Introduction

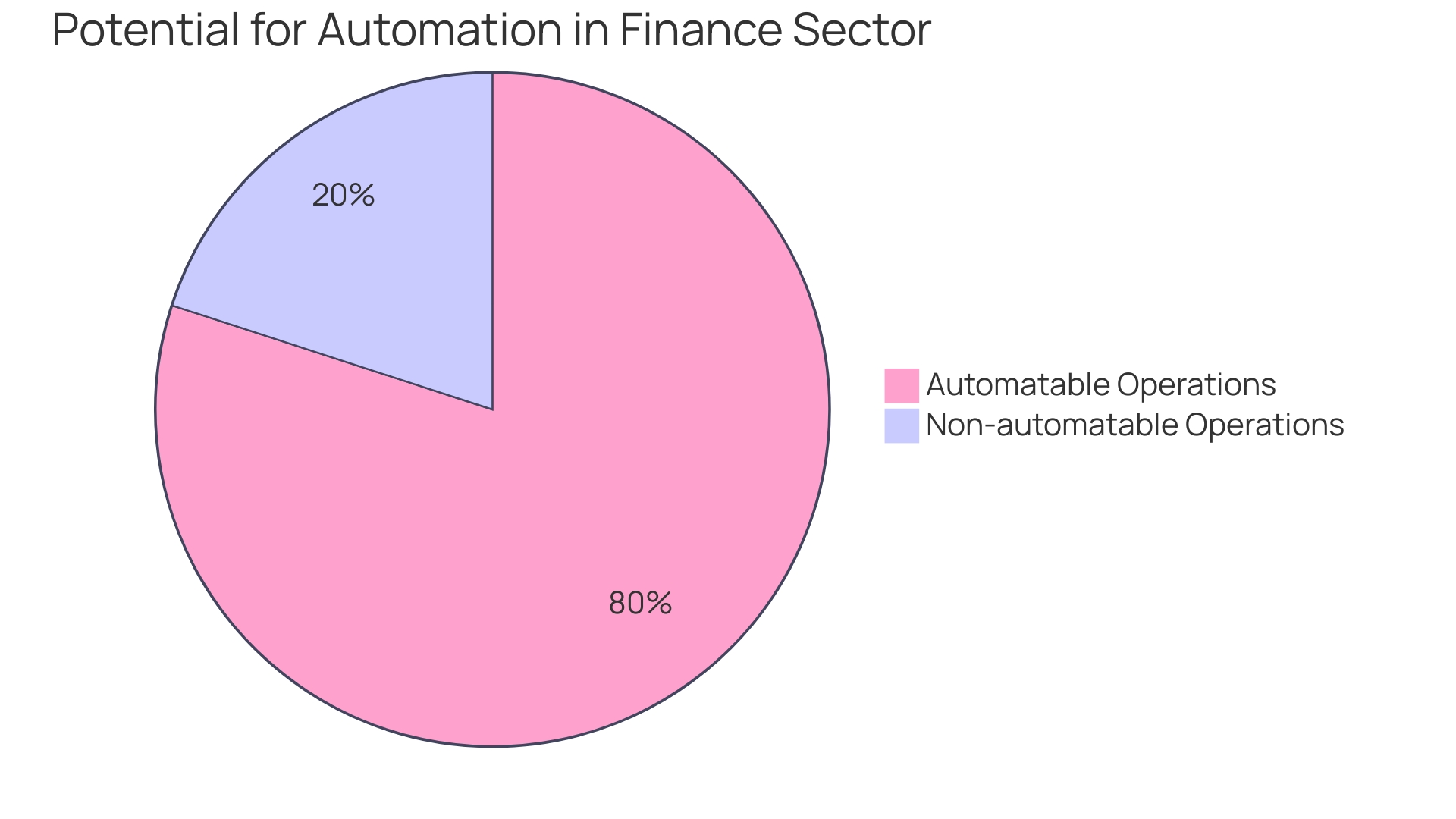

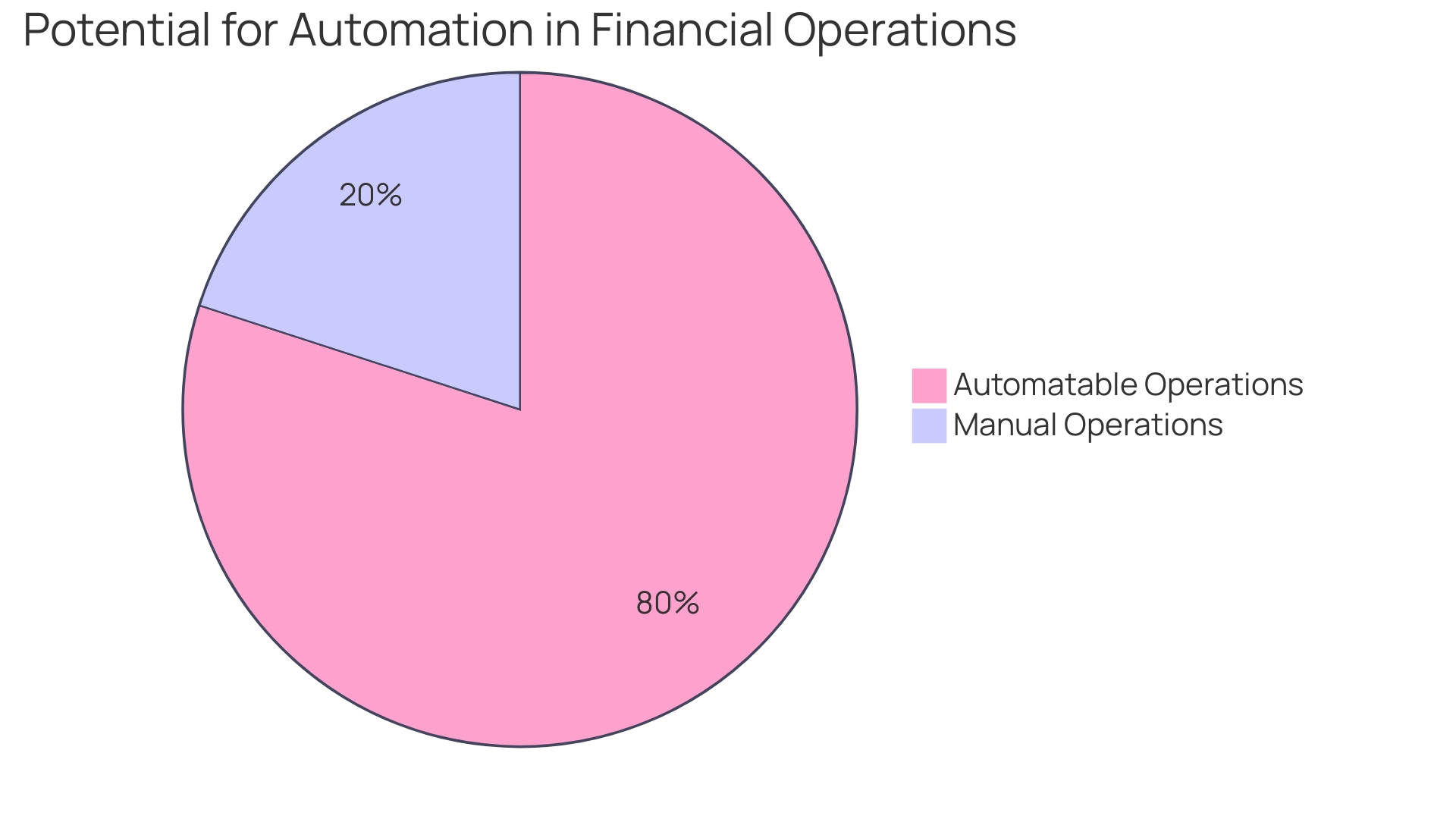

Automation has become a hot topic in the financial services industry, with the potential to revolutionize operations and enhance efficiency. Research indicates that a whopping 80% of financial tasks could be automated, freeing up valuable time for strategic initiatives and improving customer satisfaction.

Despite this immense potential, a significant number of companies have yet to embrace automation in their financial processes. This article explores the need for automation in financial services, the benefits it brings, and real-world applications of automation in the industry. By leveraging AI and machine learning technologies, financial institutions can unlock operational efficiency, informed decision-making, and a competitive edge in an evolving market.

The Need for Automation in Financial Services

In the realm of financial services, the potential for automation is immense but often underutilized. Accenture's research indicates that a staggering 80% of financial operations could be automated, which would significantly liberate employee time for strategic initiatives and enhancing customer satisfaction.

The application of AI and ML technologies stands as a beacon of transformation in this sector, enabling the automation of fundamental tasks such as bookkeeping, expense management, and tax compliance with minimal human oversight. Despite the clear advantages of automation, a Corcentric survey reveals that nearly half of the companies surveyed have yet to automate their financial processes.

This hesitation occurs even as software becomes more affordable and diverse in its offerings, signifying a crucial moment for organizations to adopt financial automation. Furthermore, the Deloitte Center for Financial Services underscores the potential of generative AI to revolutionize productivity in financial services. As banking services and AI continue to converge, traditional practices are being redefined, paving the way for innovative solutions and improved regulatory efficiency through interoperability among systems. The integration of AI into financial services is not just a technological advancement; it's a strategic imperative that can lead to increased operational efficiency and informed decision-making, ultimately benefiting the sector as a whole.

How Automation Enhances Efficiency

The transformative power of automation in the finance sector is evident in the success stories emerging from leading organizations. For example, Louvre Hotels Group, a giant in the hospitality industry, partnered with RobosizeME to implement advanced automation systems.

The results were staggering, with the group saving an impressive 188 hours per month on rate code headers and 386 hours on rate code details, showcasing the operational efficiencies that can be achieved through automation. In the banking sector, First Abu Dhabi Bank (FAB) reaped substantial benefits by deploying software robots to automate the verification of passports and identities, a process that previously consumed 80,000 hours of labor annually.

Not only did this enhance regulatory compliance and prevent fines, but it also exemplified the bank's strategic approach to automation, focusing on impactful opportunities and leveraging 'quick wins' for momentum. Accenture's research underscores the untapped potential in the finance department, revealing that 80% of financial operations could be automated, thereby freeing up valuable time for strategic initiatives and customer satisfaction.

Yet, a Corcentric survey points out the hesitation, with 49% of companies yet to automate their financial processes. This hesitation overlooks the significant cost savings and efficiency gains proven by real-world applications. For instance, FAB's reallocation of relationship managers, a previously arduous task taking up to seven days, was condensed to a single day thanks to automation, translating to an 88% surge in efficiency. These case studies and statistics affirm the critical need for finance departments to embrace automation, not only to improve operational efficiency but also to ensure accuracy and compliance, ultimately leading to a more dynamic and competitive business environment.

Real-World Applications of Automation in Financial Services

Automation in financial services is not just a trend; it's a transformative force. Despite the ubiquity of automated personal banking services, many financial departments within organizations have yet to harness this efficiency.

Accenture's analysis indicates a staggering 80% of financial tasks could be automated, potentially liberating employees from mundane tasks to concentrate on strategic initiatives and enhancing customer satisfaction. AI and ML are pivotal technologies in realizing this shift, capable of automating intricate tasks like bookkeeping, expense management, and tax compliance.

Yet, a Corcentric survey reveals an astonishing 49% of companies still rely on manual financial processes. The barriers to adoption, such as legacy systems and regulatory concerns, are being challenged by the declining cost of software and the diversification of available tools, signaling an opportune moment for companies to transition. Financial automation's impact is evidenced by Morgan Stanley's AI assistant, which streamlines wealth managers' access to information, and Betterment's AI chatbot, which has significantly reduced customer service workload. By embracing these technologies, financial services can not only enhance efficiency but also gain a competitive edge in a rapidly evolving industry.

Benefits of Automation for Financial Institutions

Embracing the transformative power of AI and machine learning, financial institutions are on the cusp of a major shift in operational efficiency. Accenture's research underscores the untapped potential, revealing that a staggering 80% of financial operations could be automated, signifying an era where strategic initiatives and customer satisfaction become focal points, liberated from the constraints of mundane tasks. Imagine a world where bookkeeping, expense management, month-end close, reconciliations, and tax compliance are seamlessly managed by sophisticated algorithms, offering a substantial uplift in productivity.

Despite the clear advantages, nearly half of the companies surveyed by Corcentric are yet to automate their financial processes. This hesitancy stands in stark contrast to the burgeoning availability and affordability of financial software. The insights from SkyStem's CEO, an ex-Fortune 100 auditor, further illuminate the gap between consumer expectations of automation and the current state within finance departments.

The future of financial services, as projected by Deloitte, is one where generative AI not only enhances productivity but also introduces groundbreaking products and services. The banking and financial sector, with AI at its helm, is poised to redefine customer relationships through personalized services, while also ensuring compliance and risk management are handled with unprecedented precision. The time to act is now, with the digital landscape offering fertile ground for financial institutions to flourish and stay ahead in the competitive market.

Conclusion

In conclusion, automation in financial services has immense potential to revolutionize operations and enhance efficiency. With 80% of financial tasks capable of being automated, organizations have an opportunity to free up valuable time for strategic initiatives and improve customer satisfaction. Real-world applications of automation, such as Louvre Hotels Group and First Abu Dhabi Bank, have demonstrated significant operational efficiencies and cost savings.

Despite hesitancy due to legacy systems and regulatory concerns, now is the perfect time for companies to transition to automated financial processes. By leveraging AI and machine learning technologies, financial institutions can unlock operational efficiency, informed decision-making, and gain a competitive edge in the market. The future of financial services lies in embracing automation, with generative AI poised to redefine the customer experience and ensure regulatory compliance.

It is crucial for organizations to act now and fully embrace the power of automation. By doing so, they can achieve operational excellence, strategic growth, and stay ahead in the ever-evolving financial landscape. Automation is not just a trend; it is a transformative force that can drive success in the finance sector.