Introduction

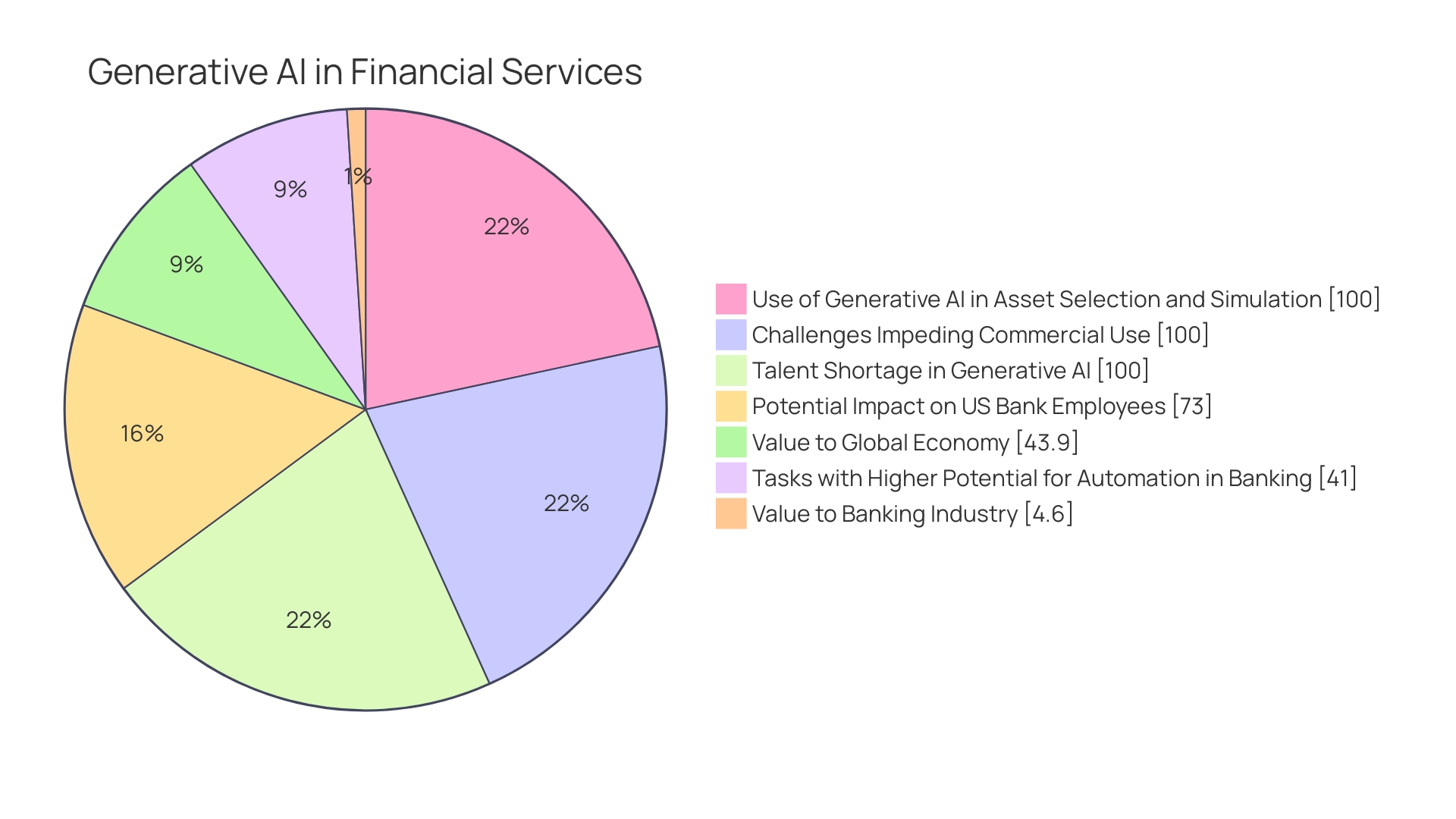

The role of automation in investment banking is undergoing a significant transformation, thanks to the emergence of generative artificial intelligence (AI). This innovative technology not only promises efficiency gains but has the potential to revolutionize various tasks within the banking sector. Accenture's analysis reveals that 73% of banking employee tasks are susceptible to AI's influence, with automation and augmentation capable of transforming a significant portion of these tasks.

While the impact of automation is felt across all banking sectors, specific roles, such as analysts, are particularly vulnerable. However, automation is not just about streamlining operations; it also fosters growth and efficiency. Financial institutions are increasingly investing in automation technologies to redefine their business processes, drive economic efficiency, and unlock new realms of growth.

As investment banks strive for a competitive advantage, automation is becoming an indispensable tool to enhance operational efficiency while upholding ethical standards and maintaining employee trust.

The Role of Automation in Investment Banking

The advent of generative artificial intelligence (AI) is dramatically altering the landscape of investment banking. Accenture's comprehensive analysis indicates a vast potential for efficiency gains, with 73% of banking employee tasks being susceptible to Ai's influence. Automation could dramatically change 39% of these tasks, while augmentation could transform an additional 34%.

The influence of this innovative technology extends across all banking sectors, from top executives to customer-facing roles, affecting every link in the value chain. However, the impact is not uniform. Specific roles that involve 41% of banking employees display a greater likelihood for automation, notably modifying the work environment for analysts who traditionally undertake extensive hours mastering the essentials of corporate finance.

Generative AI does more than just streamline operations; it's set to potentially improve productivity for early adopters by a significant margin over the next three years. The shift is palpable on Wall Street, where investment banks are becoming a prime example of how such technology can complement and even replace entire segments of the workforce. Analysts, positioned at the investment banking hierarchy's base, are particularly vulnerable as their duties—including the fine-tuning of complex financial documents and grasping the nuances of mergers and public offerings—are prime targets for generative AI's capabilities.

But the transformation isn't solely a narrative of workforce displacement; it's also about fostering growth and efficiency. Some financial institutions are leading the charge in leveraging this technology. For instance, a new AI-focused department within XTB's technology division, headed by Tomasz Gawron, a renowned robotics programmer, symbolizes a strategic movement towards the 'responsible adoption' of AI in enhancing business operations and trading activities.

As organizations like XTB invest in developing their technological capabilities, ensuring that a sizable portion of their team is proficient in programming and technical skills, the role of AI in investment banking becomes increasingly indispensable.

Jobs in IT, Finance, and Customer Sales are forecasted to be most influenced by AI, with tasks like performance monitoring, customer data collection, and document management facing considerable alterations. This evolution is not just a forecast; it's a present reality reshaping how financial firms operate and compete in the modern age. And as this technology continues to advance, the image of banks and financial institutions—even when compared to those of the recent past—will look markedly distinct, emphasizing the fact that generative AI is not merely a technological upgrade, but a catalyst for fundamental change in the investment banking sector.

Benefits of Automation in Investment Banking

As Robotic Process Automation (RPA) heralds a new era in technology, investment banking firms are witnessing substantial transformations. RPA, involving the deployment of software 'bots' to perform previously human-executed tasks such as data entry and transaction processing, is enabling firms to reallocate their human capital to more strategic, high-value activities. With the bots efficiently handling rule-based tasks, employees can now prioritize complex functions like strategic decision-making and client relationship management.

The positive implications of RPA span far beyond task reallocation. It stands as a paragon of precision in financial transactions and reporting, notably reducing the likelihood of human error. A compelling case for this is Hiscox, where embracing automation has dramatically decreased response times by clearing repetitive email workloads by 28%, allowing for more effective and personalized customer engagement.

Guilherme Batista, orchestrating automation efforts at Hiscox, highlights the central ambition: sustainable growth without a proportional surge in operating expenses.

This ambition resonates across the financial services industry. Research from the CFA Institute underscores this, revealing how 91% of professionals acknowledge that AI and data analytics implementation has significantly bolstered their firms. This leap in technology notably streamlines labor-intensive tasks, allocating time for staff towards more productive endeavors.

Moreover, this tech transformation isn't just about efficiency; it's an essential strategy for survival as generative AI takes the financial world by storm. Analysts at the lower echelons of investment banking, once tasked with tireless analysis and documentation, may find their roles redefined as AI has the potential to provide not only assistance but also replacement in certain job functions. This reshaping of the workforce is echoed in the words of industry experts who have observed the swift cultural shift within investment banks and the broad-spectrum potential of AI.

Substantial productivity gains also loom on the horizon for early adopters of AI. In banking, for instance, Accenture predicts a 73% chance of tasks being affected by AI—with automation accounting for 39% and augmentation for 34%. Such statistics reflect a significant impact that could potentially reach every corner of the banking operation, contrasting sharply with once rigid, hierarchical structures prolonged by manual processes.

Investment banks striving for competitive advantage and scalability are thus increasingly looking to automation technologies like RPA to redefine their business processes, drive economic efficiency, and unlock new realms of growth.

Case Study: Cloud-Based Automation for a Leading Investment Bank

At the core of Hiscox's operational strategy lies a powerful revelation: to keep pace with their growth and sustain competitive advantage, the company must streamline processes, improve efficiency, and importantly, do so without proportionally increasing operating expenses. Guilherme Batista, the Process and Operations Manager at Hiscox, has been instrumental in orchestrating this strategy since his early days as a business analyst and later, leading the European change team. The company set out to revitalize its client service model when faced with the undeniable fact that delays in communication could deter half of their customers from doing business with them.

With this in mind, Hiscox turned to a novel and increasingly necessary ally in the business world: automation technology, particularly Robotic Process Automation (RPA). Rapid advancements in RPA allowed Hiscox to implement a system capable of slashing the repetitive email workload by a remarkable 28%, while concurrently reducing average response times. The result?

Enhanced customer and employee satisfaction — a crucial milestone for the insurer's ambition of long-term success.

Hiscox is not alone in their journey towards embracing the power of AI and automation. For instance, the CFA Institute observed that 91% of financial firms integrating AI and big data into core operations said it improved their business. A case in point is the accelerated efficiency in trade settlements, portfolio management, and compliance monitoring, as observed in a leading investment bank's switch to cloud-based automation.

Kevin Ellis of a professional services firm attests to AI being the 'story of the year,' transforming business operations across various industries.

The financial market, in particular, has witnessed a revolution with algorithmic trading, especially High-frequency Trading (HFT). Financial services strive for innovation amidst cost pressures, and it's clear that AI and automation offer a golden ticket. Companies like Sirius Technologies harness this trend, transitioning to secure Cloud Development Environments and optimizing the software development life cycle to achieve accessible financial services.

Through the efficient allocation of tasks between human talent and digital assistants, firms are realizing that AI and automation are not just a wave of the future, but critical considerations for immediate action. As epitomized by firms like Hiscox, utilizing automation as a strategic tool for achieving sustainable growth without bloating expenses is the new mantra for success.

Implementation of Automation: Challenges and Solutions

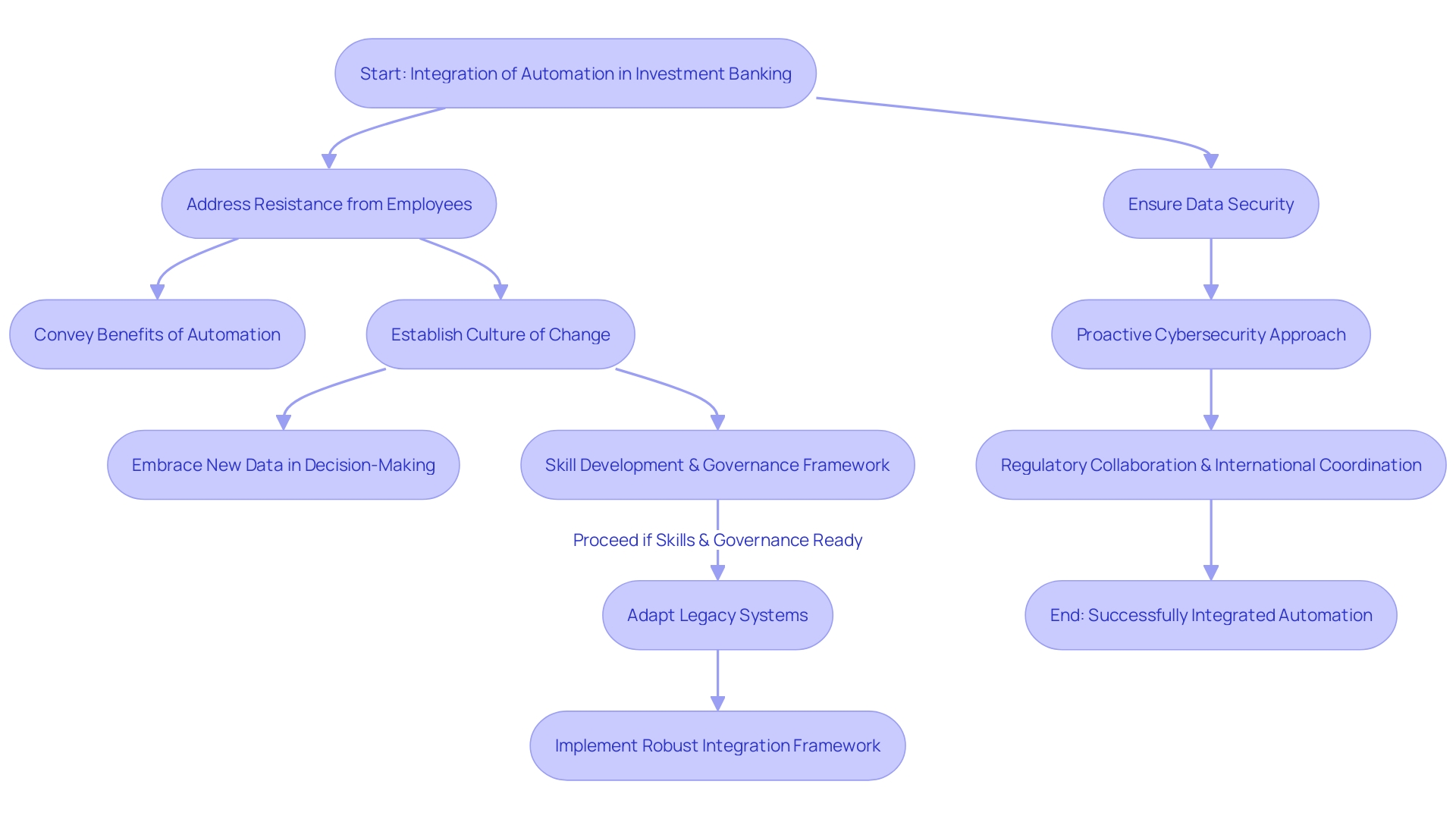

While integrating automation into investment banking promises substantial benefits, it inevitably involves navigating through several roadblocks. Among these challenges, resistance from employees, adapting existing legacy systems to modern automation capabilities, and ensuring data security stand out as substantial.

Resistance to change among employees can be particularly taxing. Automation upends familiar routines and roles, which can cause uncertainty and pushback. Yet, it's crucial to acknowledge that this resistance is often rooted in unaddressed concerns regarding job security and the changing landscape of work responsibilities.

In the case of Hiscox, a specialist insurance company faced with a similar scenario, they tackled the resistance by introducing automated solutions that reduced their email workload by 28% and improved response times. This not only elevated customer satisfaction but also boosted employee morale, demonstrating the importance of conveying the long-term benefits to employees to mitigate resistance.

Legacy systems present another hurdle. These systems, built over years or even decades, may be deeply embedded within a bank's operations, making integration with new automation technologies quite complex. However, Hiscox exemplifies overcoming such challenges through a robust integration framework designed to revamp its client service model, resulting in higher throughput without overburdening its service agents.

Data security concerns amplify with automation due to the increased accessibility of sensitive information. A proactive approach to cybersecurity—understanding the systemic risks AI could introduce and maintaining an effective governance framework—is advocated by experts. Regulatory experimentation and fostering collaborations among stakeholders can create an environment where Ai's integration considers all ethical concerns and security risks.

Statistics further endorse the transformative potential of automation in banking. For instance, Accenture projects an improvement in productivity for early adopters of AI and automation within the next three years. Their analysis indicates that 73% of time spent by US bank employees could be impacted by generative AI—39% through automation and 34% through augmentation.

The dynamic nature of the finance sector, with rapid regulatory changes and tech advancements, makes the effective implementation of automation a nuanced task. Investment banks must therefore adopt a dual focus: leveraging the power of AI to enhance operational efficiency while simultaneously upholding ethical standards and employee trust.

Impact on Employee Experience and Efficiency

In the evolving landscape of investment banking, automation technologies are proving to be game-changers in shaping the employee experience. As financial institutions embrace these advancements, they notice an uptick in operational efficiency while granting employees respite from the drudgery of mundane tasks. The transformative effects of automation not only cut down operational costs but also pave the way for heightened productivity across various banking sectors.

A striking insight reveals that early adopters of automation could see significant productivity improvements in the coming years. Accenture's research underscores the assertions, highlighting that a massive 73% of the time bank employees spend could be influenced by generative AI—39% through direct automation and 34% via augmentation. The reverberations of this technology are felt right from the C-suite down to front-line services, signifying its ubiquitous potential.

Yet, such impacts are far from homogenous, with discrepancies in automation potential among different banking roles.

One real-world application of this is echoed in the experiences of Hiscox's insurance service teams. Overwhelmed by growing demands, they found respite in an automation solution that reduced their repetitive workload by 28%, simultaneously improving their response times. This leap forward not only benefited Hiscox customers but also bolstered employee satisfaction—a testament to the virtuous cycle created by thoughtful integration of automation.

Guilherme Batista, a leading figure in Hiscox's process and operational innovation, attests to the strategy's success, revealing that automation was key in driving sustainable growth without proportionally increasing operating expenses.

Highlighting the practical implications of automation in finance departments, Shagun—a former Fortune 100 auditor and CEO of SkyStem—shares noteworthy insights. While other sectors have witnessed widespread automation, surprisingly, finance departments lag behind. With an estimated 80% of financial operations holding the potential for automation, there's an untapped reservoir of employee time that could be dedicated to strategic initiatives or enhancing customer experience.

The intersection of AI and machine learning stands as a beacon for realizing the full potential of finance automation.

Turning to Wall Street, the allure of automation is undeniable, with investment banks increasingly deploying AI to refine tasks ranging from performance reviews to crafting job descriptions. Workday's co-CEO has revealed the fervent interest banks demonstrate towards their new AI-powered productivity tools, hinting at a profound transformation within the industry. This echoes sentiments of analysts who recognize the profound potential AI holds for reshaping jobs in every industry, noting that the role GPTs play in creating and potentially accelerating industry cycles.

As we brace for the unfolding trends of 2024, it becomes apparent that employees favor AI as an assistant rather than a manager. This speaks volumes about the evolving dynamic between employees and automation—a relationship centered around AI augmenting human capabilities, rather than supplanting them. With automation reshaping the job landscape, it's clear that the focus shouldn't just be on technology uptake but also on how it harmoniously enhances the human element of banking operations.

Future of Automation in Investment Banking

The landscape of investment banking is on the cusp of a transformative leap forward with the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA). These innovations promise a horizon rich with efficiency gains, reduced operational costs, and improved customer experiences. A paradigm of this progress is evidenced in the journey of Hiscox services, where swift communication is critical.

An automated solution was employed to effectively cut down repetitive email responses by 28%, demonstrating a significant improvement in customer response times, which is instrumental in ensuring long-term success and customer loyalty.

Guilherme Batista, Hiscox’s Process and Operations Manager, emphasizes the objective of sustainable growth with increased revenue untouched by parallel upsurges in operating costs. Hiscox has leveraged these technologies to achieve a refined client service model, thus alleviating the workload on service teams and improving throughput. As investment banks, like Hiscox, look to remain in the vanguard of the financial sector, it is clear that automation isn’t a mere trend but a strategic imperative geared towards enduring growth and competitive edge.

In this dynamic era, ESG considerations are becoming paramount in the banking domain. Customers are increasingly aligning with banking solutions that resonate with their values. Neobanks are disrupting the traditional financial landscape with their digital-only platforms, compelling legacy banks to innovate rapidly.

Personalization and client experience enhancements stand at the forefront of these transformative times. Adopting data analytics, AI, and ML, institutions like Hiscox are poised to decipher complex client behaviors, enabling a more nuanced service offering.

The financial realm is rapidly shifting, and investment banking is no exception. AI and automation are not only about data processing but about drawing contextual and semantic understanding from vast unstructured data pools, such as financial reports and regulatory filings. These technologies herald a new chapter where banks can introspect and regenerate code for new strategies effortlessly, considerably optimizing the time of their analysts and researchers.

Accenture's report on AI and automation encapsulates the scenario, pointing to the 73% potential productivity improvement for early adopters in the coming years. It highlights that a staggering 41% of banking employees could see their tasks affected by automation. This is the juncture where investment banking must pivot—embracing digital assistants, prioritizing IT innovations, and fostering investment strategies aligning with emerging technologies to remain avant-garde in the financial services ecosystem.

Conclusion

In conclusion, automation is revolutionizing investment banking through generative AI. With 73% of banking tasks susceptible to AI's influence, automation and augmentation can transform operations. Investment institutions are investing in automation to drive efficiency, reallocate human capital, and unlock growth.

While challenges like resistance, legacy systems, and data security exist, early adopters can expect significant productivity improvements. Automation not only enhances efficiency but also improves the employee experience by freeing up time for strategic initiatives. Investment banks must prioritize automation to remain competitive and uphold ethical standards.

By leveraging AI, ML, and RPA, banks can achieve efficiency gains, reduced costs, and improved customer experiences. By embracing automation technologies, investment banks can thrive in the dynamic financial landscape and drive growth.