Introduction

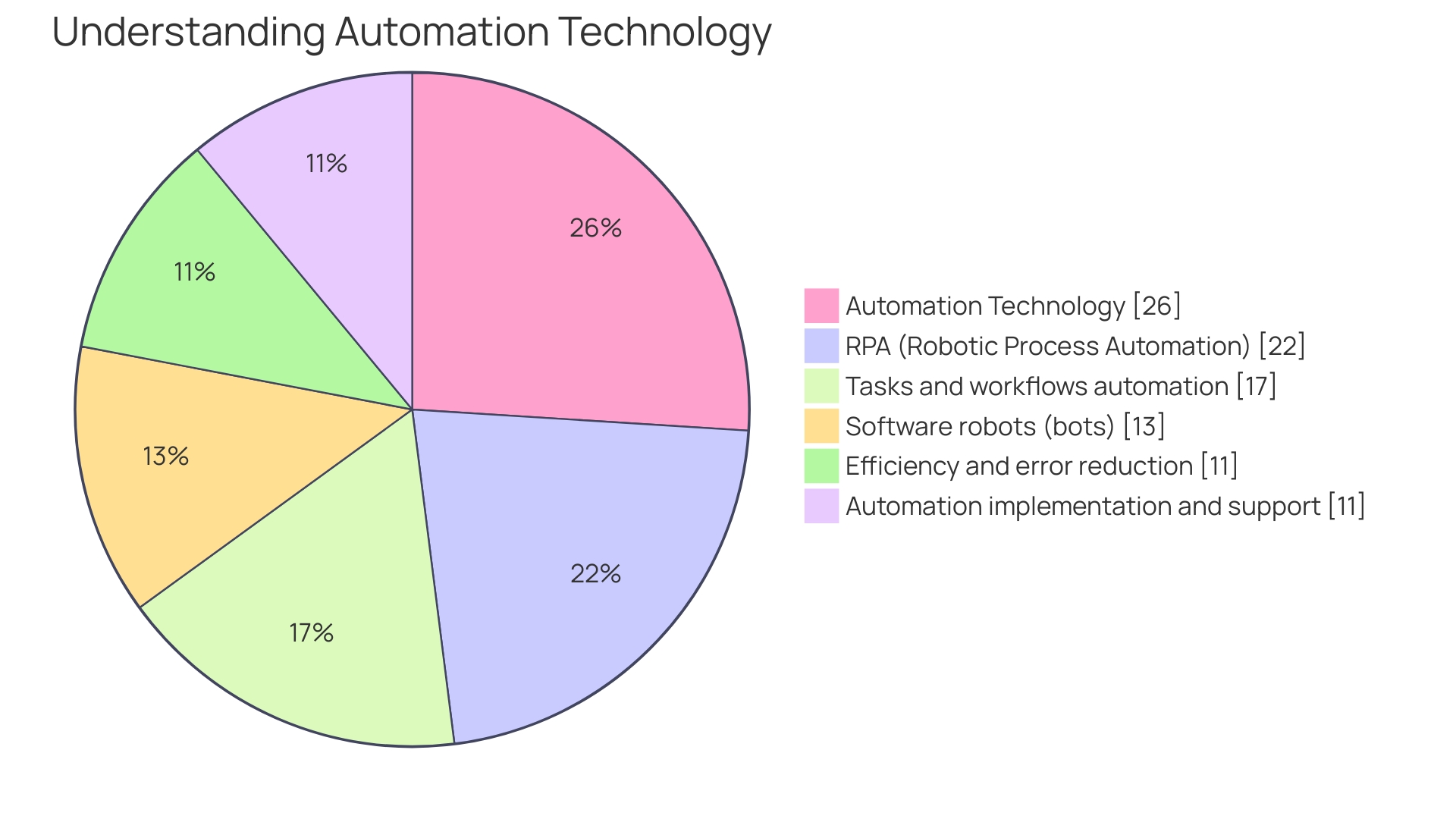

Automation has become a crucial aspect of the banking industry, revolutionizing operations and driving efficiency and accuracy. In this rapidly evolving landscape, financial institutions are recognizing the urgent need to adapt to stay competitive. From Robotic Process Automation (RPA) to Artificial Intelligence (AI), these transformative technologies are reshaping the sector and providing opportunities for growth.

This article explores the benefits, challenges, and future trends of automation in banking, shedding light on how institutions can leverage these technologies to enhance customer experience and streamline operations. As the industry continues to evolve, it is clear that the integration of automation is essential for banks to maintain their edge in the digital era.

The Need for Automation in Banking

Banking operations have grown increasingly complex, and robust solutions are essential to maintain competitive edge and customer satisfaction. Robotic Process Automation (RPA), a transformative force in technology, allows banks to surmount these challenges by automating repetitive and rule-based tasks. Thus, ensuring precision and speed in workflows and enhancing the overall customer service experience.

For instance, Commerce Bank, which prides itself on a super community bank model, found itself navigating technical debt while trying to keep pace with emerging digital solutions and FinTech competitors. To address the evolving market demands, Commerce Bank has embarked on strategic partnerships to modernize its platforms, utilizing automation to meld their sophisticated banking services with the personalized approach akin to a smaller community bank. Meanwhile, industry leaders like Capital One are setting benchmarks for digital transformation—such as their full-scale migration to the cloud and innovative use of collaborative platforms like Slack for automating tasks across various departments, emphasizing a corporate ethos of continual improvement and technological adoption.

In an industry where AI and automation are no longer just buzzwords, financial institutions have recognized the urgency to adapt. According to a study by the World Economic Forum in collaboration with Accenture, IT, finance, and customer sales roles are expected to experience the brunt of Ai's impact through substantial automation and alteration of tasks. Accenture's modelling suggests an immense 73% of time spent by bank employees could be transformed through AI and automation, with early adopters expected to see significant productivity boosts over the coming years.

Furthermore, research by Equals Money underlines this trend, showing that a staggering 95% of financial leaders are either using or considering AI—underscoring not only the technology's immediacy but also its potential to dramatically change the financial services industry as we know it.

Benefits of Automation in Banking Operations

The integration of Robotic Process Automation (RPA) within the banking sector signifies a transformative era anchored on efficiency and accuracy. RPA's deployment in critical banking operations such as data entry, transaction processing, and report generation, is pivotal in diminishing time-intensive, manual intervention. Take, for example, Hiscox, a standout in the insurance domain, which has harnessed automated solutions to manage their burgeoning client communication demands effectively.

An impressive 28% reduction in repetitive email workload and a corresponding decrease in response time are testaments to the tangible benefits of automation in enhancing customer satisfaction.

In a similar vein, Capital One, a leading US retail bank recognized for its pioneering digital strategies, leverages Slack, not just for staff collaboration but as an automation platform. This initiative has sparked a cultural shift across numerous departments, leading to increased productivity and innovation, an effort that culminated in receiving the Innovation in Slack Award for customer experience excellence.

As Guilherme Batista, Process and Operations Manager at Hiscox, articulates, automation's mandate transcends operational efficiency; it's about fostering sustainable growth without proportionally escalating operating expenses. The intention is to fuel revenue generation while mitigating the financial burden.

Scanning the landscape, we can discern the profound implications of RPA on the banking sector, mirroring strides made in other industries like healthcare. Artificial intelligence and machine learning have begun to reshape tasks that were once exclusively human-operated, such as patient wait time reduction and data retrieval in healthcare, indicating a broader trend of AI augmentation.

Moreover, reinforcing the credibility of automation technology is the report 'AI and automation: Four critical considerations—and an action guide,' which accentuates the potential for revenue growth and CAGR improvement following the adoption of intelligent automation. And with financial analysts like Shagun, CEO of System, asserting that an estimated 80% of financial operations stand to benefit from automation, the impetus for embracing RPA within financial services is clearer than ever.

Case Study: Automation in Banking Compliance

The intersection of banking operations and technology is highlighted by the efficient application of Robotic Process Automation (RPA) in streamlining compliance tasks. RPA stands out especially in sectors such as Know Your Customer (KYC) and Anti-Money Laundering (AML) for its accuracy and speed, ultimately contributing to more expedient customer onboarding and lowered compliance expenses. Recent advancements underscore this point, with Uri Rivner, CEO of Refine Intelligence, speaking to the evolving nature of banking relationships in the digital age.

The transition from face-to-face interactions to digital ones poses risks that RPA, coupled with human insights, can address by preserving crucial customer context.

Capital One's integration of cloud technology and collaborative platforms demonstrates the practical side of such technological adoption, earning recognition for novel applications that enhance customer and employee experiences alike. The elephant in the room, however, is the nuanced impact of tech giants on banking services—companies like Amazon and Apple enter as both collaborators and competitors, further spurring the banking industry's push towards digital innovation. As these dynamics unfold, key points for financial leaders to reflect on before adopting RPA include assessing manual processes ripe for automation, understanding associated inefficiencies, and calculating potential returns on investment.

Accenture projects a significant boost in productivity for early adopters, with close to 73% of banking employee time amenable to automation or augmentation by AI. This sentiment is echoed in Citi's reports warning that over half the current banking jobs may be automated, urging preparation for the transformative wave AI brings to the sector. The promise and challenges of RPA and AI in banking also intersect with the realities of payment fraud, as statistics show persistent fraud levels and heightened consumer concern, rightfully placing emphasis on technological solutions that enhance security as well as efficiency.

Streamlining Efficiency with RPA

Robotic Process Automation (RPA) represents a monumental shift in the banking sector, empowering institutions to overhaul their operational efficiency. Commerce Bank, for example, has embraced this cutting-edge technology, integrating sophisticated RPA solutions to streamline processes such as data entry, account reconciliation, and transaction processing. This harnessing of RPA allows the bank to deliver a 'super community bank' experience, fusing the robust capabilities of a large bank with the personalized services of a smaller institution, all while maintaining deep customer relationships.

In light of the challenges posed by burgeoning digital solutions and FinTech competition, Commerce Bank was compelled to modernize its infrastructure. By adopting RPA, banks like Commerce tackle technical debt head-on, repurposing their legacy systems to meet contemporary demands. These automation technologies not only offer accuracy and speed but also liberate human resources to engage in more strategic, value-added tasks.

The transformative impact of RPA is evident in its capability to adeptly navigate a variety of applications and platforms, vastly reducing the incidence of manual errors. The deployment of software robots remarkably enhances workflow automation, execution, and customer service interactions, positioning banks to excel in a competitive digital landscape. With close partnerships with automation leaders like Datafinity, Commerce Bank shows that RPA isn't just about technology, but about choosing partners who align with an organization's vision and culture, maximizing the strategic value of automation.

Enhancing Customer Experience through Automation

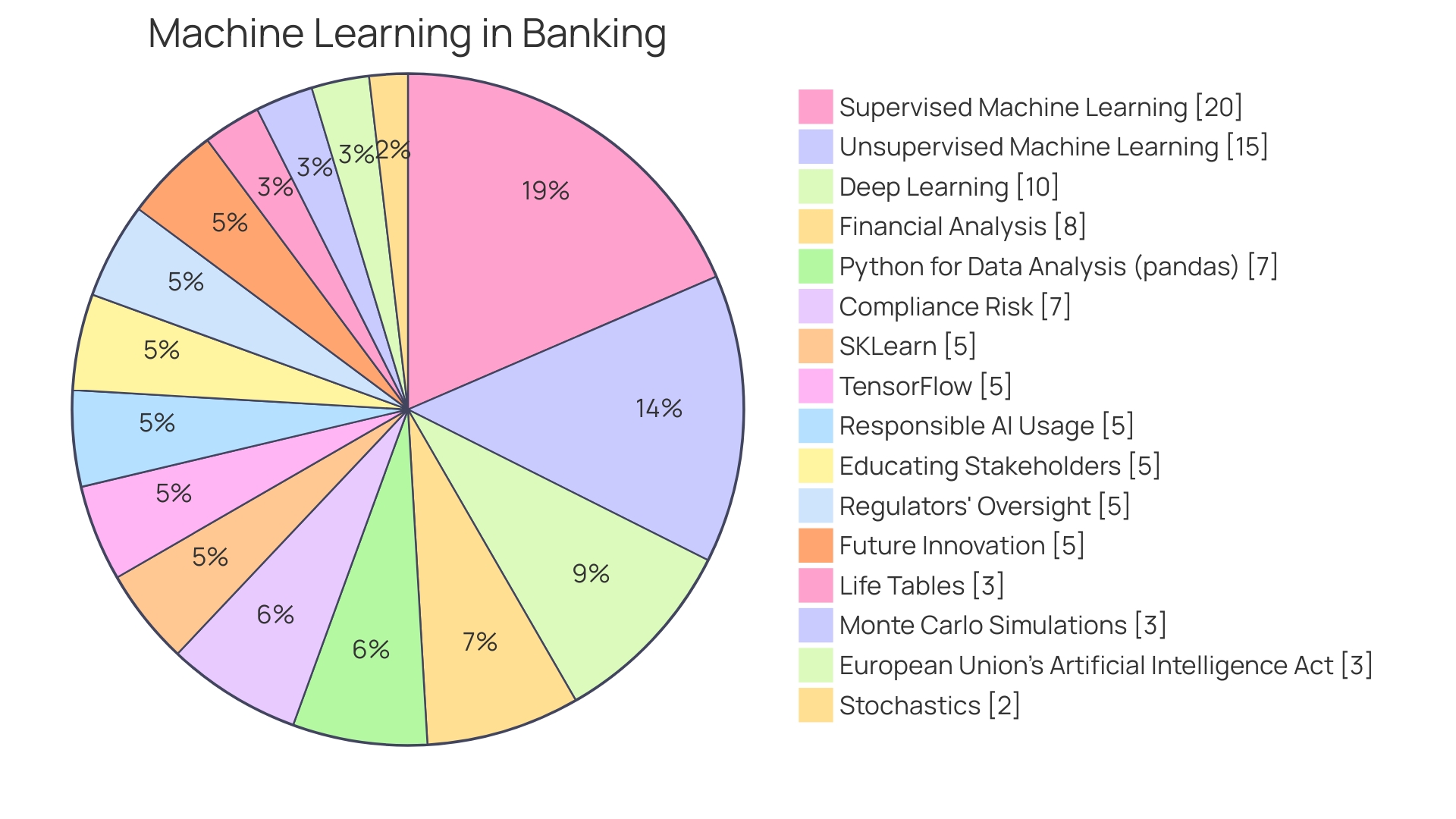

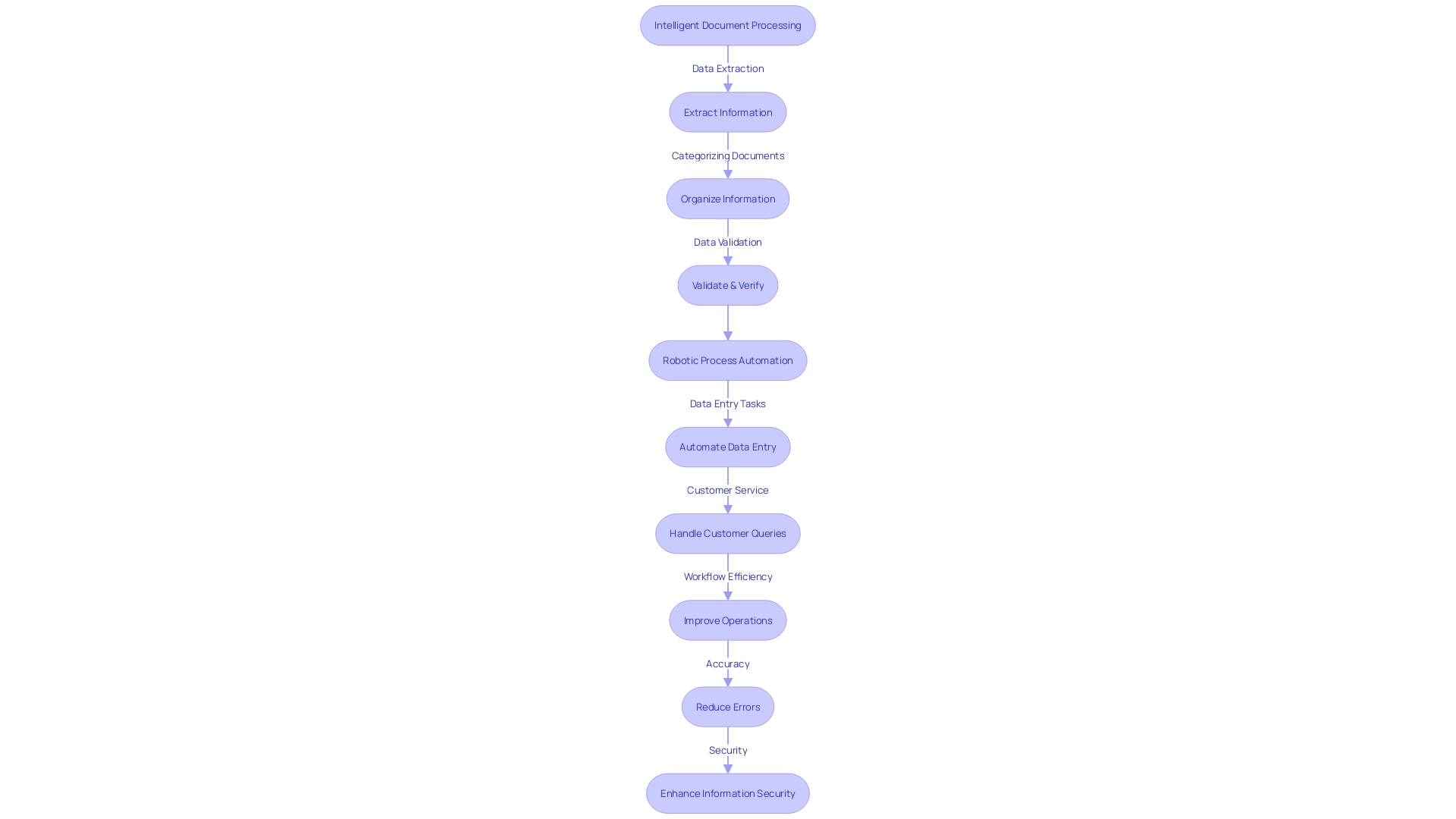

In the realm of financial services, transformative technologies like Intelligent Document Processing (IDP) and Robotic Process Automation (RPA) are revolutionizing customer interactions. IDP harnesses AI and machine learning to meticulously extract information from a plethora of document types, a task that once bogged down institutions with its complexity and tedium. This innovation propels banks into a new era where offerings are tailored precisely to market needs, delivering solutions with efficiency unheard of in manual paradigms.

RPA, as a facet of automation technology, deploys software robots capable of mimicking human actions across diverse software systems. From mundane data entry to intricate customer service dialogs, these bots are reshaping the landscape, driving a significant uptick in process speeds and accuracy. The amalgamation of IDP and RPA underpins a seamless banking environment where time-consuming operations, such as account openings or loan approvals, are distilled into effortless experiences that resonate with customer expectation for rapid, precise service.

A stark reminder of the importance of these developments comes from reports of the MoveIt software vulnerability causing data breaches and emphasizing the need for robust, secure automation solutions. Efforts to improve document processing and information security can substantially mitigate such risks, underscoring the critical nature of advancements in automation within the banking sector.

Challenges and Limitations of Automation in Banking

Banks face a critical juncture where the need to modernize through automation intersects with the imperative to maintain robust security and comply with ever-evolving regulations. The challenges are multifaceted, ranging from integrating automation with legacy systems to navigating the potential resistance from employees more accustomed to traditional banking relationships. As Uri Rivner, CEO of Refine Intelligence, aptly noted, the shift away from traditional banker-customer interactions has significant implications for how these institutions understand and serve their clientele.

The complex challenge of ensuring regulatory alignment and security conformance requires a balanced approach, complementing the swift capabilities of automation with diligent human oversight. By consciously addressing these hurdles with forward-thinking strategies and a dedication to both innovation and security, banks can harness the full power of automation, as observed in the rapid adoption of AI within the financial sector. Meanwhile, the increased activity of Big Tech companies in financial services, as seen with the likes of Amazon and Google, adds a competitive pressure but also serves as a catalyst for banks to accelerate their technological adaptation and overcome these challenges, maintaining an edge in this digitally evolving landscape.

Future of Automation in Banking: Trends and Innovations

As the horizon expands for banking automation, the integration of Artificial Intelligence (AI) and machine learning heralds a transformative era. The sophistication of these technologies now extends to intricate capabilities like natural language processing and predictive analytics, empowering banking institutions to offer more personalized services. In particular, chatbots and virtual assistants are becoming de rigueur, delivering customized and expedient banking interactions to customers.

Accenture's financial analysis underscores the significant influence of generative AI, projecting a notable potential for productivity enhancements, particularly for early adopters over the coming three years. An astonishing 73% of time currently invested by employees at US banks could be influenced by generative AI, with a nearly even split between automation and augmentation of tasks. This sea change in technology promises to touch every banking sector layer, from boardrooms to customer service counters.

Case in point, Capital One, a giant within the retail banking landscape of the United States with over 100 million customers, has already fully embraced cloud technology, setting a benchmark in digital transformation across the financial industry. Their commitment to innovation is mirrored in their utilization of platforms like Slack, which facilitates collaboration and automates work processes for more than 50,000 employees.

Bringing automation to life within the banking sector, a collaboration between a firm like Datafinity and leading financial institutions reveals an affinity for careful selection of technology partners, ensuring shared values and robust support systems.

Moreover, as AI's role becomes more pronounced, the banking industry has an obligation to ensure this technology is employed responsibly. Ensuring AI models are explainable, unbiased, and secure will be critical to their successful and ethical application across banking functions.

In the rapidly evolving landscape of financial technology (FinTech), banks are compelled to adapt and adopt these innovations. Fintechs are making waves by leveraging technology to reimagine traditional financial operations, significantly impacting the movement, storage, and management of funds. Alongside this digital shift, there's a growing alignment between customers' values and the banking services they choose, with a rising demand for environmental, social, and governance (ESG) considerations.

The narrative around banking automation is clear: the intersection of AI and human ingenuity is deeply redefining roles and services. This paradigm shift foretells a future where proficiency in AI and technology augments human expertise, reshaping the landscape of banking jobs and enabling a more efficient and customer-centric banking environment.

Conclusion

In conclusion, automation is revolutionizing the banking industry, offering benefits such as enhanced efficiency, accuracy, and customer experience. By integrating technologies like Robotic Process Automation (RPA) and Artificial Intelligence (AI), banks can streamline operations, reduce manual intervention, and improve outcomes.

RPA automates repetitive tasks, improving speed and precision while reducing costs. Case studies of banks like Commerce Bank and Capital One showcase how automation can streamline processes, enhance customer satisfaction, and drive growth.

Automation plays a crucial role in banking compliance, particularly in tasks like Know Your Customer (KYC) and Anti-Money Laundering (AML), enabling faster customer onboarding and reduced compliance expenses.

Efficiency is a key driver of automation in banking, empowering institutions to navigate the digital landscape, streamline processes, and deliver personalized services. By adopting automation technologies, banks can enhance execution and excel in a highly competitive environment.

Automation also revolutionizes customer experience by enabling tailored offerings and efficient service. Technologies like Intelligent Document Processing (IDP) and RPA enhance document processing, ensuring information security and reducing manual errors.

While challenges exist, such as legacy system integration and employee resistance, banks must balance automation with human oversight to ensure regulatory compliance and security.

The future of automation in banking lies in trends and innovations. The integration of AI and machine learning enables personalized experiences, with chatbots and virtual assistants becoming commonplace.

To stay competitive in the rapidly evolving landscape, banks must embrace automation. Automation allows them to drive efficiency, enhance customer experience, and position themselves as leaders in the digital era. It is clear that automation is essential for banks to thrive and succeed in the evolving financial industry.