Introduction

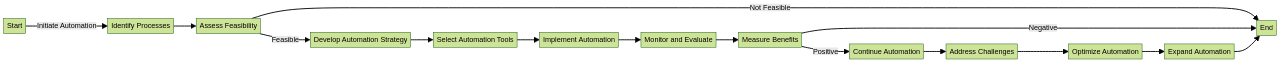

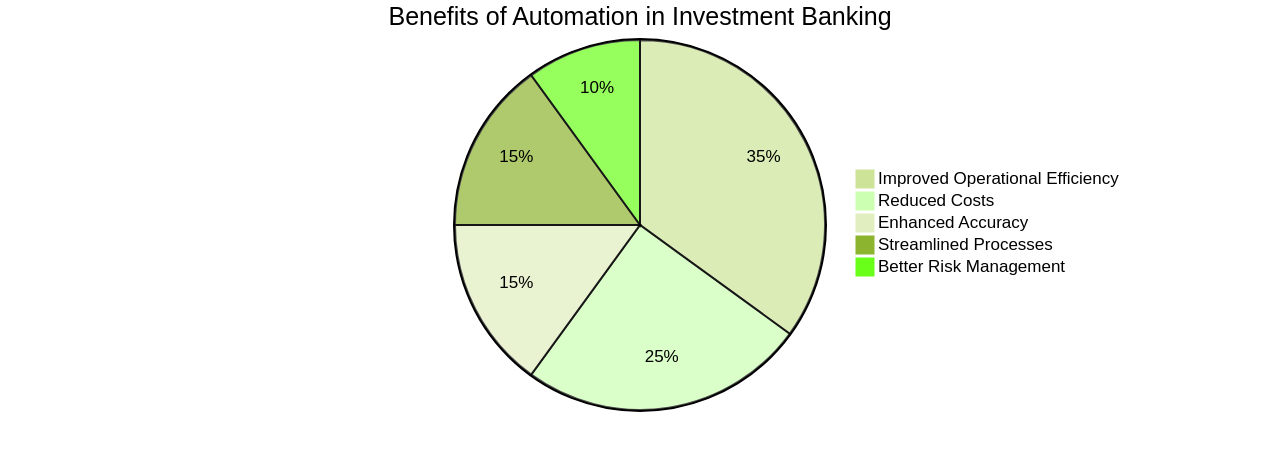

Automation has revolutionized the realm of investment banking, bringing about significant improvements in efficiency, accuracy, and decision-making. By leveraging advanced technologies like Robotic Process Automation (RPA), investment banks have streamlined operations, reduced manual workloads, and achieved substantial cost savings. Automation tools like RPA have enabled banks to process vast amounts of data quickly and accurately, leading to enhanced risk management and improved decision-making processes.

In this article, we will explore the impact of automation on investment banking operations and delve into real-life case studies of major banks that have successfully implemented automation initiatives. We will also discuss key areas within investment banking that have benefited from automation, such as trade processing, risk management, and compliance reporting. Furthermore, we will examine future trends in automation, including the expanded role of AI and Machine Learning (ML), the potential of blockchain technology, and the integration of chatbots for customer service. By understanding these advancements in automation, investment banks can unlock new opportunities for efficiency, productivity, and growth in the rapidly evolving digital landscape.

1. The Impact of Automation on Investment Banking Operations

The wave of digital transformation sweeping across various sectors has not left the banking industry untouched, particularly the realm of investment banking. The rise of automation technology has revolutionized operations, enhancing efficiency, and precision to unprecedented levels.

As a result, the reliance on labor-intensive data entry has significantly diminished, reducing human errors and freeing personnel to focus on strategic initiatives.

Robotic Process Automation (RPA), a key player in this transformation, has proven instrumental in streamlining banking operations, enhancing everything from risk management to compliance and reporting. The ability of RPA to process vast quantities of data with speed and accuracy has considerably improved decision-making processes and risk mitigation strategies.

For instance, consider the case of KeyBank, a well-regarded financial services company. By harnessing the power of intelligent automation, specifically RPA, the bank managed to alleviate manual workloads and enhance operational efficiency. This innovative approach resulted in the creation of nine bots capable of performing nine years' worth of work within two weeks. This was achieved through the simultaneous processing of 40,000 documents using IQ Bot, another intelligent automation tool. The outcome? A staggering $5 million in savings for the fiscal year 2020.

But the success story of KeyBank extends beyond operational efficiency. The bank also improved the quality of its mortgage checks by automating the process, thereby reducing the need for manual reviews and enhancing accuracy. Following the successful implementation of the Automation Anywhere platform, KeyBank is planning to further expand its digitization program, including the use of IQ Bot for additional capabilities like classifying and preparing documents for data extraction.

Another commendable case is that of Swiss Re, a leading provider of reinsurance and insurance. With the assistance of UiPath RPA technology, the company automated 100 processes, resulting in an 80% reduction in the bank account reconciliation procedure. This condensed the process from 15 business days to just three. This efficiency was achieved through a combination of features including UI and API automation, low-code development, generative AI, intelligent document processing, and process orchestration.

Automation in investment banking has transformed the operational landscape, leading to increased efficiency and accuracy.

By eliminating the need for manual data entry, reducing the risk of human error, and freeing up employees to focus on strategic tasks, automation tools like RPA have been instrumental in streamlining operations.

Streamline your operations with automation tools like RPA.

These tools have enabled banks to process large volumes of data quickly and accurately, leading to improved decision-making and risk mitigation.

However, the implementation of automation in investment banking is not without its challenges. It requires a clear definition of objectives and goals, thorough analysis of existing processes, involvement of stakeholders from different departments, investment in the right automation tools, and a well-defined change management and communication plan.

When these factors are addressed, investment banks can successfully implement automation initiatives and reap the benefits of improved efficiency, cost savings, and reduced errors.

In the fast-paced world of investment banking, the right balance between technology and human expertise is crucial. While advanced algorithms and machine learning models can automate various processes such as risk assessment, portfolio management, and trading execution, human oversight is essential to ensure alignment with strategic goals and regulatory requirements. The combination of automation and human expertise can enhance efficiency, accuracy, and compliance in investment banking operations.

2. Key Areas in Investment Banking Benefiting from Automation

The advent of automation has brought significant advancements in trade processing, risk management, and compliance reporting within the investment banking sector. This has been achieved through the introduction of various automation tools designed to enhance the efficiency and accuracy of these operations.

Trade processing, previously a time-consuming and error-prone manual procedure, has been greatly optimized with the advent of automation tools.

Optimize your trade processing with automation tools.

These include trade capture systems, reconciliation tools, risk management systems, and settlement platforms. By automating tasks such as trade matching, confirmations, clearance, settlement, and reporting, investment banks can now process trades with greater speed and precision. This has led to substantial reductions in cost and time, resulting in more streamlined operations.

Risk management has also seen significant improvements with the integration of automation. Through the use of automated tools, investment banks can now conduct real-time risk assessments and alerts. These tools, which include advanced analytics and modeling capabilities, allow banks to make more informed decisions and better manage their risk exposure. This has enabled prompt and proactive risk mitigation strategies, thereby enhancing the overall risk management process.

Moreover, the area of compliance and reporting, a critical aspect of investment banking, has greatly benefited from automation. Tools designed to automate repetitive tasks and data entry processes have not only increased the speed of compliance and reporting activities but have also enhanced their accuracy. They have also helped ensure regulatory compliance by automatically monitoring and flagging any potential violations. This has reduced the risk of regulatory penalties, ensuring more accurate and efficient reporting.

KeyBank, a financial services company, serves as a noteworthy example of the successful implementation of automation in investment banking. By leveraging automation solutions from Automation Anywhere, KeyBank was able to enhance business efficiency and automate manual processes. The results were significant, with the bank being able to process 40,000 documents with IQ Bot and complete nine years of work in just two weeks. Moreover, KeyBank plans to further scale its digitization program and explore additional capabilities such as classifying and preparing documents for data extraction using IQ Bot.

In essence, automation has indeed brought transformative changes to investment banking. By enhancing efficiency, reducing costs, and improving accuracy, it has paved the way for a more efficient and productive future for investment banking operations.

3. Case Study: How Major Banks are Implementing Automation

Automation's impact in the financial services sector is a testament to its transformative power, with leading global banks reaping significant operational enhancements. A shining example is JPMorgan Chase's integration of the automated system COIN, an ingenious program that excels in reviewing legal documents and extracting relevant information. This has led to a considerable reduction in document review time, saving an impressive 360,000 hours per year.

In a parallel development, Goldman Sachs has tapped into the power of automation to streamline its Initial Public Offering (IPO) process. This strategic move has cut down the time spent on IPO-related tasks by a substantial 50%, underlining the efficiency that automation brings to investment banking operations.

The success of intelligent automation is further exemplified by KeyBank, one of the nation's major financial services companies. By employing intelligent automation, KeyBank managed to accomplish nine years' worth of work in just two weeks, a feat achieved by creating nine bots that processed 40,000 documents. The exception rate for document processing stood at a mere 15%, leading KeyBank to realize run rate savings of $5 million in 2020.

Heritage Bank, Australia's largest mutual bank, has also harnessed the power of automation. Utilizing UiPath's Robotic Process Automation (RPA) platform, the bank automated both customer-facing and back-office processes. Since its 2017 implementation, the bank has successfully automated 80 processes, leading to significant time savings and an improved customer experience.

The bank also incorporated artificial intelligence into their workflows using UiPath's AI Center platform. This integration has led to a high degree of process automation and a 98% accuracy rate in their most recent machine learning model. The bank now targets a 90% level of automation when compiling living expense reports.

These instances underline the transformative potential and benefits of automation in the banking sector. From reducing time spent on labor-intensive tasks to achieving substantial cost savings, the fusion of automation and AI technologies is redefining the landscape of investment banking. The integration of these technologies can streamline operations, enhance data accuracy, accelerate data analysis, and enable better decision-making. This not only increases productivity but also ensures consistent and auditable processes, helping banks comply with regulatory requirements and gain a competitive edge in the industry.

4. The Role of Chatbots in Streamlining Customer Service in E-commerce

The integration of chatbots into e-commerce operations has been a transformative shift, enhancing customer service significantly. Chatbots, with their multifaceted capabilities, can manage numerous tasks like answering customer inquiries, suggesting products, and handling transactions, making them an essential tool for e-commerce businesses.

Enhance your customer service with chatbots.

Consider a company like BestToolbars. By integrating chatbots into their operations, they can provide 24/7 support, improve customer engagement, and reduce the burden on their customer service teams. Furthermore, chatbots can be programmed to deliver personalized service based on customer data, thereby elevating the overall customer experience.

The effectiveness of chatbots in e-commerce is further highlighted by platforms such as PubNub and Kafka, which facilitate event bridging between Kafka deployments and PubNub. This integration enables more efficient and seamless communication with customers.

Chatbots boast high engagement rates, reaching up to 60% in some cases, far surpassing those of emails. One reason for this is their ability to prevent app switching fatigue. By incorporating chatbots into messaging apps, customers can effortlessly browse products and receive suggestions without having to switch between apps, enhancing user experience and satisfaction.

Chatbots can also assist in tracking and altering item delivery through in-app updates and real-time geolocation tracking. This not only enhances the customer experience but also ensures an efficient and transparent delivery process.

Chatbots can remind customers about abandoned carts, providing another channel for customer engagement, reducing cart abandonment, and improving conversion rates.

Chatbots have also made significant strides in driving online conversions. For instance, Jio Haptik has set a new standard with 15 billion AI-powered conversations. By leveraging conversational interfaces such as online messaging, chatbots, and voice assistants, it can provide an enhanced shopping experience to customers.

These conversational commerce chatbots emulate the behavior of an in-store sales assistant. They engage customers in conversation, understand their preferences, make product recommendations, and encourage them to make a purchase. This strategy not only reduces cart abandonment but also increases upselling opportunities, builds customer loyalty, and boosts conversions.

In essence, the integration of chatbots into e-commerce operations is a game-changer. Their ability to engage customers, provide personalized service, and facilitate seamless shopping experiences makes them an invaluable tool for e-commerce businesses. As more companies continue to adopt this technology, the future of customer service in e-commerce is promising.

5. Future Trends: The Next Steps for Automation in Investment Banking

Automation is reshaping the investment banking landscape, offering promising prospects for the future. AI and Machine Learning (ML) are set to play an expanded role in automating processes within this sector. These advanced technologies are being harnessed to enhance predictive analytics capabilities and streamline decision-making processes. In particular, AI and ML applications are being increasingly utilized to automate areas such as risk management, fraud detection, trading algorithms, and customer relationship management. By leveraging these technologies, investment banks can improve efficiency, accuracy, and decision-making capabilities.

Investment banks have also identified the potential of blockchain technology for increased adoption. Blockchain's ability to automate and secure financial transactions can revolutionize the banking operations and customer interactions. Features such as transparency, immutability, and decentralized record-keeping offered by blockchain can streamline and automate various processes in investment banking. For instance, smart contracts built on blockchain can automate and enforce the terms of financial agreements, eliminating the need for intermediaries and reducing transaction costs. Additionally, blockchain can enhance the security and efficiency of asset tokenization, enabling easier and faster transfer of ownership.

Furthermore, chatbots and other customer service automation tools are gaining traction in the banking sector. By integrating chatbots into their operations, banks can provide round-the-clock support, reduce response times, and improve overall customer satisfaction. These AI-powered virtual assistants are capable of handling a wide range of customer inquiries and transactions, such as balance inquiries, fund transfers, and bill payments. By leveraging natural language processing and machine learning algorithms, chatbots can understand and respond to customer queries in real-time, reducing the need for human intervention. Banks can also use chatbots to provide personalized recommendations based on the customer's financial goals and risk appetite and to answer frequently asked questions about investment products and services.

A case in point of automation in action is the deployment of GPT-4 by Morgan Stanley, a leading player in wealth management. The company has used this AI technology to organize its extensive knowledge base, which consists of hundreds of thousands of pages of investment strategies, market research, and analyst insights. By using the model's embedding retrieval capabilities, advisors can now perform comprehensive searches of wealth management content, thereby unlocking the cumulative knowledge of the company. This has resulted in improved efficiency, reduced costs, and enhanced risk management capabilities. This transformative capability has been well-received across the organization, with widespread engagement and buy-in from employees.

The future of automation in investment banking holds immense potential. With the integration of AI, ML, blockchain technology, and chatbots, banks can improve their operations, enhance customer service, and stay ahead in the competitive landscape. The use of these technologies is not just a trend, but a necessity for banks to thrive in the digital age.

Conclusion

Automation has brought significant improvements to investment banking operations, revolutionizing the industry. By leveraging advanced technologies like Robotic Process Automation (RPA), investment banks have streamlined their processes, reduced manual workloads, and achieved substantial cost savings. The implementation of automation tools like RPA has enabled banks to process large volumes of data quickly and accurately, leading to enhanced risk management and improved decision-making processes. Real-life case studies of major banks, such as KeyBank and Swiss Re, have demonstrated the tremendous benefits of automation in terms of operational efficiency, cost savings, and improved accuracy.

The impact of automation extends beyond specific areas within investment banking. It has transformed trade processing, risk management, and compliance reporting by automating labor-intensive tasks and reducing the risk of human error. The integration of automation tools has led to faster trade processing times, real-time risk assessments, and more accurate compliance reporting. However, the successful implementation of automation initiatives requires careful planning, clear objectives, stakeholder involvement, and investment in the right automation tools.

To unlock new opportunities for efficiency, productivity, and growth in the rapidly evolving digital landscape, investment banks must embrace automation. By harnessing emerging technologies like AI, ML, blockchain technology, and chatbots, they can further enhance their operations and customer service. The future trends in automation hold immense potential for improving predictive analytics capabilities, streamlining decision-making processes, securing financial transactions through blockchain technology, and providing personalized customer service through chatbots. It is crucial for investment banks to adapt to these trends to stay competitive in the digital age.

Start now to explore the benefits of automation in investment banking operations and unlock new opportunities for efficiency and growth in this rapidly evolving digital landscape.