Introduction

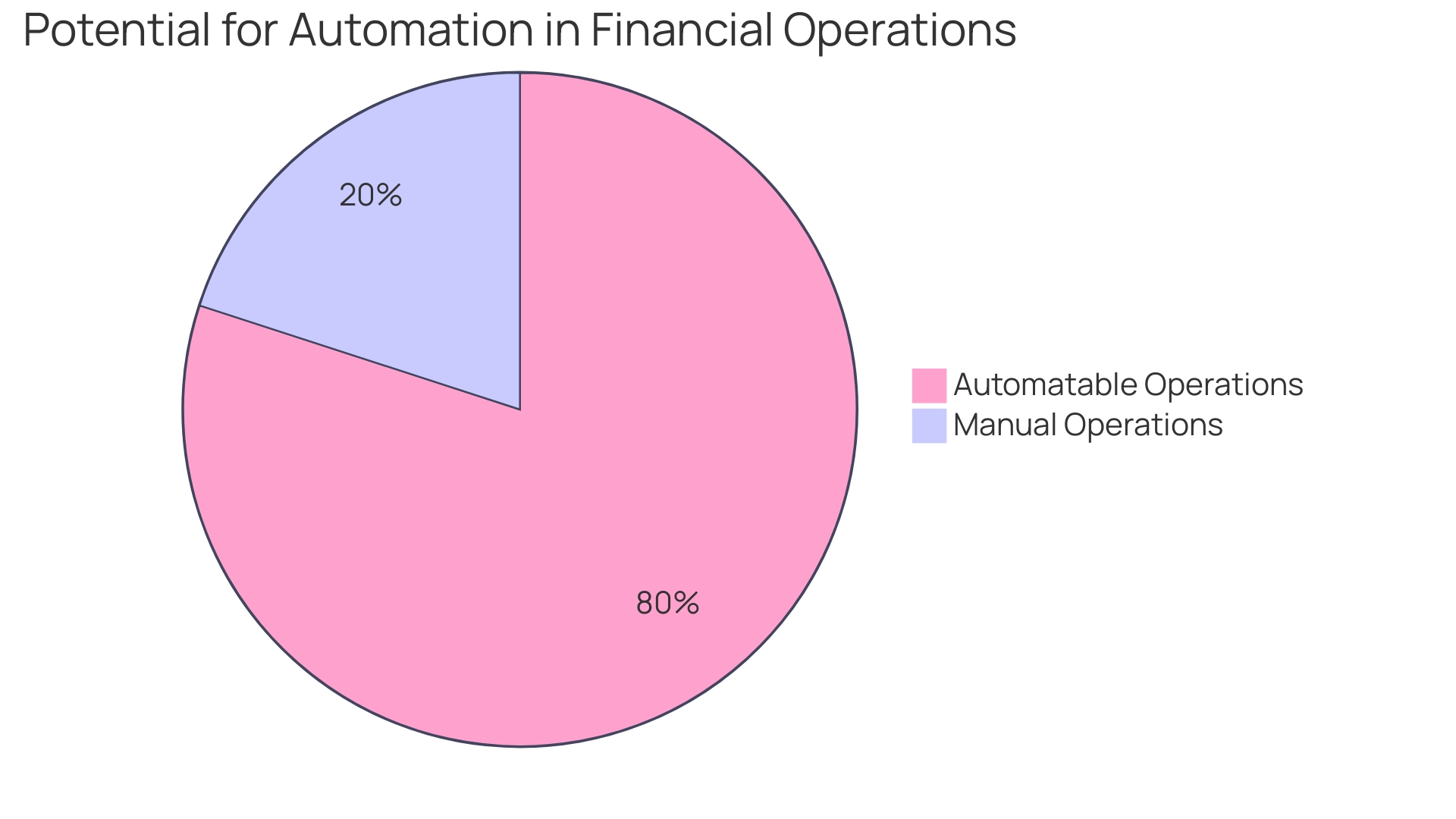

Robotic Process Automation (RPA) is revolutionizing the finance sector, delivering streamlined operations, significant cost savings, and enhanced efficiency. With the potential to automate 80% of financial operations, RPA offers a vast untapped opportunity for improved productivity.

However, despite its benefits, many companies have yet to embrace automation in their financial processes. This article explores the benefits of RPA in finance, the challenges of implementing it, real-world use cases, case studies, and the future of RPA in the financial landscape. By delving into these topics, we will uncover how RPA is transforming finance departments and shaping the future of the industry.

Benefits of RPA in Finance

Robotic Process Automation (RPA) is transforming finance departments, streamlining operations, and yielding significant cost savings. For instance, by reallocating relationship managers—a previously cumbersome and error-prone task—RPA has accelerated the process from a week to just a single day, enhancing efficiency by a staggering 88%.

This not only demonstrates RPA's potential to improve processing times but also highlights its impact on customer-facing activities. Remarkably, 80% of financial operations could be automated, as noted by Accenture, suggesting a vast untapped potential to enhance productivity.

By automating functions like bookkeeping and tax compliance, finance professionals can redirect their focus to strategic initiatives, ultimately elevating customer satisfaction. Despite this, nearly half of companies have yet to embrace automation in their financial processes, as per a Corcentric survey.

The integration of RPA with existing IT infrastructure is a game-changer, enabling businesses to leverage automation without significant investment in new systems. This compatibility with a wide range of software systems allows for seamless data extraction and entry while maintaining compliance. The promise of machine-readable regulations further indicates a revolution in compliance tasks, ensuring precision and reducing inefficiencies. Through real-world applications, such as the case of a bank that cut the time to market by 40% for a strategic product, RPA is proving to be a powerful tool for finance organizations seeking to become more effective, transparent, and value-oriented. The journey towards transformation, underpinned by agile principles, not only increases employee satisfaction but also aligns resources more effectively with organizational strategy.

Challenges of Implementing RPA in Finance

Robotic Process Automation (RPA) is transforming the finance sector, evidenced by a staggering AED 210 million in cost savings and significant efficiency gains. For instance, a once cumbersome process of reallocating relationship managers, which took seven days due to the need to coordinate multiple systems and record changes, has been condensed to a mere day.

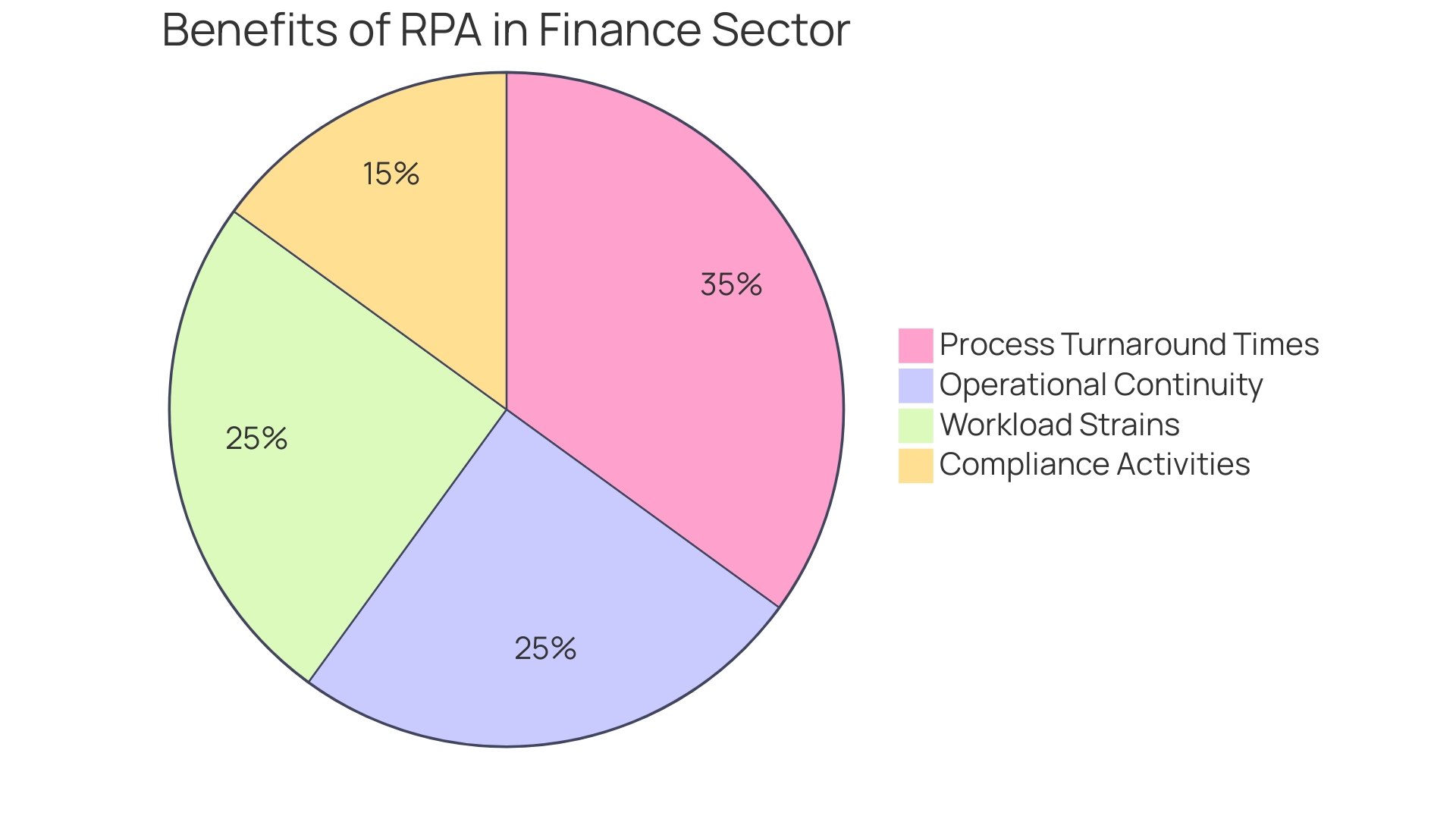

This 88% leap in efficiency, along with a 75% improvement in process turnaround times, saving 840 hours annually, underscores the transformative power of RPA. However, the path to such benefits is not without its hurdles.

Employees often harbor concerns about job security, fearing replacement by automation. It's essential to address these fears head-on, positioning RPA as an enhancer of human roles, not a replacement.

Moreover, financial organizations grapple with integrating RPA into their complex, existing infrastructures. The necessity to maintain operational continuity during integration is paramount.

As financial services companies strive to do more with less, amidst economic uncertainties, the integration of AI and automation technologies, like RPA, is crucial. While AI alone isn't a panacea, its combination with RPA can alleviate workload strains significantly. The key lies in finance leaders taking an active role in AI implementation, ensuring minimized risks and maximized benefits. This strategic approach to RPA adoption allows organizations to navigate the complexities of today's regulatory environment without the need for extensive IT infrastructure upgrades. By interfacing with various software systems, RPA bots streamline compliance activities, reinforcing the argument for their adoption in a sector that is under constant pressure to remain both compliant and efficient.

Use Cases of RPA in Finance

Robotic Process Automation (RPA) is transforming finance functions with its ability to streamline operations and enhance efficiency. For example, in accounts payable and receivable, RPA's role is pivotal in automating tasks like invoice processing, payment reconciliation, and credit control, significantly reducing the time and resources spent on these routine tasks.

When it comes to financial reporting and compliance, RPA excels by automating the creation of financial statements, regulatory reports, and facilitating audit processes. The technology's precision minimizes the risk of human error, contributing to more accurate financial records and compliance adherence.

Additionally, RPA's impact on risk management is noteworthy, with its capability to execute risk assessments, detect fraud, and monitor financial transactions with greater speed and accuracy. A striking case of RPA's effectiveness comes from a high-value initiative that revolutionized the process of reallocating relationship managers, cutting down the time required from seven days to just one.

This 88% leap in efficiency, along with a 75% improvement in process turnaround times, saved 840 hours annually. Such transformative outcomes demonstrate RPA's potential in optimizing finance-related workflows, offering significant cost savings and freeing up staff to focus on more strategic tasks. With the integration of machine-readable regulations, RPA is poised to further streamline compliance tasks, marking a new era in regulatory adherence. As small businesses seek cost-effective solutions, RPA stands out for its round-the-clock operation without the need for overtime pay or additional staffing during peak seasons. Moreover, by ensuring real-time data accuracy and compliance, RPA equips businesses with the tools for confident, law-abiding operations, and informed decision-making.

Case Studies of RPA in Finance

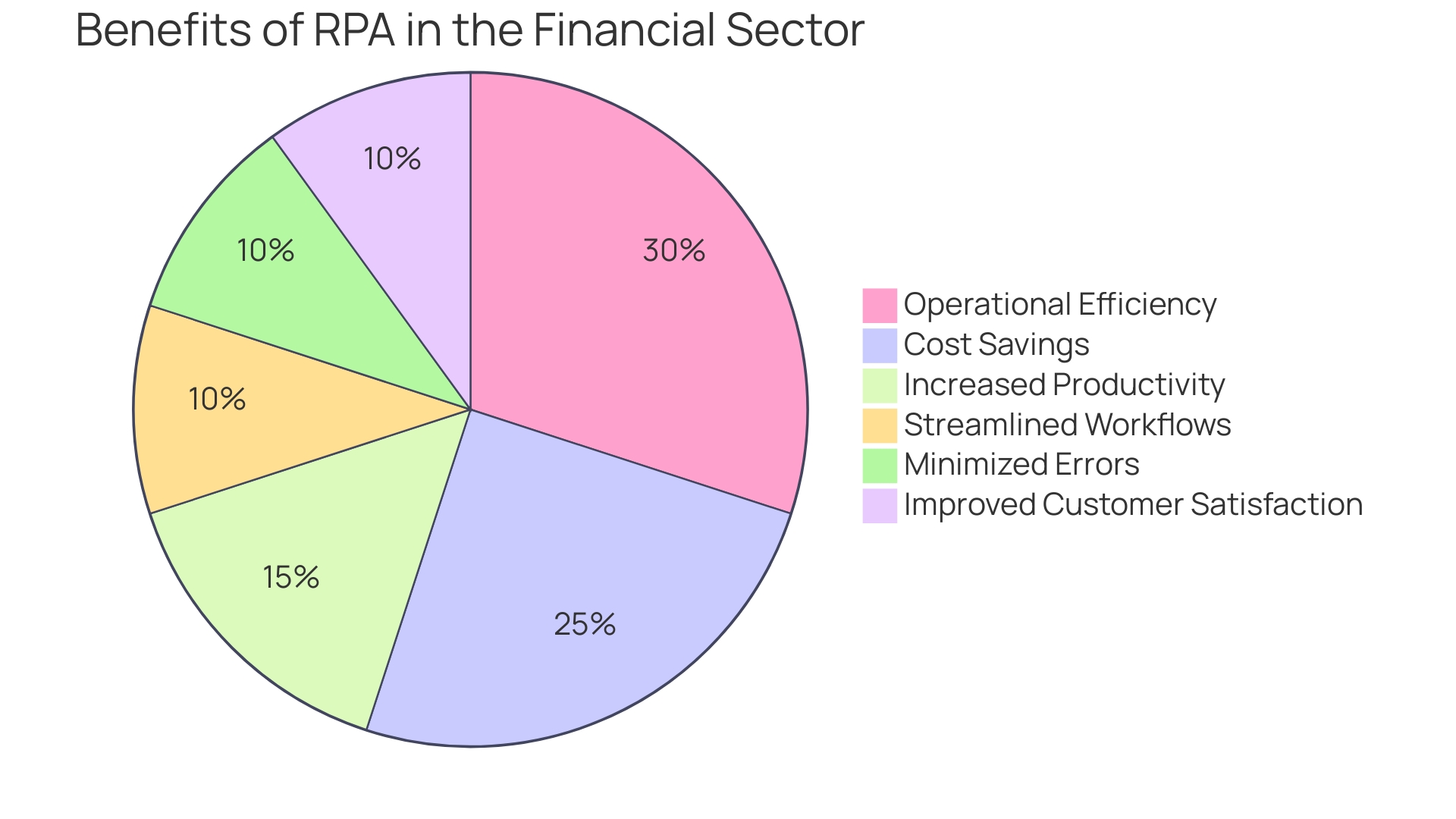

The transformative impact of Robotic Process Automation (RPA) in the financial sector is undeniable. With RPA, companies have realized not only a significant uptick in operational efficiency but also substantial cost savings.

For instance, by deploying RPA to reallocate relationship managers, a process that was traditionally bogged down by administrative burdens and prone to human error, organizations have seen an 88% increase in efficiency. This previously laborious task, spanning seven days, has been condensed to a mere 24 hours, thereby saving 840 hours annually and contributing immensely to the customer experience.

In one groundbreaking case, the automation of this process led to staffing and cost savings that exceeded AED 210 million. This swift and effective change is a testament to the profound capabilities of RPA in streamlining workflows, minimizing errors, and fostering a culture of innovation within financial institutions. As a result, employees are freed from mundane tasks to engage in more strategic, value-added activities, bolstering a dynamic and agile workforce ready to adapt to market shifts. Furthermore, customers benefit from quicker and more precise service, enhancing their overall satisfaction and loyalty to the institution.

Future of RPA in Finance

Robotic Process Automation (RPA) is making waves in the financial sector, offering transformative potential beyond mere cost savings. For instance, when relationship managers were reallocated across various accounts, a task that was once labor-intensive and prone to errors, RPA reduced the process time from seven days to one, enhancing efficiency by 88%. This leap in productivity also slashed process turnaround times by 75%, saving a staggering 840 hours each year.

As AI and machine learning continue to advance, RPA's scope is expanding to include complex decision-making and data analysis, empowering finance professionals with deeper insights. The integration of these technologies is poised to redefine finance operations, propelling innovation and efficiency to new heights. This is particularly relevant in regions like South America, where the industry is pioneering its own regulatory frameworks and adoption strategies.

Meanwhile, North America is navigating a more uncertain regulatory landscape, and Asia is crafting its unique approach. Furthermore, the financial gap in developing countries for micro, small, and medium-sized enterprises (MSMEs) is approximately $5 trillion. FinTech firms are stepping in to bridge this gap, especially in emerging markets where traditional banking services are scarce.

In such economies, FinTech penetration is not only the highest but also brimming with growth potential. For example, Nubank has captivated nearly half of Brazil's adult population, a testament to FinTech's expansive reach. With the FinTech industry's revenues projected to outpace traditional banking by a significant margin, the future holds a myriad of opportunities for RPA to drive further innovation and value creation within the financial landscape.

Conclusion

In conclusion, Robotic Process Automation (RPA) is revolutionizing the finance sector by streamlining operations, delivering significant cost savings, and enhancing efficiency. With the potential to automate 80% of financial operations, RPA offers a vast untapped opportunity for improved productivity. The integration of RPA with existing IT infrastructure enables businesses to leverage automation without extensive system upgrades.

Real-world use cases highlight how RPA automates tasks like invoice processing, payment reconciliation, and financial reporting, improving accuracy and freeing up employees for strategic initiatives. Despite initial hesitations, companies can overcome resistance by addressing concerns about job security and positioning RPA as a complement to human roles. The future of RPA in finance holds tremendous potential as AI and machine learning advance, redefining finance operations and driving innovation.

In developing countries with limited banking services, fintech firms are bridging the financial gap for small businesses through RPA's round-the-clock operation. Embracing RPA in finance leads to streamlined operations, cost savings, enhanced efficiency, improved customer satisfaction, and increased innovation. By adopting RPA, companies position themselves as industry leaders while effectively navigating regulatory challenges.

The transformative power of RPA in optimizing workflows and empowering employees sets the stage for a more productive and agile financial landscape. In summary, RPA is transforming finance departments by automating tasks, improving accuracy, and enabling employees to focus on strategic activities. Leveraging the potential of RPA will shape a more productive and innovative future for the finance industry.