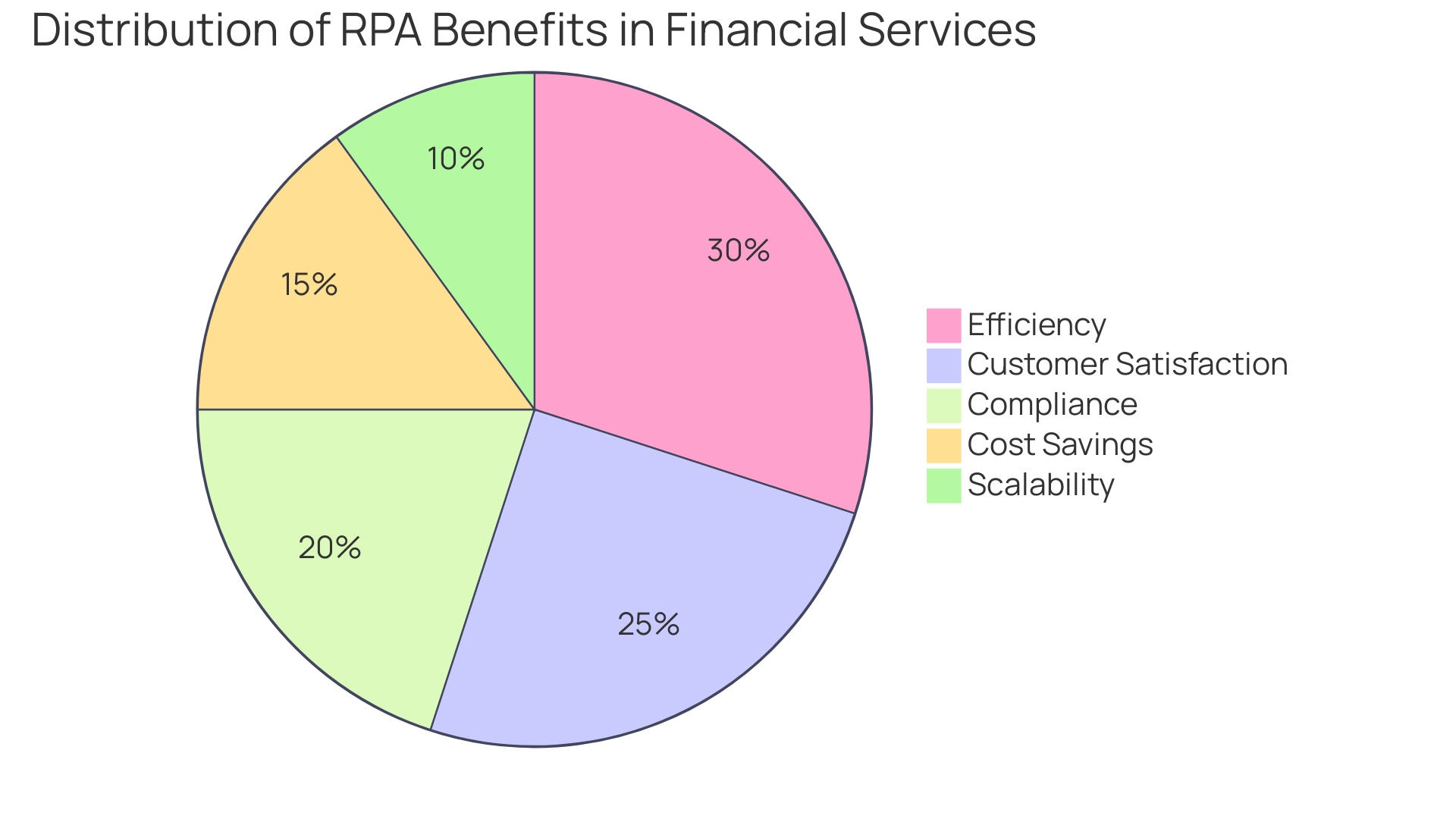

Benefits of RPA in Financial Services

The transformative power of Robotic Process Automation (RPA) in the financial services sector is underscored by staggering cost savings and efficiency gains. Empirical evidence suggests that RPA can lead to staff cost reductions in the realm of AED 210 million. By reallocating relationship managers, a task once fraught with administrative burdens, RPA slashed a week-long process to a single day, boosting efficiency by an impressive 88%.

The operational efficiency doesn't stop there; turn-around times improved by 75%, saving 840 hours annually. These benefits extend beyond time management; by automating routine tasks like data entry and reconciliation, RPA also minimizes errors, allowing employees to dedicate their efforts to more strategic and creative tasks. With 80% of financial operations ripe for automation according to Accenture, and a potential 5.4% CAGR tied to the adoption of intelligent automation, the financial sector stands at the cusp of a revolution.

Despite the availability and decreasing costs of software, nearly half of companies have yet to automate their financial processes, a gap that presents an opportunity for significant competitive advantage. However, the journey is not without its challenges, such as managing exceptions and requiring skilled resources for integration. Nonetheless, the strategic implementation of RPA, paired with proper governance and change management, can lead to a more innovative, agile workforce and an enhanced customer experience.

Current Status of RPA Adoption in Financial Services

Financial services are increasingly harnessing the power of Robotic Process Automation (RPA) to enhance operational efficiency and maintain competitive differentiation. A striking example is the transformative impact on the administrative process of reallocating relationship managers, which saw an 88% efficiency increase.

Previously a seven-day task, RPA condensed it to just one day, thereby saving a substantial 840 hours annually. Such efficiency gains are corroborated by the projected growth of the RPA market, expected to hit $8.75 billion by 2027 in the financial sector alone.

Nationwide Building Society, in collaboration with Hazy, demonstrated the prudent use of synthetic data over real customer transaction data to test RPA solutions, thereby mitigating security risks and adhering to data minimization principles. Meanwhile, the banking sector, as highlighted by Keith Berry from Moody's Analytics, is not far behind in adopting AI, with a 12% adoption rate among respondents, indicating a sector-wide push towards innovating risk management and compliance. This trend reflects a strategic commitment to AI and data technology investment, even in the face of tight central bank policies and economic challenges. Firms are prioritizing these technologies, seen as critical to remaining relevant and efficient in a rapidly evolving financial landscape.

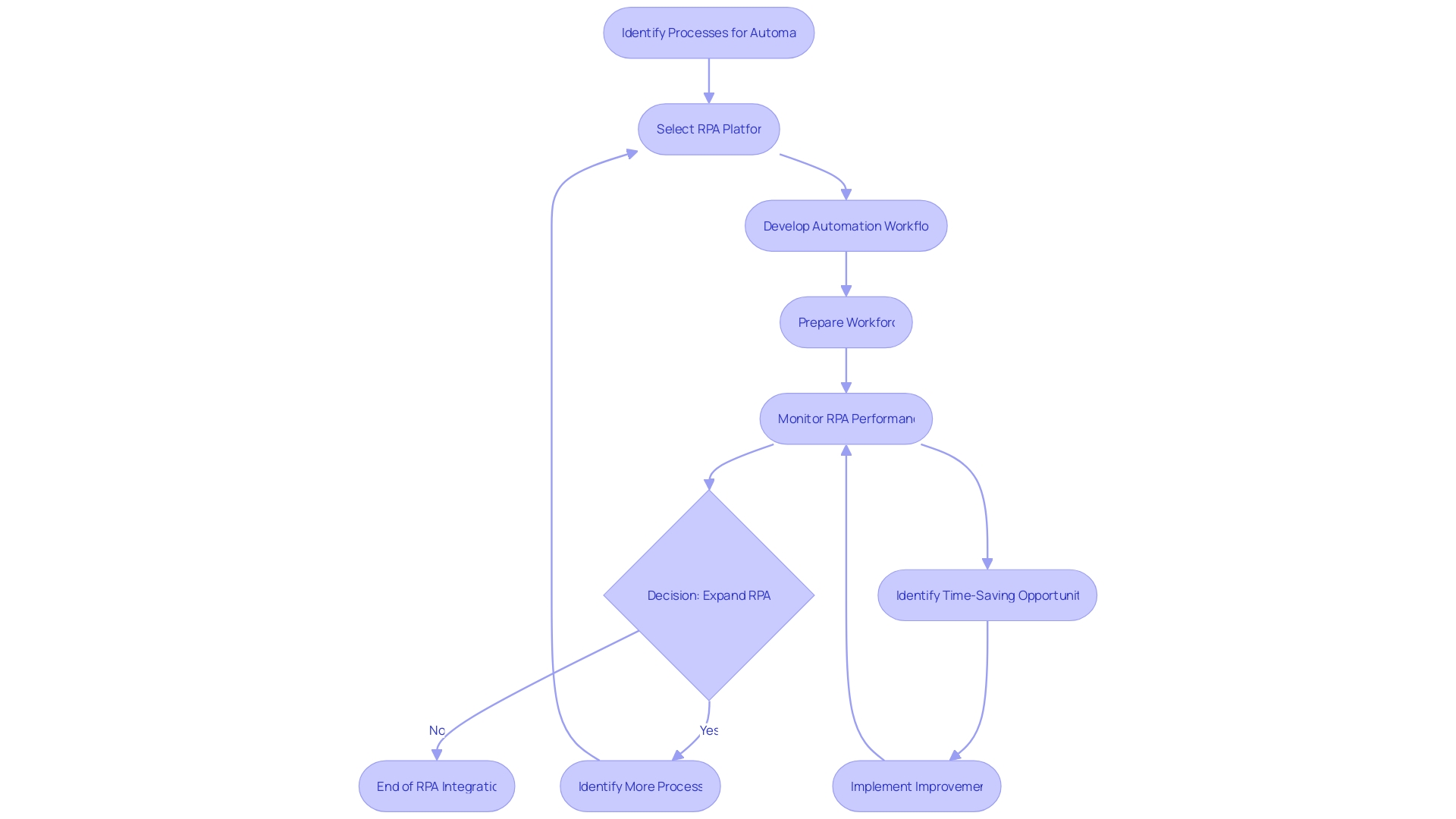

Implementing RPA in Financial Services: Key Steps

When integrating Robotic Process Automation (RPA) into financial services, precision and strategic planning are paramount. Start by identifying processes that are highly repetitive, rule-governed, and time-intensive.

These characteristics make a process ripe for RPA, as demonstrated by the reallocation of relationship managers in a financial institution, which led to an 88% increase in efficiency by reducing a seven-day task to just one day. Choosing the correct RPA platform is critical; it must be assessable for its capabilities, scalability, and system compatibility.

Select a platform that not only meets the current needs but also supports future growth and complies with regulatory standards, as underscored by the Financial Services Regulatory Authority of Ontario's commitment to adaptability in a changing environment. The development of automation workflows is a collaborative effort.

These workflows should accurately replicate the tasks previously performed by humans, which, once optimized, can lead to significant time savings—like the 840 hours saved annually in the case of relationship manager reallocation. It's also essential to prepare the workforce for the transition to RPA. Adequate training and change management can alleviate resistance and promote system adoption. Lastly, continuous monitoring of RPA performance allows for ongoing optimization, ensuring that the financial services organization remains efficient, compliant, and ahead of the curve in a competitive landscape.

Case Studies of RPA Implementation in Financial Services

Robotic Process Automation (RPA) has become a game-changer in the financial services industry, driving significant improvements in efficiency and customer satisfaction. For instance, one financial institution achieved an 88% increase in efficiency by employing RPA for reallocating relationship managers, transforming a week-long task into a one-day operation.

This not only saved 840 hours annually but also had a profound impact on customer interactions. In another example, a collaboration between Hazy and Nationwide Building Society resulted in the innovative use of synthetic data to test solutions aimed at supporting vulnerable customers.

This approach effectively minimized risks associated with using real customer data and adhered to data minimization principles. Furthermore, recent news of financial institutions facing legal consequences due to unethical practices underlines the importance of compliance and trust in the sector. RPA's ability to monitor transactions and compliance in real-time can help organizations avoid such pitfalls, ensuring they adhere to regulations and maintain customer trust. With RPA's proven track record of delivering staffing and cost savings in the millions, it's clear that the technology is a valuable asset for any financial service organization looking to improve operations and customer experience.

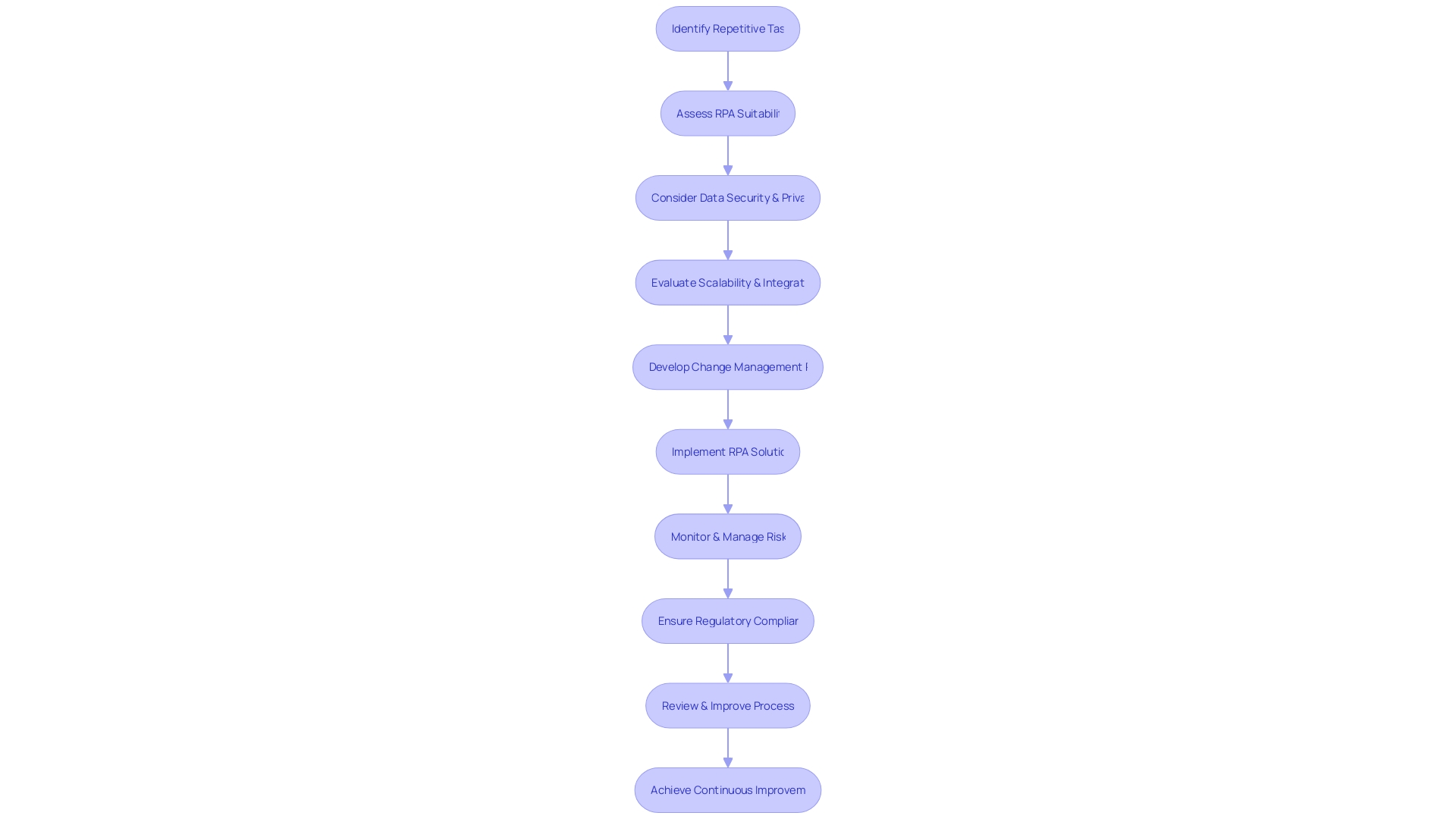

Challenges and Considerations for RPA Adoption

Adopting Robotic Process Automation (RPA) in the financial services sector is a significant strategic move that requires careful consideration of several factors. Protecting sensitive customer data is paramount, and RPA systems must comply with stringent data security and privacy regulations. With a report highlighting that data is akin to currency, it's essential to make data security a prime directive in the world of embedded finance to fuel ML models and tailor services.

Scalability and integration are also critical as organizations grow their RPA initiatives. A case in point is the utilization of RPA to reallocate relationship managers across accounts, which transformed a week-long process into a single day's task, increasing efficiency by 88% and saving 840 hours annually. This underscores the need for an RPA platform that can integrate with existing systems without causing disruptions.

Furthermore, change management is a crucial aspect of RPA adoption. Organizations must effectively manage the transition, offering adequate training and support to employees. As the regulatory authorities shift from a reactive to a proactive stance on AI, financial institutions must also adapt to ensure successful adoption and minimize resistance.

Lastly, RPA is not a set-and-forget solution; it necessitates continuous improvement. Organizations should establish a process for ongoing monitoring, optimization, and fine-tuning to maximize the benefits of RPA. This is in line with the advice that industry players be cognizant of data privacy issues when deploying AI and maintain an effective governance framework to understand the systemic risks AI can introduce.

Conclusion

In conclusion, Robotic Process Automation (RPA) is revolutionizing the financial services industry by automating tasks, improving efficiency, and reducing costs. Despite a gap in adoption, organizations have the opportunity to gain a competitive advantage by embracing RPA. The current status of RPA adoption in financial services is promising, with organizations using it to enhance operational efficiency and stay ahead in a rapidly evolving landscape.

Implementing RPA requires careful planning, selecting the right platform, collaboration, workforce preparation, and continuous monitoring. Case studies demonstrate the transformative impact of RPA on efficiency and customer experience. However, challenges such as data security, scalability, integration, change management, and continuous improvement need to be addressed.

Embracing RPA can reshape the financial landscape by driving innovation and improving operations. Financial services organizations should seize this technology to remain efficient, compliant, and competitive in an evolving industry. By leveraging RPA's benefits and addressing its challenges, organizations can achieve significant cost savings and enhance customer satisfaction.

In summary, RPA offers immense potential for financial services by automating processes and streamlining operations. With careful implementation and ongoing optimization, organizations can unlock the full benefits of RPA and position themselves as leaders in the industry. The time to embrace this transformative technology is now.

Take advantage of RPA to revolutionize your financial services business today!