Introduction

Integrating Google Pay into your payment options streamlines the checkout process, significantly enhancing customer satisfaction. With the rise of mobile and contactless payments, Google Pay provides the convenience that modern consumers demand. This ease of use is increasingly vital as businesses like City Bird have experienced, where a versatile platform like Lightspeed Retail POS, coupled with Lightspeed Payments, has been pivotal in managing a diverse range of products and adapting to the challenges of multimodal retail experiences.

The integration of Google Pay not only caters to the preferences of customers who opt for mobile device payments but also leverages the familiarity and trust associated with the Google brand. As Google has evolved from a powerful search engine to a multifaceted tech giant offering a plethora of internet-based services, it's clear that their payment solutions are designed with both the consumer and merchant in mind. For instance, American Express and Capital One cardholders can now view their card benefits at checkout when using Google Pay, making it simpler to maximize rewards.

Moreover, the growing public expectation for contactless payment methods, with 90% of transit riders seeking such options, highlights the trend towards digital solutions that Google Pay embodies. By adopting Google Pay, merchants are not just offering another payment method, but aligning themselves with a trend that improves the customer service experience, potentially increasing loyalty and contributing positively to the company's reputation and financial success.

Benefits of Using Google Pay for Business

Integrating Google Pay into your payment options streamlines the checkout process, significantly enhancing customer satisfaction. With the rise of mobile and contactless payments, Google Pay provides the convenience that modern consumers demand. This ease of use is increasingly vital as businesses like City Bird have experienced, where a versatile platform like Lightspeed Retail POS, coupled with Lightspeed Payments, has been pivotal in managing a diverse range of products and adapting to the challenges of multimodal retail experiences. The integration of Google Pay not only caters to the preferences of customers who opt for mobile device payments but also leverages the familiarity and trust associated with the Google brand. As Google has evolved from a powerful search engine to a multifaceted tech giant offering a plethora of internet-based services, it's clear that their payment solutions are designed with both the consumer and merchant in mind. For instance, American Express and Capital One cardholders can now view their card benefits at checkout when using Google Pay, making it simpler to maximize rewards. Moreover, the growing public expectation for contactless payment methods, with 90% of transit riders seeking such options, highlights the trend towards digital solutions that Google Pay embodies. By adopting Google Pay, merchants are not just offering another payment method, but aligning themselves with a trend that improves the customer service experience, potentially increasing loyalty and contributing positively to the company's reputation and financial success.

Setting Up Google Pay for Your Business

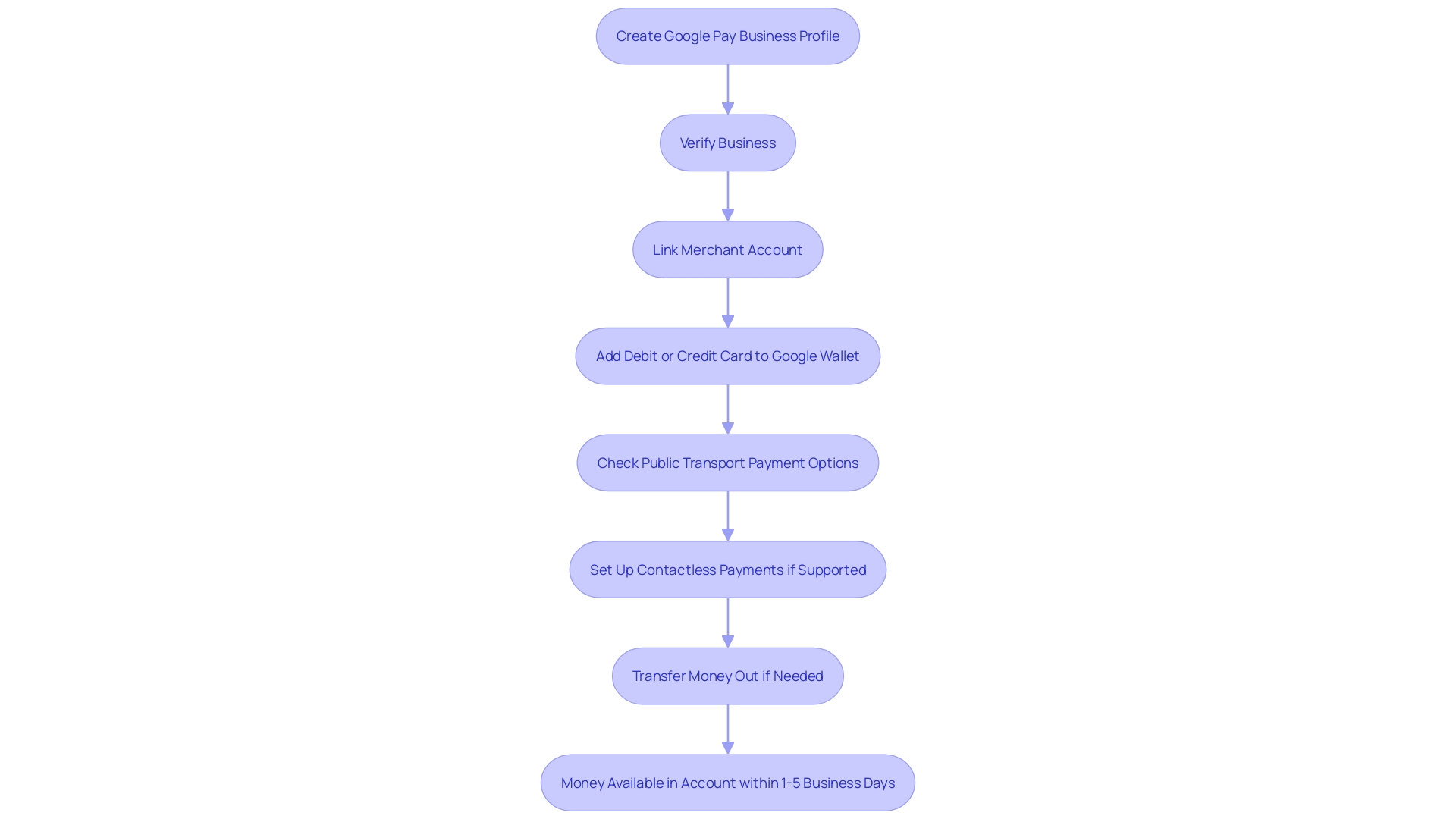

Setting up Google Pay for your business is a straightforward process that opens up a world of convenience for both you and your customers. To begin, create a Google Pay Business Profile by visiting the setup page and entering your business details. Next, you'll need to verify your business to confirm its legitimacy, which Google may require. This step is crucial for establishing trust and security for your transactions.

Once verified, the final step is to link your merchant account, such as ConnectPay App, to Google Pay. This connection is essential as it facilitates the receipt of payments directly into your merchant account, streamlining your finances and providing a smoother transaction experience for customers.

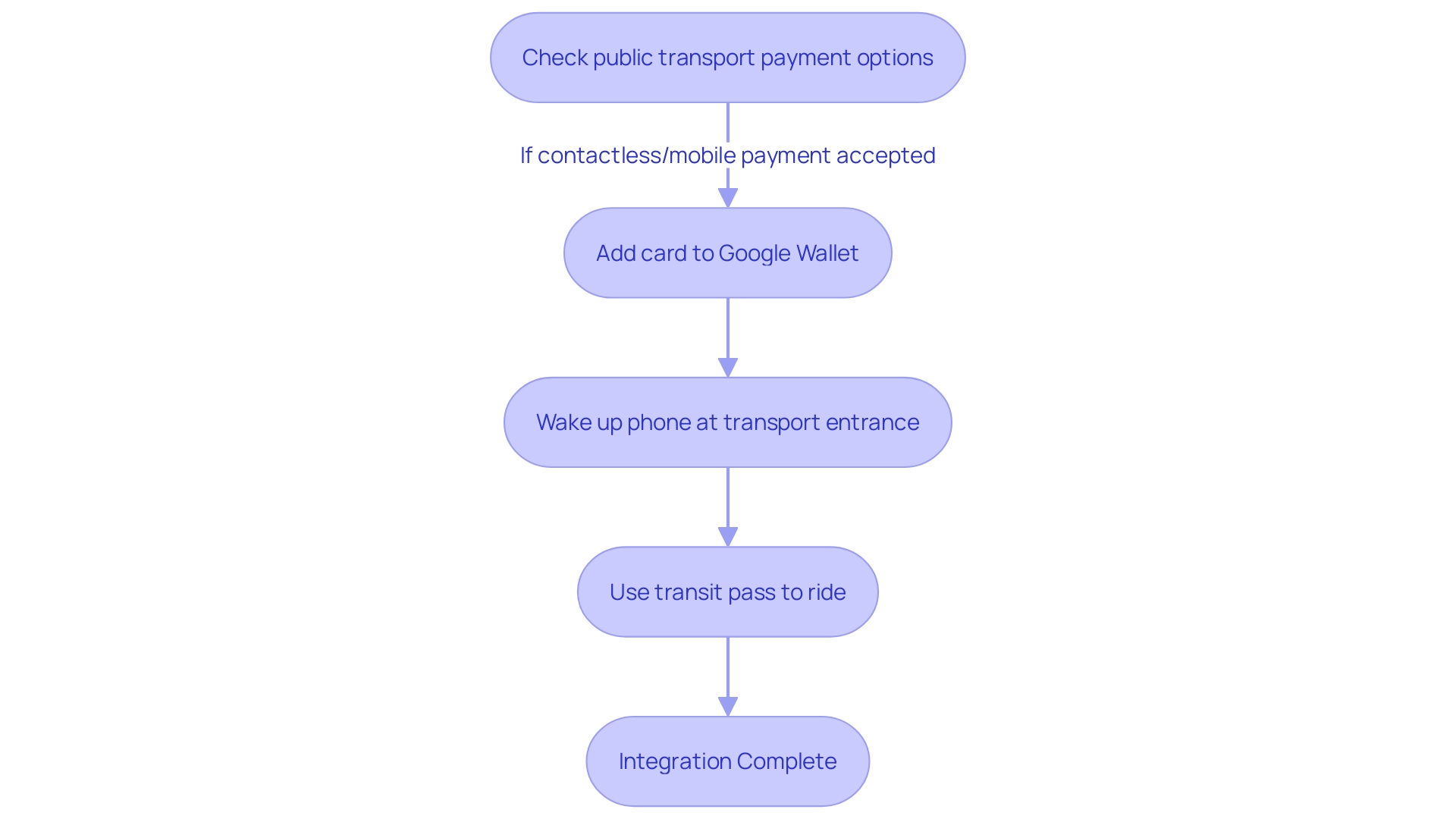

In the current digital landscape, the demand for contactless payment options is growing exponentially. Notably, 90% of public transit riders expect to have contactless payment options available. By integrating Google Pay, you not only meet this expectation but also tap into a system that supports multi-leg journeys and a variety of ticketing options through Google Maps, utilized by over 250 ticketing partners globally.

Moreover, Google Pay has evolved significantly since its inception as Google Wallet in 2011. It's more than a payment platform; it stores transport passes, IDs, and more, showcasing its versatility. With Google's commitment to enhancing the platform, including features like ride history and fare cap savings, you're not just adopting a payment system, but a comprehensive service that adds value to the user experience.

By following these steps and considering the broader context of digital payments' evolution and consumer preferences, you position your business at the forefront of the digital payment revolution, catering to the modern customer's need for security, convenience, and versatility.

Requirements for Accepting Google Pay

Integrating Google Pay into your e-commerce setup is a strategic move to accommodate evolving consumer payment preferences. To effectively adopt this payment method, ensure your payment terminals are equipped with near-field communication (NFC) technology, as this is a prerequisite for facilitating Google Pay transactions. Staying ahead in the dynamic payments landscape also requires awareness of the geographical availability of services like Google Pay, which is continuously expanding but still limited to specific countries.

As highlighted by the Global Payments Report 2023, understanding regional consumer behavior is essential for merchants aiming to penetrate new markets or optimize operations in existing ones. Incorporating Google Pay can align with customer preferences for security and convenience, which are paramount in online transactions. The report, in its eighth iteration, offers a comprehensive overview of payment methods across 40 markets, emphasizing the rapid shift towards alternative payment solutions and real-time processing.

Merchants must also establish a reliable merchant account that can seamlessly integrate with Google Pay. The ConnectPay App is an example of a merchant service that supports Google Pay, providing a streamlined setup for businesses to manage their online transactions. The importance of such integrations is underscored by recent developments, such as Google Pay's introduction of features that display credit card benefits at checkout, aiding consumers in selecting the most advantageous payment option. This addition, which currently benefits American Express and Capital One cardholders, exemplifies the ongoing enhancements in the digital checkout experience.

Furthermore, as security continues to be a top concern for online shoppers, Google Pay's security measures are designed to foster trust. The platform's adherence to stringent privacy principles ensures that consumers have control over their payment methods and the option to utilize the same security protocols that safeguard their Google accounts.

In summary, by ensuring device compatibility, verifying the availability of Google Pay in your country, and setting up a merchant account with services like ConnectPay, you can tap into the advantages of a user-friendly, secure, and forward-thinking payment ecosystem.

Integrating Google Pay with Your Merchant Account

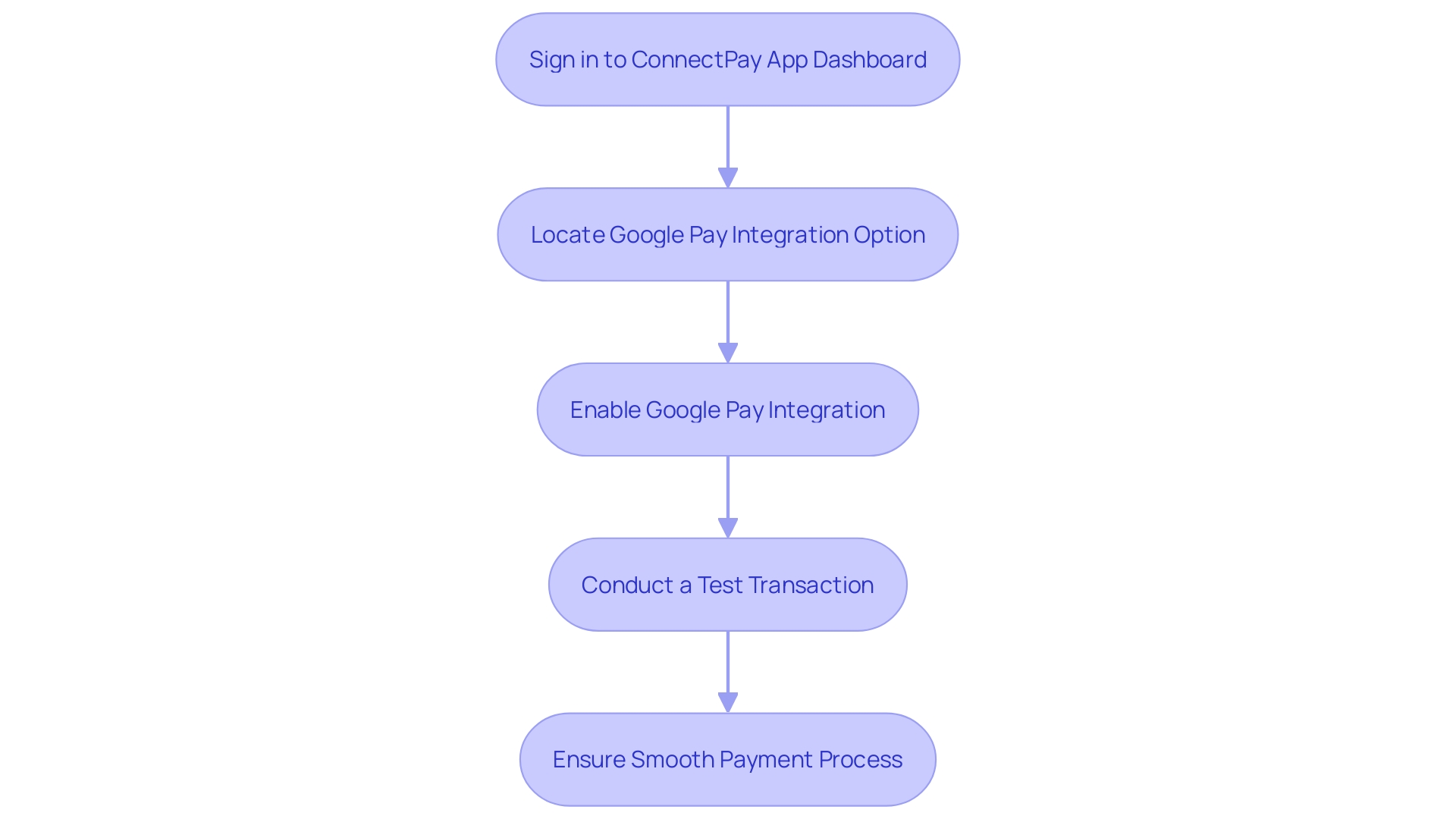

To offer a seamless payment experience to customers, integrating Google Pay into your ConnectPay App can be a game-changer. Start by signing in to your ConnectPay App dashboard, where you'll find the settings or integrations section. Here, you'll locate the Google Pay integration option and can enable it by following the on-screen instructions. Once activated, it's vital to conduct a test transaction, ensuring the process is smooth and payment through Google Pay is processed without hitches.

With consumer preferences shifting rapidly, as noted in the Global Payments Report 2023, it's essential to adopt payment solutions that cater to convenience, security, and smart spending tools. Google Pay answers this call by offering a user-friendly interface where customers can easily manage their card benefits and rewards, a feature increasingly important to users as they look for added value in their transactions.

Moreover, integrating Google Pay is not just about adding another payment option; it's about enhancing the customer journey. As learned from the case of La Redoute and their adoption of Stripe, a unified payment system that revolves around the customer's needs is paramount. This strategy aligns with Google Pay's vision, which leverages payment habits to keep users engaged within its ecosystem, offering a central hub for various services.

Liability shift for Visa device tokens, recently announced for Google Pay, highlights the security benefits for merchants. This shift means that in the case of fraudulent transactions, the responsibility moves from the merchant to the issuing bank, providing an extra layer of protection and peace of mind.

Remember, when integrating Google Pay, it's not just about following the technical steps but about aligning with the strategic vision of creating a customer-centric payment system that responds to current market trends and consumer behaviors.

Using NFC Payment Terminals

Embracing the future of contactless payments, many businesses are adopting NFC (Near Field Communication) terminals to accommodate the growing trend of mobile wallet usage, including Google Pay. To integrate this technology into your operations, start by confirming that your NFC terminal supports Google Pay. This can typically be verified by reviewing the terminal's specifications or reaching out to the manufacturer for confirmation.

Once compatibility is established, it's crucial to enable the NFC feature on your payment terminal. This will allow your customers to enjoy the convenience of tapping their smartphones or NFC-enabled devices to make payments quickly and securely.

Training is equally important to ensure a seamless adoption of this technology. Your staff should be well-informed on the operation of NFC payment terminals and ready to assist customers in using Google Pay for their transactions.

Lastly, signaling Google Pay acceptance clearly is essential. Utilize visible signage or stickers in the vicinity of the NFC payment terminals to inform customers that they can use Google Pay at your establishment. As the world moves towards digital solutions for transactions, including the ability to buy transit tickets directly from Google Maps, it's evident that the demand for digital payment options is on the rise.

With reports indicating that 90% of public transit riders expect contactless payment options and transit agencies worldwide are moving towards open-loop systems, the trend towards contactless payments is becoming more widespread. This not only includes public transportation but extends to retail and service industries as well. By adopting NFC terminals and showcasing Google Pay compatibility, your business is well-positioned to meet customer expectations for a fast, secure, and convenient payment experience.

Configuring Point of Sale (POS) Systems

Integrating Google Pay with your point-of-sale (POS) system is a strategic move that can streamline payment processing and enhance the customer experience. To ensure a smooth integration, follow these essential steps:

-

Verify POS System Compatibility: Confirm that your POS system is compatible with Google Pay. This may involve reaching out to your POS provider or reviewing system documentation for specific integration instructions.

-

Update POS Software: Ensure your POS software is current by updating to the latest version that supports Google Pay integration. This step is crucial for maintaining system security and functionality.

-

Adjust Google Pay Settings: Within the POS system settings, locate the Google Pay configuration options. Adhere to the provided instructions to enable Google Pay as an available payment method.

-

Conduct a Test Transaction: To confirm successful integration, perform a test transaction using Google Pay. This helps identify and resolve any issues before rolling out the feature to customers.

Businesses like Tebi have recognized the need for seamless payment solutions, offering platforms that simplify operations with integrated payment systems. By adopting Google Pay, merchants can tap into the benefits highlighted in the Global Payments Report 2023, which emphasizes the rapid evolution of payment methods and the importance of staying abreast of consumer preferences.

Furthermore, embracing mobile payment apps can cater to customer convenience, as these platforms often include loyalty and reward programs. As technology advances and consumer habits shift, integrating Google Pay into your POS system is a forward-thinking approach that aligns with the latest industry insights, ensuring your business remains competitive and responsive to market demands.

Mobile Processing Hardware for Google Pay

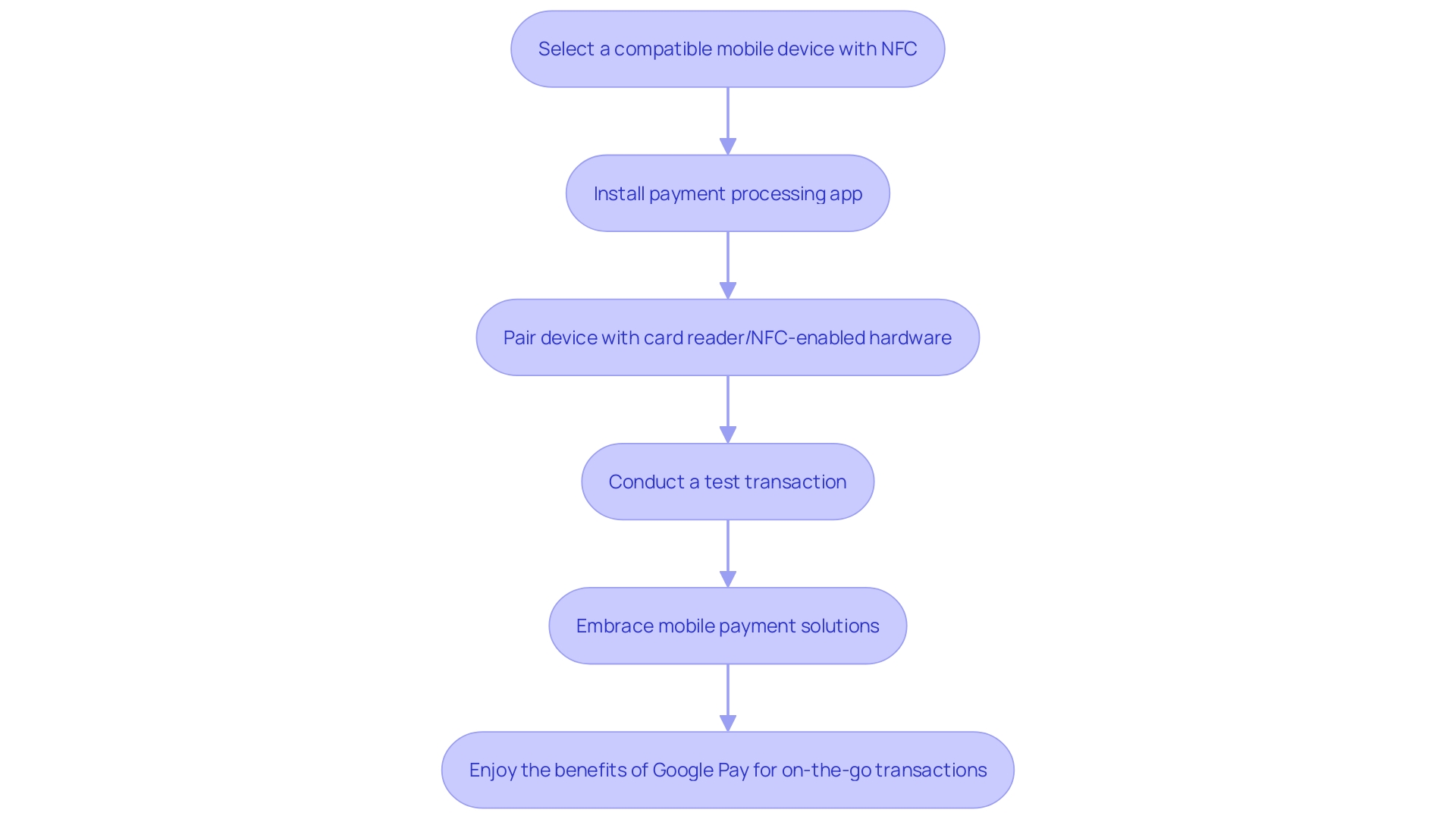

To harness the power of mobile payments, such as Google Pay, for on-the-go transactions, certain steps must be followed to set up the necessary processing hardware. Begin by selecting a mobile device that is compatible with Google Pay, ensuring that it supports NFC (Near Field Communication) technology for contactless payments. Next, install a robust payment processing application like ConnectPay App on your device, verifying its compatibility with Google Pay.

Once the app is in place, pair your mobile device with a card reader or NFC-enabled hardware, which is essential for processing Google Pay transactions. This hardware acts as a bridge between your customer's payment method and your sales system. To validate the setup, conduct a test transaction to confirm that the payment process through Google Pay is seamless and secure.

Embracing mobile payment solutions like Google Pay not only provides convenience but also reflects the shifting trends in consumer preferences, as highlighted in the Global Payments Report 2023. With the increasing adoption of digital wallets, it's crucial for businesses to stay ahead of the curve by implementing flexible payment options that cater to customers' desires for security and convenience.

Moreover, integrating mobile payment solutions aligns with the movement towards a cashless and cardless society, addressing the concerns over traditional payment methods' vulnerability to fraud and the associated costs. As businesses transition to innovative payment models, they benefit from preferential transaction rates and the elimination of unnecessary fees, ultimately enhancing their financial management and customer experience.

Integrating Google Pay for E-commerce Payments

Integrating Google Pay into your e-commerce site enhances the shopping experience by providing a frictionless payment solution. Begin by selecting a compatible e-commerce platform, such as Shopify or WooCommerce, which readily supports Google Pay. After choosing your platform, install the necessary Google Pay plugin or extension, carefully following the provided installation instructions.

Once installed, navigate to the payment options within your e-commerce platform's settings to enable Google Pay as a payment method. It's crucial to conduct a test transaction after configuration to confirm the successful processing of payments via Google Pay.

This integration not only streamlines the checkout process but also connects your online and offline sales, creating a cohesive consumer experience. Retail giants like MediaMarkt have recognized the importance of a unified retail ecosystem, where online tactics bolster offline sales and vice versa.

Furthermore, the recent updates to Google Pay, including new features like workplace ID card support and a refreshed user interface, reflect evolving consumer preferences for convenience and security during checkout. Leveraging these enhancements can encourage customer loyalty and potentially increase sales, as evidenced by Avery Dennison's research indicating a strong consumer shift towards frictionless shopping experiences.

By providing customers with a seamless payment option like Google Pay, you're aligning with the trend of smart spending tools that offer security and convenience, factors highly valued by today's shoppers.

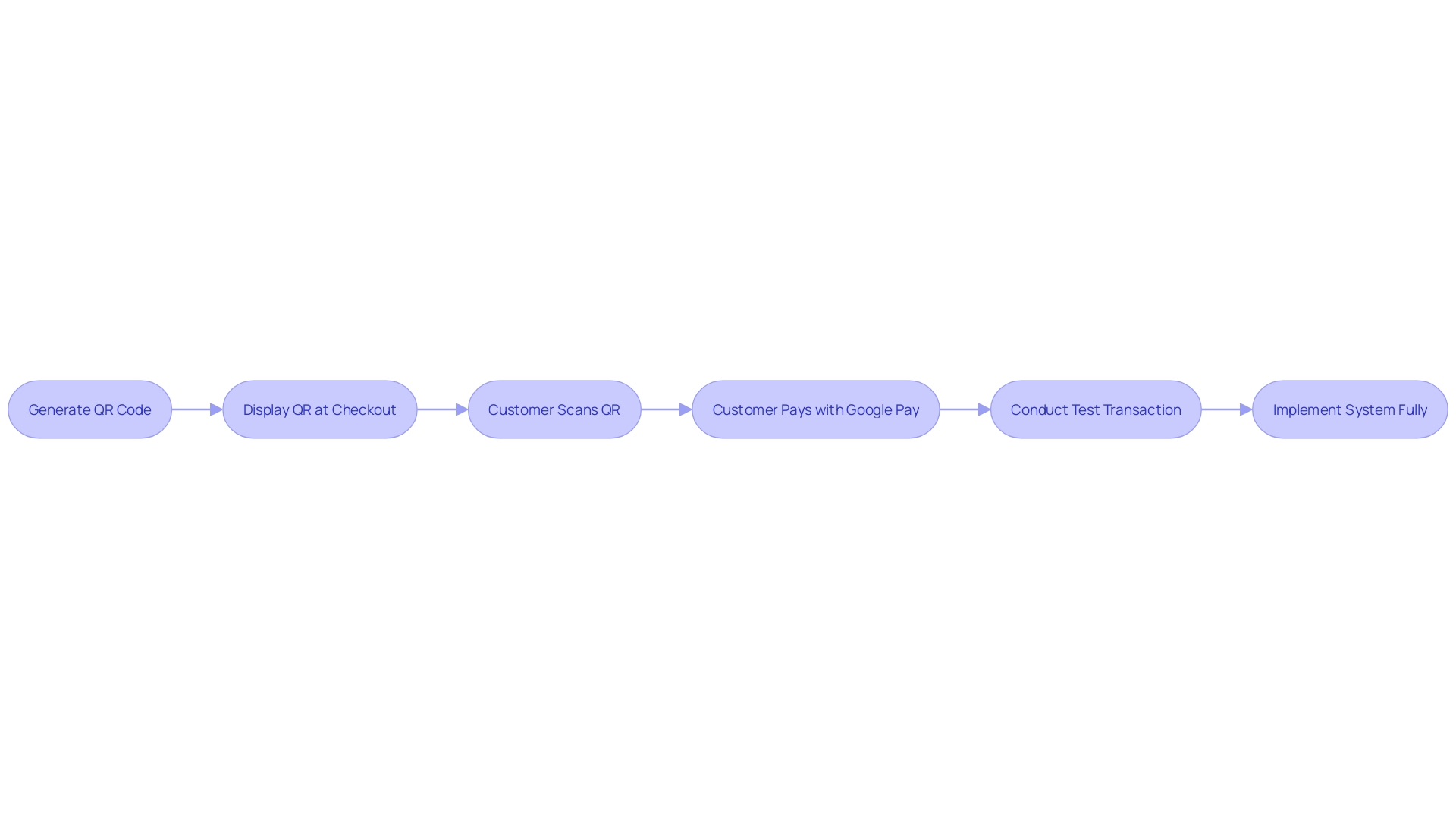

Using QR Codes with Google Pay

Integrating QR codes for Google Pay transactions is a seamless way to cater to the evolving preferences of consumers, who are increasingly seeking digital solutions for their payment needs. To set up Google Pay QR code payments for your business, begin by generating a unique QR code through a compatible generator. Once created, prominently display this code at your checkout areas for easy customer access. It's essential to ensure your staff are well-versed in guiding customers through the QR code scanning and payment process to provide a smooth experience. Before fully implementing this system, conduct a test transaction to confirm the functionality and reliability of QR code payments via Google Pay.

As digital payments continue to advance, services like Google Maps have already integrated options to purchase transit tickets for multi-leg journeys, highlighting the demand for such digital conveniences. Moreover, Google Pay's ability to display card benefits during checkout simplifies the decision-making process for consumers, ensuring they maximize the value of their purchases. This feature is particularly beneficial as it supports various cards, including those from American Express and Capital One.

The integration of QR codes is a testament to their versatility, as they serve as a bridge between physical and digital interactions. Their capacity to store diverse information types makes them an indispensable tool in the payment sector. By adopting QR code payments, businesses can align with consumer trends that favor convenience, security, and smart spending tools, as highlighted in the latest Google Pay updates.

Furthermore, the Global Payments Report 2023 emphasizes the need for businesses to stay abreast of payment trends and consumer preferences, which are rapidly shifting towards digital and contactless options. By leveraging QR codes in conjunction with Google Pay, merchants are better positioned to meet these evolving expectations and enhance the checkout experience for their customers.

Technical Steps for Google Pay Integration

As the world of e-commerce evolves, so does the need for seamless payment integrations. Google Pay, a leader in the digital wallet space, is enhancing the checkout experience by offering features that benefit both merchants and consumers. Integrating Google Pay into your e-commerce platform begins by determining the correct API version for your needs and configuring your systems to support it. A PaymentDataRequest object is then created, encapsulating all necessary parameters to process payments.

Merchants can check their customer's readiness to pay using Google Pay's API, ensuring a frictionless payment experience. Adding a Google Pay button to your website or app is not just about functionality—it's about providing a convenient option for your customers, many of whom are already familiar with contactless payments in their daily commute. In fact, nine out of ten public transit riders expect contactless payment options, and Google Pay's integration into transit systems worldwide is a testament to its growing acceptance and reliability.

Once you initiate the payment process and follow the steps to verify your Google Pay account, it's crucial to display the Google Pay logo prominently. This not only informs customers of this payment option but also leverages the trust and convenience associated with the brand. With features like showing card benefits at checkout, Google Pay is making it easier for consumers to make informed decisions, ultimately enhancing the shopping experience provided by your e-commerce platform.

Moreover, Google Pay's recent expansions, such as allowing users to purchase multi-leg transit tickets directly from Google Maps, illustrate the platform's commitment to convenience and innovation. This level of integration can inspire merchants to adopt and promote Google Pay, providing customers with a cohesive and enjoyable shopping journey.

As the Global Payments Report 2023 indicates, understanding the rapidly changing payment landscape is vital for tapping into new markets and keeping up with consumer preferences. Google Pay's integration is a strategic move that aligns with these evolving trends, offering a secure and convenient payment method that meets the modern shopper's needs.

Common FAQs and Troubleshooting for Google Pay

Navigating the integration of Google Pay into your business's online platform can be a straightforward process, but it's not uncommon to encounter questions or challenges along the way. The setup typically only takes a few minutes, but you should be prepared to meet verification requirements that may extend this timeline.

If you're facing issues with Google Pay payments not processing, it's crucial to double-check your payment terminals and device configurations. Look out for error messages and don't hesitate to reach out to Google Pay support for further assistance.

For those considering Google Pay as their exclusive payment method, it's technically feasible. However, in today's omnichannel retail landscape where customer preferences vary widely, offering a variety of payment options is often more advantageous.

Promoting Google Pay can be effectively done through various channels. Include information on your website, utilize your social media presence, and don't forget physical in-store signage. Emphasizing the ease and security of Google Pay can enhance customer trust and streamline their checkout experience.

In light of the evolving digital payment space, and with Google Pay's app discontinuation on the horizon for June 4, 2024, it's more important than ever to stay informed about the latest payment trends and technologies. As you adapt your payment infrastructure, consider the insights from global payment reports and the successes of companies like HUGO BOSS, who have benefited from a robust, seamless payment system that aligns with their digital strategy.

Conclusion

In conclusion, integrating Google Pay into your payment options offers significant benefits for businesses and customers. It streamlines the checkout process, enhances customer satisfaction, and increases loyalty. By leveraging the trust associated with the Google brand, Google Pay caters to customers who prefer mobile device payments.

The integration of Google Pay aligns with the trend towards digital solutions and contactless payment methods. It positions businesses at the forefront of the digital payment revolution, improving the customer service experience and contributing positively to their reputation and financial success.

Setting up Google Pay is a straightforward process involving creating a Google Pay Business Profile, verifying your business's legitimacy, and linking your merchant account. It is crucial to ensure NFC technology in your payment terminals and establish a reliable merchant account that integrates seamlessly with Google Pay.

Integrating Google Pay with your ConnectPay App provides a seamless payment experience, enhancing convenience and security. It aligns with the strategic vision of creating a customer-centric payment system that responds to market trends and consumer behaviors.

Embracing NFC payment terminals and showcasing Google Pay compatibility positions businesses to meet customer expectations for fast, secure, and convenient payments. Integrating Google Pay with your point-of-sale (POS) system streamlines payment processing and enhances the customer experience.

By following the necessary steps and aligning with the strategic vision, businesses tap into a user-friendly, secure, and forward-thinking payment ecosystem. Integrating Google Pay into e-commerce payments enhances the shopping experience, connecting online and offline sales with a frictionless payment solution.

Integrating QR codes for Google Pay transactions caters to evolving consumer preferences for convenience, security, and smart spending tools. It aligns with industry insights, ensuring businesses remain competitive and responsive to market demands.

In summary, integrating Google Pay offers convenience, enhances the customer experience, and aligns with evolving consumer preferences. By following the necessary steps and considering the broader context of digital payments' evolution, businesses position themselves as industry leaders, providing authoritative advice and recommendations.