Introduction

In an age where customer experience is paramount, Mobile Point of Sale (POS) systems are redefining the way businesses engage with their clientele. By replacing traditional cash registers with mobile devices, companies across various sectors are not only streamlining transactions but also enhancing service delivery in ways previously unimaginable.

The rise of mobile POS is driven by a need for efficiency and personalization, enabling businesses to meet the demands of a tech-savvy consumer base. As advancements in technology, such as artificial intelligence and cloud solutions, continue to shape this landscape, understanding the benefits and best practices associated with mobile POS systems becomes essential for any enterprise aiming to thrive in today’s competitive market.

This article delves into the transformative power of mobile POS systems, exploring their advantages, security considerations, and the future trends that will further revolutionize the retail and service industries.

Understanding Mobile POS Systems: A Modern Business Essential

Mobile POS apps are fundamentally transforming transaction processes across various industries. Unlike conventional cash registers, mobile POS apps allow enterprises to handle transactions via smartphones or tablets, facilitating smooth operations in various environments such as retail, hospitality, and food services. This inherent flexibility is crucial for organizations striving to deliver superior customer experiences.

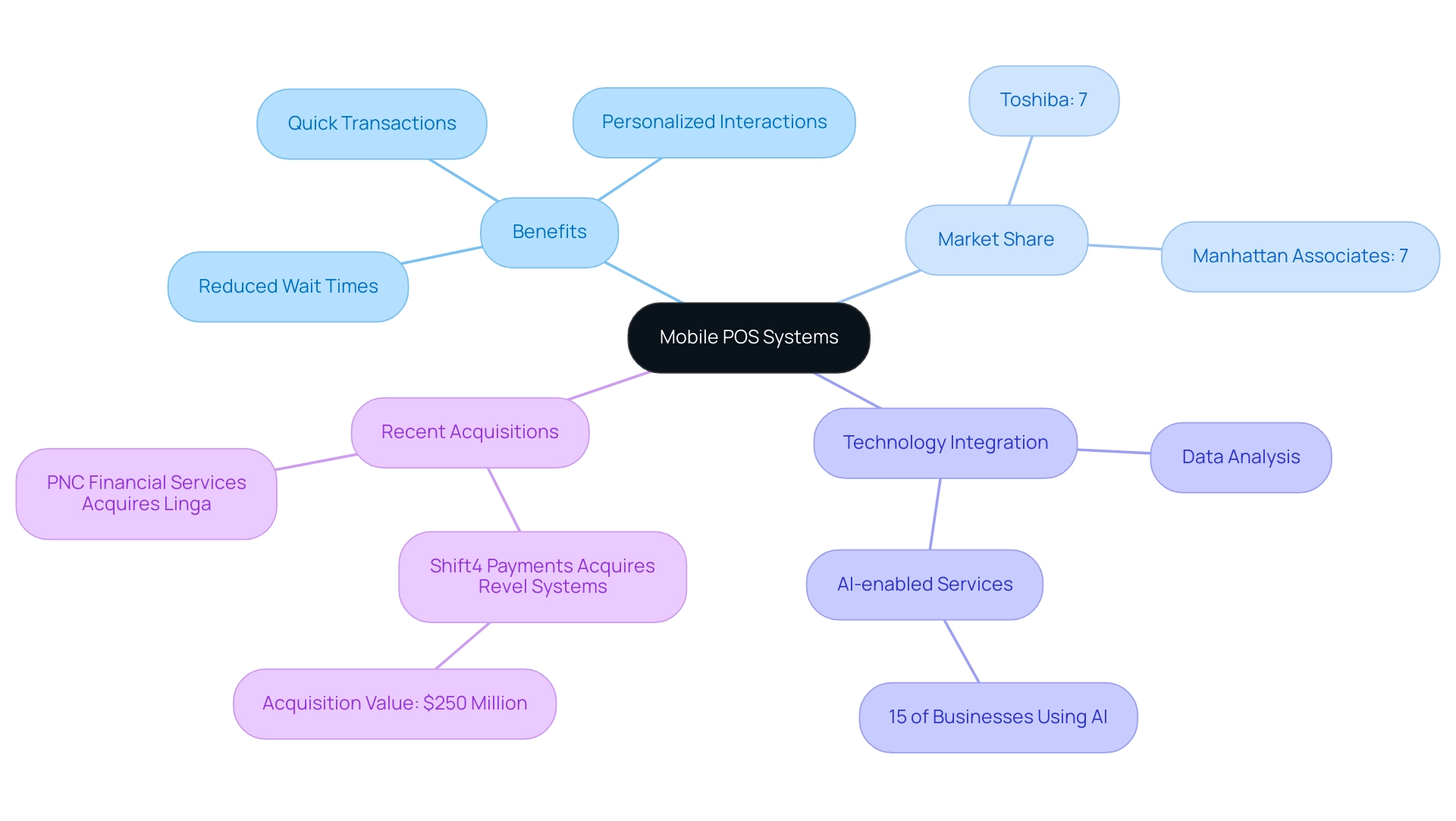

As experts observe, the integration of AI-enabled services is increasing, with 15% of businesses already incorporating such technology into their POS solutions, enhancing both functionality and efficiency (Adobe Blog). Moreover, as of late 2016, Manhattan Associates and Toshiba each possessed a 7% market share in North America, emphasizing the competitive environment of point-of-sale solutions. Recent acquisitions, such as Shift4 Payments' announcement to acquire Revel Systems for $250 million and PNC Financial Services Group's acquisition of Linga, illustrate the ongoing evolution and investment in mobile POS apps, aiming to enhance market presence and digital resources in the restaurant and retail sectors.

Mobile POS apps significantly enhance customer service by reducing wait times, enabling quicker transactions, and facilitating more personalized interactions. Additionally, they assist in gathering valuable customer data, allowing companies to analyze preferences and purchasing behaviors. This data-driven approach leads to informed decision-making and refined sales strategies, ultimately driving revenue growth.

As the market continues to change, portable POS solutions stand out as an essential tool for improving customer interaction and contentment.

Key Benefits of Implementing Mobile POS Applications

Implementing mobile POS applications offers a multitude of benefits that can transform operations and enhance customer interactions:

-

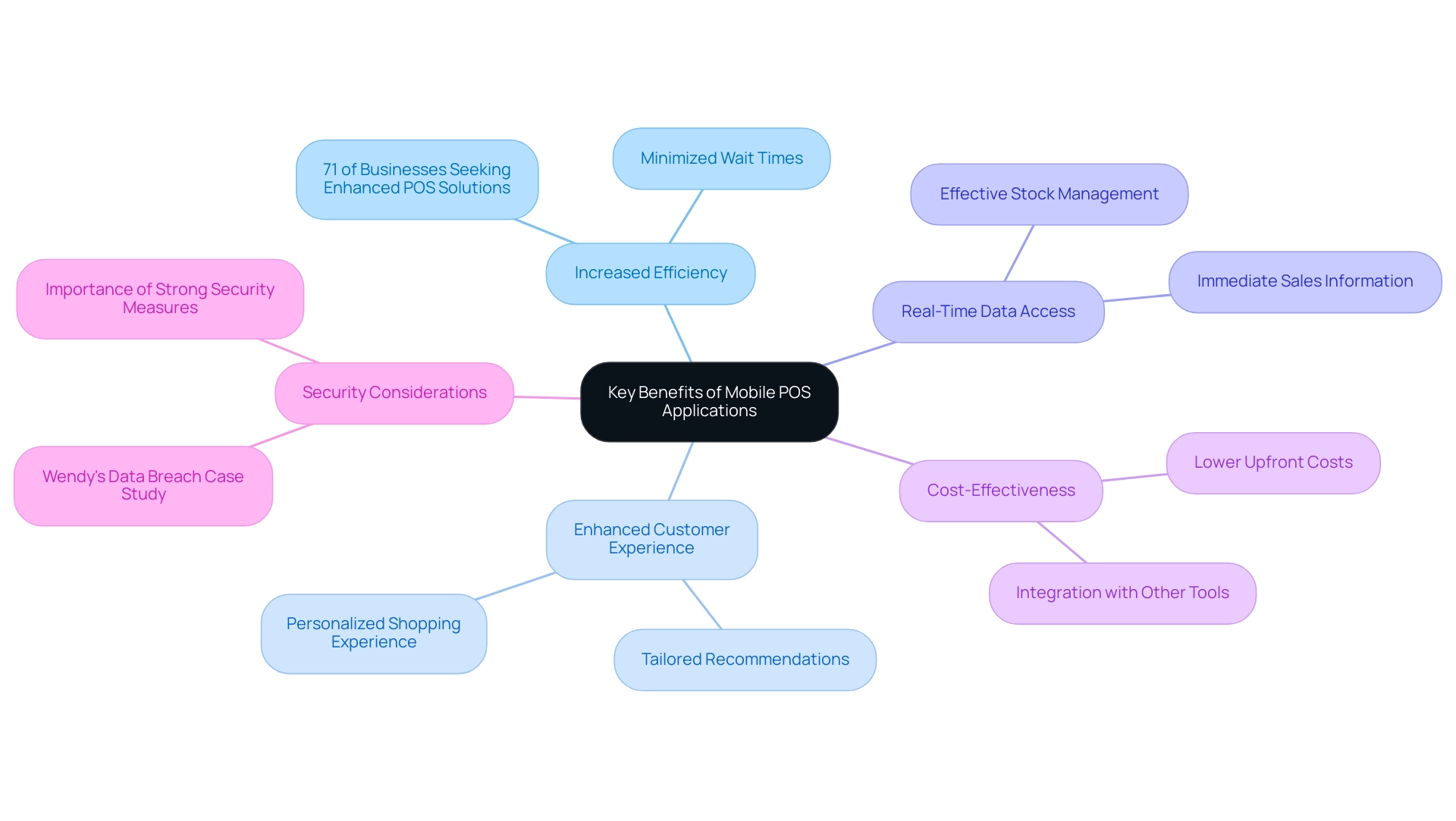

Increased Efficiency: Mobile POS apps enable swift transaction completion, effectively minimizing wait times and significantly enhancing customer satisfaction. Recent surveys indicate that 71% of businesses are looking to enhance their POS solutions with new features in 2023, demonstrating a clear shift towards more efficient transaction processes.

-

Enhanced Customer Experience: With mobile POS apps, sales associates can engage with customers throughout the store, fostering a personalized shopping experience. This capability not only improves service quality but also allows staff to make tailored recommendations, further elevating the customer experience.

-

Real-Time Data Access: Businesses gain immediate access to vital sales information and inventory levels through portable POS devices. This real-time insight facilitates effective stock management and informed decision-making, which are crucial in today’s fast-paced retail environment.

-

Cost-Effectiveness: Many mobile POS apps are cost-effective because they come with lower upfront costs compared to traditional setups, making them a viable option for small to medium-sized enterprises. This affordability enables companies to adopt sophisticated technology without straining their budgets. Mobile POS apps often seamlessly integrate with other tools, including accounting software and customer relationship management (CRM) platforms. This interoperability streamlines operations and enhances overall business efficiency.

-

Security Considerations: The significance of secure portable POS devices cannot be overstated, particularly considering events like Wendy's data breach in 2016, which impacted over a thousand locations and resulted in numerous lawsuits. This cautionary tale emphasizes the necessity for strong security measures to safeguard customer data and uphold trust.

Additionally, statistics reveal that Uganda's POS payment penetration reached 10.36% in 2023, indicating a growing trend in digital payment adoption that reflects similar patterns across various sectors worldwide. Notably, countries like China lead with a penetration rate of 38.25%, while Italy showcases a widespread use of POS terminals, further highlighting the increasing adoption of digital payment solutions. The shift towards portable POS systems not only signifies a technological advancement but also corresponds with evolving consumer preferences, making it an essential factor for progressive enterprises.

Exploring the Top Mobile POS Apps for Diverse Business Needs

Here are some of the top mobile POS applications that cater to diverse commercial needs:

-

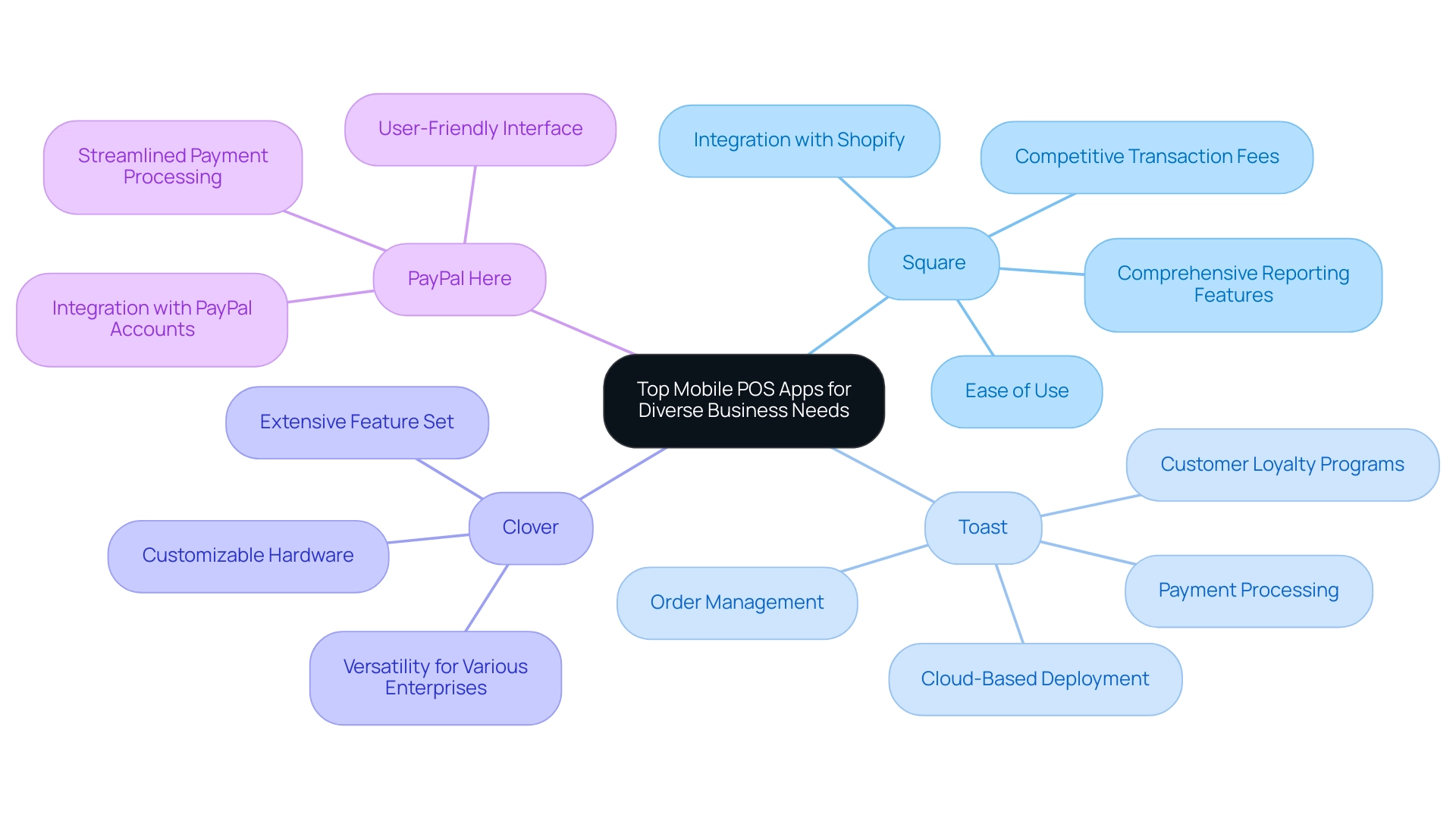

Square: Highly regarded for its ease of use, Square is ideal for small enterprises that utilize mobile POS apps. It provides a straightforward setup, competitive transaction fees, and comprehensive reporting features that assist owners in making informed decisions. As a testament to its popularity, Square's user ratings reflect a strong preference among small retailers seeking efficiency and reliability in mobile POS apps. Mobile POS apps, like Shopify POS, provide a perfect match for retailers utilizing Shopify’s e-commerce platform, offering seamless integration and effective inventory management. Users appreciate how mobile POS apps unify online and in-store sales, enhancing operational efficiency. Real-world implementations show that retailers benefit from increased sales visibility and streamlined processes.

-

Toast: Toast is one of the mobile POS apps specifically designed for the restaurant industry, streamlining operations with features for order management, payment processing, and customer loyalty programs. It provides a customized solution that addresses the distinct requirements of restaurants, which is essential in a setting where customer experience influences repeat patronage. The growth of cloud-based deployment in this sector, projected to have a CAGR of 9.2% through 2030, highlights the industry's shift towards innovative solutions like mobile POS apps, including Toast, reflecting the broader trend of modernization in the restaurant sector while still contending with older technologies.

-

Clover: Clover, known for its versatility, supports a wide range of enterprises with customizable hardware and various mobile POS apps. This flexibility enables companies to customize their POS systems to specific operational needs, making Clover a favorite among various enterprises. User reviews consistently praise Clover for its adaptability and extensive feature set, especially among mobile POS apps.

-

PayPal Here: A preferred choice for enterprises already utilizing PayPal, this app is among the mobile POS apps that streamline payment processing and invoicing. Its user-friendly interface and integration with existing PayPal accounts make it an appealing option for small enterprises looking to enhance their payment capabilities with mobile POS apps. With a market penetration rate of 10.36% for POS payments in Uganda in 2023, PayPal Here is well-positioned to capitalize on the growing demand for payment solutions.

In the context of a competitive landscape, key players such as Apple Pay, Google Wallet, and Samsung Wallet are also influencing the market for mobile POS apps. As experts predict that the transaction value of POS payments will reach $1,006,220 million by 2025, businesses must consider adopting mobile POS apps to stay competitive in the evolving market landscape, particularly as they navigate the challenges of modernization alongside the reliance on older technologies.

Ensuring Security in Mobile POS Transactions

Security in mobile POS apps transactions is not just a necessity; it is paramount for protecting sensitive customer information. With 75% of companies planning to allocate budgets for in-store technology tools within the next year, the emphasis on security investments is increasing. Here are several best practices to ensure secure processing:

-

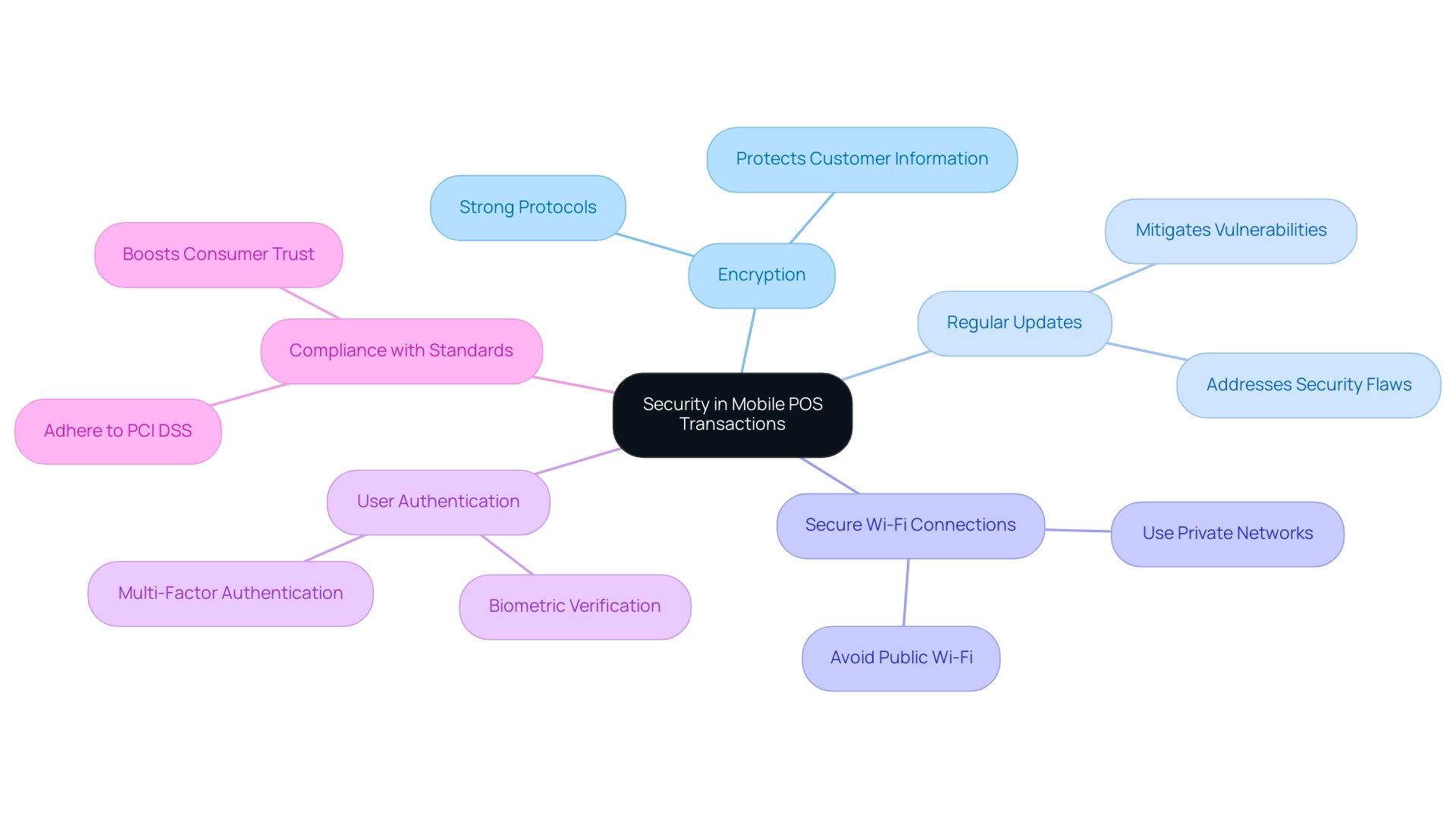

Encryption: It is essential that the portable POS solution utilizes strong encryption protocols to protect sensitive customer information during transactions. This encryption acts as a protective barrier, ensuring that unauthorized parties cannot access or manipulate transaction details.

-

Regular Updates: Keeping both software and hardware updated is essential to mitigate vulnerabilities. Regular updates can significantly reduce the risk of breaches by addressing potential security flaws promptly.

-

Secure Wi-Fi Connections: Using secure, private networks for transactions is vital. Public Wi-Fi poses significant risks, making it imperative to avoid such connections for conducting sensitive transactions.

-

User Authentication: Implementing strong user authentication protocols is critical for restricting access to the POS platform. This may include multi-factor authentication or biometric verification to fortify security.

-

Compliance with Standards: Adhering to the Payment Card Industry Data Security Standards (PCI DSS) is non-negotiable. Adherence to these standards guarantees that customer information is sufficiently safeguarded, demonstrating a dedication to security that can boost consumer trust.

Furthermore, it's essential to note that women are 15% less likely than men to utilize internet access in 2024 worldwide, which may affect payment adoption and its effects on security practices. As mobile POS apps evolve, the significance of portable payment systems becomes increasingly clear. Notably, recent statistics indicate that the total transaction value of payments in China decreased to 500 trillion yuan in 2022, highlighting current challenges in the payment landscape.

As more companies allocate budgets for in-store technological tools in 2024, prioritizing these security measures will be critical to fostering trust and ensuring safe transactions.

Future Trends in Mobile POS Technology: What to Expect

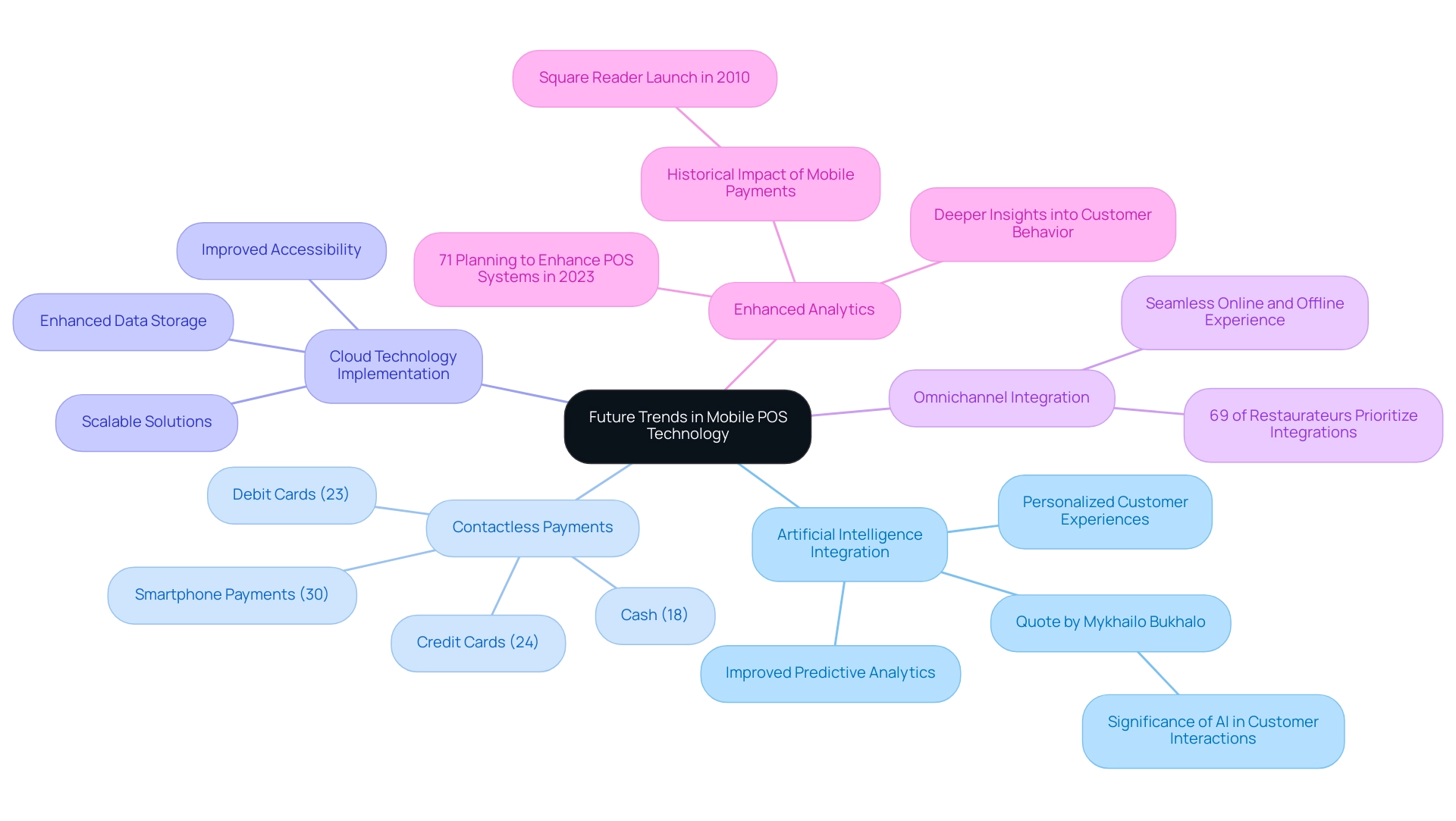

As technology progresses, several pivotal trends are shaping the future of point-of-sale systems:

- Artificial Intelligence Integration: The incorporation of AI is poised to transform the POS landscape by providing personalized customer experiences and improving predictive analytics. This will allow companies to anticipate customer needs and optimize their offerings. Mykhailo Bukhalo, a Delivery Manager, highlights the significance of AI, noting its potential to transform customer interactions.

- Contactless Payments: The surge in contactless payment methods is expected to persist, driven by consumer demand for speed and safety during transactions. In fact, smartphone payments accounted for 30% of in-store POS transactions by 2021, showcasing a marked shift in payment preferences. Additionally, credit cards were the second most popular payment method at 24%, followed by debit cards at 23% and cash at 18%, underscoring the growing trend towards contactless solutions.

- Cloud Technology Implementation: The implementation of cloud technology in mobile POS apps will enhance data storage and accessibility, allowing companies to oversee their operations more effectively. This trend aligns with the increasing preference for scalable and flexible solutions in the retail industry.

- Omnichannel Integration: Businesses are actively seeking POS solutions that offer seamless integration between online and offline channels, ensuring a unified customer experience. Significantly, 69% of restaurateurs view integrations with other platforms as the most crucial feature when selecting new POS software. This approach not only enhances customer satisfaction but also drives operational efficiency.

- Enhanced Analytics: Future portable POS solutions will feature advanced analytics capabilities, allowing businesses to gain deeper insights into customer behavior and sales trends. As noted in a recent HospitalityTech survey, 71% of respondents are planning to enhance their POS systems with new features in 2023, reflecting a proactive approach to leveraging data for strategic decision-making. Furthermore, the historical impact of mobile payments is evidenced by the Square Reader launch in 2010, which contributed significantly to the rise of mobile payments and has influenced current trends. These trends underscore the evolving landscape of mobile POS apps and the critical role they play in meeting modern consumer expectations.

Conclusion

Mobile Point of Sale (POS) systems are undeniably reshaping the retail and service industries, offering a range of benefits that enhance both operational efficiency and customer satisfaction. By allowing businesses to conduct transactions via smartphones and tablets, mobile POS systems minimize wait times and enable personalized interactions, which are essential in today’s competitive market. The integration of advanced technologies, such as artificial intelligence and cloud-based solutions, further amplifies the capabilities of these systems, facilitating real-time data access and informed decision-making.

The advantages of implementing mobile POS applications are numerous, including:

- Increased efficiency

- Cost-effectiveness

- Seamless integration with other business tools

As companies prioritize customer experience, mobile POS systems emerge as vital assets that not only streamline operations but also foster deeper engagement with consumers. Security remains a paramount concern, necessitating robust measures to protect sensitive information and maintain trust. Organizations must commit to best practices such as:

- Encryption

- Regular updates

- Compliance with industry standards

to safeguard both their operations and their customers.

Looking ahead, the future of mobile POS technology is poised for further transformation, driven by trends that include:

- Enhanced analytics

- Omnichannel integration

- The continued rise of contactless payments

As businesses adapt to these evolving consumer preferences and technological advancements, mobile POS systems will remain central to crafting exceptional customer experiences and driving revenue growth. In an era where agility and responsiveness are essential, embracing mobile POS technology is not just a strategic move—it is a necessity for businesses aiming to thrive in a digitally-driven landscape.