Introduction

The banking industry is undergoing a transformative shift towards automation, driven by the need for increased efficiency and streamlined operations. With over 50% of banking CEOs already prioritizing process automation, manual methods are being rapidly replaced by intelligent technologies.

This article explores the impact of automation in banking, highlighting case studies and benefits, and emphasizes the crucial role of AI in enhancing customer experience through hyper-personalization. As the sector stands on the brink of a revolution, it's clear that embracing automation is essential for banks to redefine their performance and stay ahead in a competitive market.

The Need for Automation in Banking

In the dynamic world of banking, where financial transactions grow increasingly complex, the pivot towards automation is not just a luxury—it's a necessity. With over 50% of banking CEOs focusing on process automation to simplify operations, the traditional, error-prone manual methods are swiftly being replaced.

For example, by deploying 11 software robots, one bank saved a staggering 80,000 hours of labor annually, ensuring compliance and avoiding fines. This strategic adoption of automation, using assessment tools like 'Robofit', allows banks to prioritize high-impact opportunities that can generate quick wins and significant time savings.

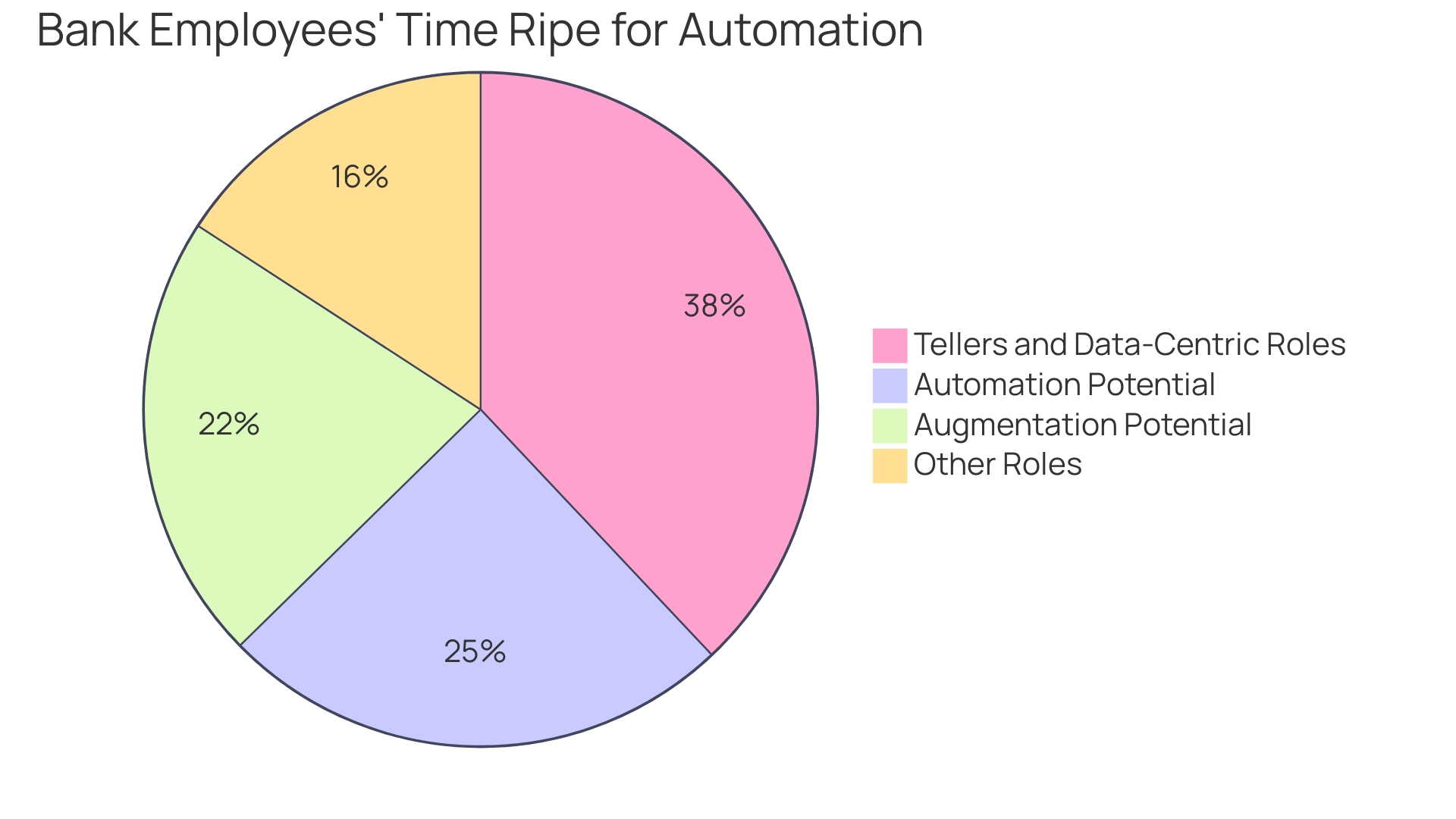

Accenture's research underscores the breadth of automation's impact, with 73% of bank employees' time being ripe for transformation through AI—39% through automation and 34% via augmentation. Interestingly, tellers and other data-centric roles could see 60% of their tasks automated, ushering in a new era of efficiency. Despite the clear advantages, a Corcentric survey reveals that 49% of companies have yet to automate their financial processes, although the potential for automation stands at a remarkable 80% of financial operations. As software becomes more affordable and diverse, the banking sector stands on the cusp of a revolution, one that promises to redefine the landscape of financial services.

Streamlining Operations with Intelligent Automation

In the dynamic world of finance, AI and machine learning are pivotal in enhancing efficiency and innovation. By employing intelligent automation, banks are able to automate tasks that were once time-consuming and prone to human error.

For example, First Abu Dhabi Bank (FAB) adopted this technology by introducing 11 software robots to verify passports and identities, a move that saved 80,000 hours of labor each year and ensured stringent regulatory compliance. This strategic implementation of robotic process automation (RPA), coupled with Ai's cognitive capabilities, has allowed FAB to prioritize high-impact opportunities and achieve 'quick wins' that build momentum for further innovation.

Through tools like 'Robofit', FAB assesses automation proposals based on time savings, compliance, customer impact, revenue potential, and complexity. This thoughtful approach has not only improved efficiency but also fostered a collaborative environment where employees view robots as assistants.

As a result, staff can redirect their focus to strategic tasks and customer engagement, ultimately enhancing service quality. Moreover, with Ai's ability to automate manual tasks, financial institutions are poised to develop and launch new services more rapidly, staying ahead in a competitive market. Despite the vast potential of AI in finance, a Corcentric survey revealed that 49% of companies have yet to automate their financial processes. However, with 80% of financial operations amenable to automation, as noted by Accenture, there's a significant opportunity to free up employee time for strategic initiatives. In this light, it's evident that the integration of AI in finance is just beginning, with a promising future of augmented capabilities across various banking roles.

Case Study: HSBC’s Hyperautomation Journey

HSBC's adoption of hyperautomation is a prime example of how generative AI and machine learning technologies are propelling the banking sector into a new era of operational efficiency. By deploying intelligent chatbots, HSBC has not only enhanced customer support through real-time, personalized assistance but also streamlined the loan approval process with automated document handling, significantly improving the customer journey. This transformation echoes the rapid rise of generative AI, as seen with ChatGPT's swift milestone of 100 million active users, demonstrating the technology's profound daily impact on banking operations.

The integration of AI in financial services is underscored by Accenture's analysis, which suggests that 73% of bank employee time could be influenced by AI, with roles like tellers experiencing up to 60% task automation. Moreover, the potential for interoperability among systems has led to more accurate data and efficient regulatory processes, as financial institutions leverage automation to fulfill regulatory reporting with uniformity. However, this shift is not without its challenges.

Despite the promise of AI, a Corcentric survey reveals that nearly half of companies have yet to automate their financial processes. Yet, with software costs declining and the variety of software increasing, the opportunity for embracing financial automation has never been greater. Indeed, workflow automation is anticipated to improve business processes by 60%, with the market projected to reach $18.45 billion by 2025, highlighting the critical window for organizations to harness these technologies to redefine performance and customer satisfaction.

Benefits of Automation in Banking

Banks are increasingly turning to automation and AI technologies to revolutionize the financial sector. A noteworthy example is the deployment of software robots by a prominent bank to verify customer identities, a move that saved an impressive 80,000 hours of labor annually and ensured strict adherence to regulations.

This strategic prioritization of automation initiatives, such as the 'Robofit' tool, evaluates proposals based on criteria like time savings, customer impact, and revenue generation, leading to significant operational improvements. Accenture's research reinforces the transformative impact of automation in banking, revealing that 73% of bank employee tasks in the US could be influenced by AI, with 39% amenable to full automation and 34% to augmentation.

This advancement is not just for back-office operations; it extends to every bank role, from the C-suite to customer-facing positions. For example, tellers, who often handle repetitive data collection tasks, could see 60% of their workload automated.

Meanwhile, roles that require nuanced judgment, such as credit analysts, can benefit from AI tools that enhance their capabilities, affecting 34% of the workforce. Despite the potential, a Corcentric survey found that 49% of companies have yet to automate their financial processes. This is surprising, considering that automation not only streamlines operations but also frees up employees to focus on strategic initiatives and customer satisfaction. The banking sector is at a pivotal point, with the cost of software decreasing and the variety of tools increasing, making it an opportune time to embrace financial automation and its myriad benefits.

Enhancing Customer Experience through Hyper-Personalization

Financial institutions are harnessing the power of AI and machine learning not just to crunch numbers, but to forge deeper connections with their clients. By meticulously analyzing data points such as transaction histories, purchase patterns, and personal preferences, banks are now delivering hyper-personalized experiences that resonate on an individual level.

Ally Financial exemplifies this trend, utilizing Microsoft Azure and Azure OpenAI Service to automate tasks that previously consumed valuable time, allowing customer service associates to focus on providing more personalized assistance. This shift towards AI-driven personalization is more than a convenience; it's about creating a sense of being understood and appreciated, which fosters loyalty and satisfaction among customers.

Embracing such technology is not without its challenges. As the adoption of AI and automation becomes more widespread, banks must navigate a landscape where data accessibility and infrastructure can become hurdles.

However, the potential benefits are significant. With the ability to analyze and act on customer data in real-time, banks can offer tailor-made financial solutions that meet customers exactly where they are, enhancing the ROI of marketing campaigns and bolstering customer engagement. Moreover, as mega tech companies like Amazon and Apple flirt with financial services, traditional banks must leverage AI to maintain a competitive edge and offer the seamless experiences that customers have come to expect. The key to success lies in striking the right balance between technological innovation and human touch, ensuring that while processes are automated, the customer experience remains personal, relevant, and secure. In doing so, banks not only meet the immediate needs of their customers but also pave the way for enduring relationships built on trust and mutual value, which are the cornerstones of any successful financial enterprise.

Conclusion

In conclusion, automation is revolutionizing the banking industry by replacing manual methods with intelligent technologies. With over 50% of banking CEOs prioritizing process automation, the benefits are clear.

Automation saves time, ensures compliance, and enhances operational efficiency. Intelligent automation, powered by AI and machine learning, streamlines operations and fosters innovation in finance.

By automating tasks prone to human error, banks can focus on strategic initiatives and customer engagement. However, despite the potential benefits, many companies have yet to fully embrace financial automation.

HSBC's hyperautomation journey exemplifies how AI technologies improve efficiency. Through intelligent chatbots and automated document handling, HSBC enhances customer support and streamlines processes.

The integration of AI in financial services leads to more accurate data and efficient regulatory processes. Automation also plays a crucial role in enhancing customer experience through hyper-personalization.

By analyzing data points, banks can deliver tailor-made experiences that foster loyalty among customers. However, challenges such as data accessibility need to be addressed. Embracing automation is essential for banks to redefine their performance and stay competitive in the evolving landscape of financial services. Striking the right balance between technological innovation and human touch is key to ensuring personalized experiences that build trust with customers. In summary, automation drives efficiency, compliance, and customer satisfaction in the banking industry. Banks must embrace automation now to redefine their performance and remain competitive. It is an opportune time for organizations to harness these technologies for enhanced operations and customer satisfaction.