Introduction

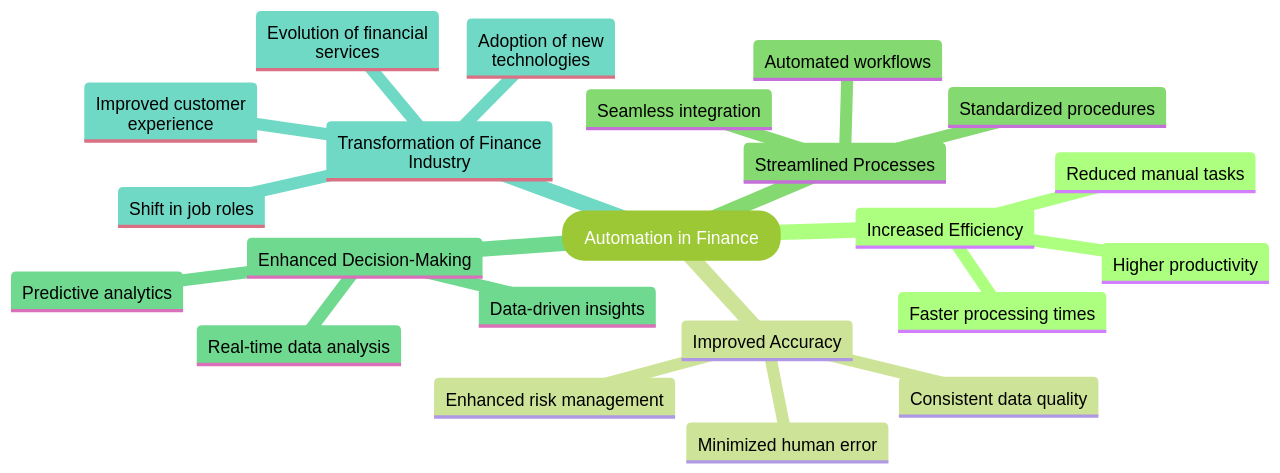

The finance industry is experiencing a profound transformation with the integration of automation technologies. These advanced technologies, such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and blockchain, are reshaping traditional financial systems and processes. Automation is streamlining operations, improving efficiency, and enabling financial professionals to focus on strategic responsibilities. In this article, we will explore the impact of automation on the finance industry, examine real-world examples of companies leveraging automation to enhance their financial processes, and discuss the future implications of automation in finance.

The integration of automation in the finance industry has already demonstrated its potential to revolutionize traditional financial processes. Companies like Keybank and Jana Small Finance Bank have successfully leveraged automation technologies to streamline manual tasks, improve efficiency, and achieve significant cost savings. Automation has also paved the way for advancements in AI, ML, and data analytics, empowering financial professionals with predictive insights and enhancing decision-making processes. As the finance industry continues to embrace automation, it is poised to deliver superior value to customers and stakeholders while driving digital transformation in the sector.

1. Understanding the Role of Automation in Finance

The finance sector is undergoing a radical transformation with the introduction of automation, a change that is reshaping traditional systems and processes. Automation, powered by advanced technology, simplifies financial tasks, minimizes errors, and enhances efficiency. It covers a wide spectrum of operations, from basic calculations to complex financial analyses and reporting. This shift in operations allows finance professionals to focus more on strategic responsibilities, adding significant value to their organizations.

Illustrating the profound impact of automation, Keybank, a prominent financial services company, took advantage of intelligent automation to complete an astonishing nine years worth of work in just two weeks. This achievement showcases the efficiency that automation can deliver. Keybank harnessed this technology to manage their manual workload and improve business efficiency. They primarily focused on automating tasks such as loan processing and account reconciliation. To achieve this, Keybank employed Automation Anywhere's IQ Bot for processing appraisal and flood certification forms, successfully processing 40,000 documents. This implementation resulted in a run rate savings of 5 million in 2020. Keybank's success story exemplifies the power of automation to streamline manual processes, automate documentation, and the benefits that IQ Bot brings to document processing.

In another instance, Jana Small Finance Bank utilized the UiPath Enterprise RPA platform for ID management and credit report generation and verification. Before the implementation of RPA, service requests were manually executed, which was not only time-consuming but also cumbersome. With the deployment of RPA, they witnessed a 65-70% reduction in the turnaround time for these processes. This implementation not only significantly reduced time and effort but also injected more accuracy and efficiency into their operations. The bank plans to expand the use of RPA to other functions, aiming to have at least one robot at every branch office.

The integration of automation in the finance industry has revolutionized traditional processes, providing a more efficient and error-free platform to handle financial tasks.

Companies like Keybank and Jana Small Finance Bank are testament to the potential of this technology. Automation not only streamlines operations but also enables finance professionals to focus on strategic tasks, thereby adding value to the organization.

To effectively implement automation in the finance industry, consider the best practices.

Learn more about best practices for implementing automation in finance.

This includes identifying areas for automation, setting clear objectives, choosing the right automation tools, starting with small-scale implementations, involving stakeholders, ensuring data accuracy and security, providing training and support, and continuously monitoring and measuring performance. Following these practices can lead to improved efficiency, accuracy, and overall financial operations.

2. Digital Transformation in the Finance Industry: A Closer Look

The finance sector is in the midst of a digital revolution, fueled by advancements in technology and the need for improved operational efficiency and customer-focused services.

This transformation involves the comprehensive integration of digital technologies into all aspects of business operations, revolutionizing how services are delivered and value is created for customers.

The integration of Artificial Intelligence (AI) into the financial sector is a significant part of this digital transformation. AI can be used in various ways, such as fraud detection and prevention, risk assessment and management, algorithmic trading, and customer service and chatbots. AI technology enables financial institutions to process and analyze large amounts of data swiftly and accurately, enhancing operational efficiency and decision-making processes. Additionally, AI helps automate repetitive tasks, reduce errors, and improve the overall customer experience.

Machine learning, a subset of AI, also offers numerous benefits. Financial institutions can leverage machine learning algorithms to analyze large data volumes, identifying patterns and trends, making accurate predictions, and automating repetitive tasks. This technology can enhance risk assessment, fraud detection, customer segmentation, investment strategy optimization, portfolio management, and trading algorithms. It can also assist in improving the customer experience by personalizing financial advice and providing real-time insights.

Blockchain technology is another critical component of this digital revolution in the finance sector. It can secure and transparently handle transactions, eliminating intermediaries and reducing costs. Blockchain also enables faster and more efficient cross-border payments and provides enhanced security for storing and sharing sensitive financial data. In addition, blockchain technology can be utilized for smart contracts, automated compliance, and improving the overall efficiency and transparency of financial processes.

Data analytics is another transformative force in the finance sector. It enables organizations to gain valuable insights from the vast amounts of data they collect. Advanced analytics techniques allow financial institutions to analyze customer behavior, detect patterns, and make data-driven decisions. This technology improves risk management, fraud detection, and customer experience. Additionally, data analytics allows for predictive modeling, enabling financial institutions to forecast market trends and make strategic investment decisions.

Various tools and platforms are available to implement digital transformation in finance. These technologies, including customer relationship management (CRM) systems, data analytics tools, cloud computing platforms, and robotic process automation (RPA) software, streamline processes, improve efficiency, and enhance the overall customer experience. Mobile apps and online portals are also widely used to provide convenient and accessible banking services.

Regulatory considerations play a crucial role during this transformation, including data protection and compliance. Financial institutions need to ensure compliance with data protection and privacy laws, anti-money laundering (AML) regulations, know-your-customer (KYC) requirements, and cybersecurity standards. They may also need to address issues related to cross-border data transfers, customer consent, and regulatory reporting.

In summary, the digital transformation is redefining the finance sector, offering new opportunities through automation, artificial intelligence, and cloud-based systems. However, this requires a significant cultural change and a focus on collaboration, learning, and innovation. Those who fail to embrace this transformation risk losing their competitive position, customer base, and key talent within their business.

3. Insights from Studies on Automation in Finance

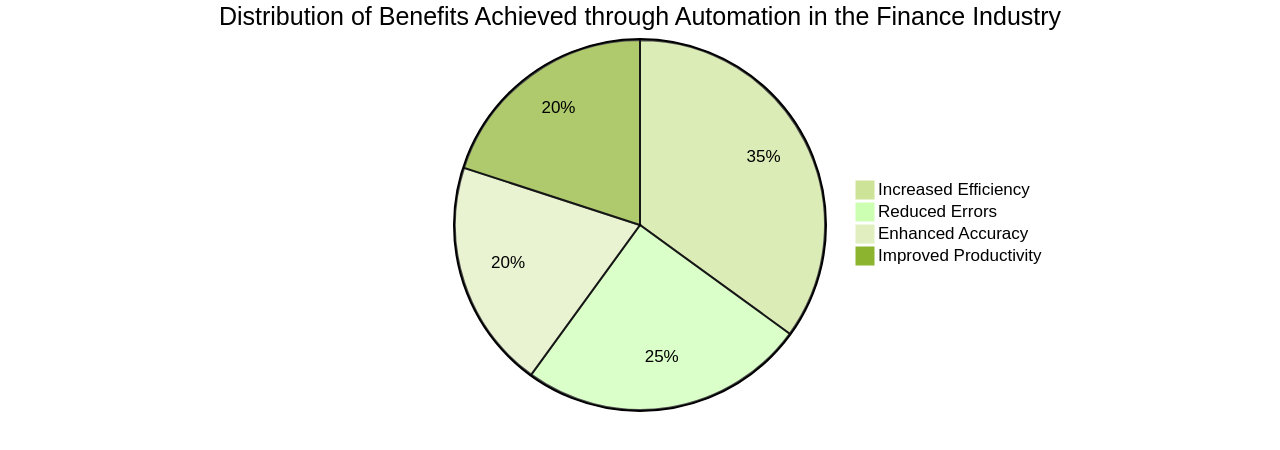

The exploration of financial automation has uncovered its significant potential to impact efficiency, precision, and productivity.

Comprehensive studies from notable firms like McKinsey have revealed that automation can reduce the time spent on financial tasks by a remarkable 20-30%. This is achieved by minimizing errors that stem from manual procedures, thereby enhancing accuracy.

Furthermore, Accenture's research estimates that automation could lead to substantial savings of up to $1 trillion for the banking sector by 2025. The findings from these studies highlight the transformative power of automation in the finance industry.

However, it's crucial to understand that automation's full potential can only be tapped into when it's deployed on a larger scale rather than in small, isolated projects. For instance, Accenture's report indicates that a strategic focus on roles best suited for reinvention through automation can enable organizations to maximize value and achieve a quick and sustainable return on investment. Additionally, the report underscores the importance of having a plan for the capacity released through automation, aligning with the organization's values.

A holistic approach to automation could be the key to unlocking up to $140 billion of industry value in the North American financial services sector. Consequently, the response of financial services business leaders to the evolving technology landscape will determine their readiness to compete in the future.

Automation tools available today can help streamline various financial activities, increasing efficiency and productivity.

Explore automation tools to improve your financial processes.

These tools are designed to automate repetitive tasks, reduce manual errors, and enhance overall productivity in financial operations. Common automation tools include accounting software, expense management systems, invoice processing software, financial reporting tools, and payment processing solutions. These tools can assist with tasks like data entry, reconciliation, financial analysis, and reporting, enabling financial professionals to concentrate on more strategic activities.

To amplify accuracy in financial processes, automation strategies can be implemented. By leveraging software tools and technologies, tasks like data entry, calculations, and reconciliation can be automated, reducing the chances of human errors. Automation can also help streamline processes, ensuring that data is consistently and accurately captured, analyzed, and reported. Moreover, the implementation of automated validation checks and error handling mechanisms can further boost accuracy in financial processes.

4. Leveraging Advanced Technology for Financial Professionals

The financial industry is at the cusp of a major transformation, driven by the adoption of advanced technologies. These technologies are not just enhancing the capabilities of financial professionals, but are also reshaping the entire financial landscape.

Artificial Intelligence (AI) and Machine Learning (ML) are playing an instrumental role in this transformation. These technologies are empowering financial professionals with predictive insights, which are critically important for making informed, strategic decisions. A survey conducted by Deloitte's Center for Controllership and Institute of Management Accountants (IMA) revealed that only 18% of organizations had implemented AI and ML, underscoring the vast potential for growth in this area.

Robotic Process Automation (RPA) is another transformative technology that's making its mark in the financial industry. By automating repetitive tasks, RPA is freeing up valuable time for financial professionals, enabling them to focus on strategic activities. However, the Deloitte and IMA survey found that only 36% of organizations had implemented RPA, indicating a significant opportunity for further adoption.

Data analytics is also playing a pivotal role in the digital transformation of the financial industry. By providing valuable insights into customer behavior, market trends, and business performance, data analytics is helping financial professionals make more informed decisions.

Blockchain technology is enhancing security and transparency in financial transactions. This technology is disrupting the industry by offering a secure, efficient, and transparent platform for transactions.

The adoption of these advanced technologies is not just a matter of staying competitive.

Discover how advanced technologies can transform your financial operations.

It's a matter of survival in the rapidly evolving digital landscape. The COVID-19 pandemic has amplified the urgency of digital transformation, making it a top priority for organizations worldwide.

In order to successfully navigate this transformation, financial professionals need to possess a unique set of qualities. According to the Deloitte and IMA survey, these include strong business acumen, technological skills, analytical thinking, adaptability, and the ability to anticipate business needs.

By embracing these technologies and developing these qualities, financial professionals can not only enhance their own capabilities and performance, but also contribute to the overall success and resilience of their organizations. They can create deeper and more meaningful work, build a more robust and resilient workforce, and deliver more insights and strategic value to their organizations.

In the end, the successful integration of human and machine-based competencies will be the key to staying ahead in the rapidly evolving digital landscape.

5. The Impact and Future of Automation in Finance

The financial sector is currently undergoing a transformation as automation technologies redefine conventional systems and processes. The integration of automation technologies has greatly enhanced operational efficiency, increased accuracy, and boosted productivity, while also enabling personalized services and real-time data processing.

Historically, the financial services sector has relied heavily on large workforces to carry out repetitive and mundane tasks using outdated technologies. This approach has often led to manual handoffs, bottlenecks, staff attrition, and data inaccuracies, which have adversely affected productivity, profitability, and competitiveness. However, the introduction of intelligent automation has resulted in the industry shifting towards more efficient work models.

To better understand this transformation, a global research study involving 550 financial services professionals was conducted. The aim was to uncover the progress made in the reinvention of work within financial services institutions and to understand the changing work models. Additionally, the study sought to predict future changes in the industry. The findings from this survey were published in a white paper that provides insights into how financial services institutions are leveraging intelligent automation to overcome challenges posed by complex process architectures and manual-intensive processes.

Furthermore, the rise of advanced technologies like AI and machine learning has paved the way for a more significant role of automation in the finance industry. Companies like Trintech are offering solutions to automate various financial processes, including account reconciliations, transaction matching, close task management, journal entry, intercompany accounting, audit and compliance, reporting and analytics, and financial consolidation and close. These solutions are designed to streamline and standardize financial close processes, increase efficiency, and provide insights and controls for better decision-making.

Trintech's solutions have been effective in improving accuracy and reducing time spent on close processes, resulting in a positive return on investment. For instance, the Dallas Cowboys managed risk and standardized internal controls by automating their financial close with Adra, as highlighted in a case study. Another case study showcases Serco Group PLC, which increased efficiency and reduced enterprise risk by automating their financial processes with Cadency.

Looking to the future, automation is poised to play an even more significant role in the finance industry. With advancements in AI, machine learning, and other technologies, automation will become more sophisticated and pervasive. It will continue to drive digital transformation, enabling the finance industry to deliver superior value to customers and stakeholders. As noted by Boston Scientific, a customer of Trintech, Cadency allows them to optimize costs while making controls more robust and effective.

Overall, the future of the finance industry is closely linked with the progression of automation technologies. As automation becomes more sophisticated and pervasive, it will continue to drive digital transformation in the sector, enabling it to deliver superior value to customers and stakeholders. The journey towards this future is already in progress, and the industry is already witnessing the benefits of automation in improving productivity, profitability, and competitiveness.

Automation has revolutionized the finance industry by enabling tasks such as data entry, transaction processing, and report generation to be executed quickly and accurately, reducing the need for manual intervention. This has led to enhanced security and compliance measures within the finance industry. Furthermore, automation has improved risk management by implementing algorithms and machine learning models that can detect anomalies and potential fraud in real-time.

Automation in the finance industry refers to the use of technology and software to streamline and automate various financial processes. This can include tasks such as data entry, transaction processing, risk management, compliance, and reporting. By implementing automation solutions, financial institutions can improve efficiency, reduce human error, and enhance overall productivity in their operations. Additionally, automation can also enable faster decision-making and provide better insights into financial data, leading to more informed business strategies.

Automation and digital transformation have become key strategies in the finance industry. By leveraging technology, financial institutions can streamline processes, improve efficiency, and enhance customer experiences. Automation allows for the automation of manual tasks, such as data entry and document processing, which reduces human error and frees up employees to focus on more strategic activities.

Finally, for automation and real-time processing in the finance industry, it is crucial to have innovative solutions that can cater to specific needs and questions. A team of software developers, designers, and engineers work harmoniously to craft such solutions. Whether you need a one-on-one consultation or access to top-tier talent, consulting services can help you launch your minimum viable product (MVP) and test its market fit. Flexible demand contracts are also offered to speed up development and test hypotheses. Whether you are looking for bug fixes, market alignment, or full outsourcing, a team is here to assist you.

Conclusion

The integration of automation technologies in the finance industry has had a profound impact, revolutionizing traditional financial processes and systems. Companies like Keybank and Jana Small Finance Bank have successfully leveraged automation to streamline manual tasks, improve efficiency, and achieve significant cost savings. Automation has not only enhanced operational efficiency but has also paved the way for advancements in AI, ML, and data analytics, empowering financial professionals with predictive insights and enhancing decision-making processes. The adoption of automation in the finance industry is poised to deliver superior value to customers and stakeholders while driving digital transformation in the sector.

In conclusion, automation has brought about a significant transformation in the finance industry. It has streamlined operations, improved efficiency, and enabled financial professionals to focus on strategic responsibilities. Companies like Keybank and Jana Small Finance Bank have demonstrated the potential of automation to revolutionize traditional financial processes, achieving remarkable cost savings and improving business efficiency. As the finance industry continues to embrace automation technologies, it will be able to deliver enhanced value to customers and stakeholders while driving digital transformation. To fully leverage the benefits of automation, organizations should consider best practices such as identifying areas for automation, setting clear objectives, choosing the right tools, involving stakeholders, ensuring data accuracy and security, providing training and support, and continuously monitoring performance.

Start now to explore how automation can transform your finance operations and drive digital innovation in your organization.