Introduction

The landscape of insurance claims processing is undergoing a transformative shift with the advent of generative artificial intelligence (GenAI). In this article, we will explore the challenges in traditional claims processing and how AI, specifically large language models (LLMs), can revolutionize the industry.

We will also discuss the implementation of Robotic Process Automation (RPA) in claims processing and the benefits it brings to insurance companies. Additionally, we will examine real-life examples of RPA in insurance claims, highlighting the remarkable improvements in efficiency and customer satisfaction. Join us as we delve into the world of AI-powered claims processing and discover how it is reshaping the insurance industry.

Challenges in Traditional Claims Processing

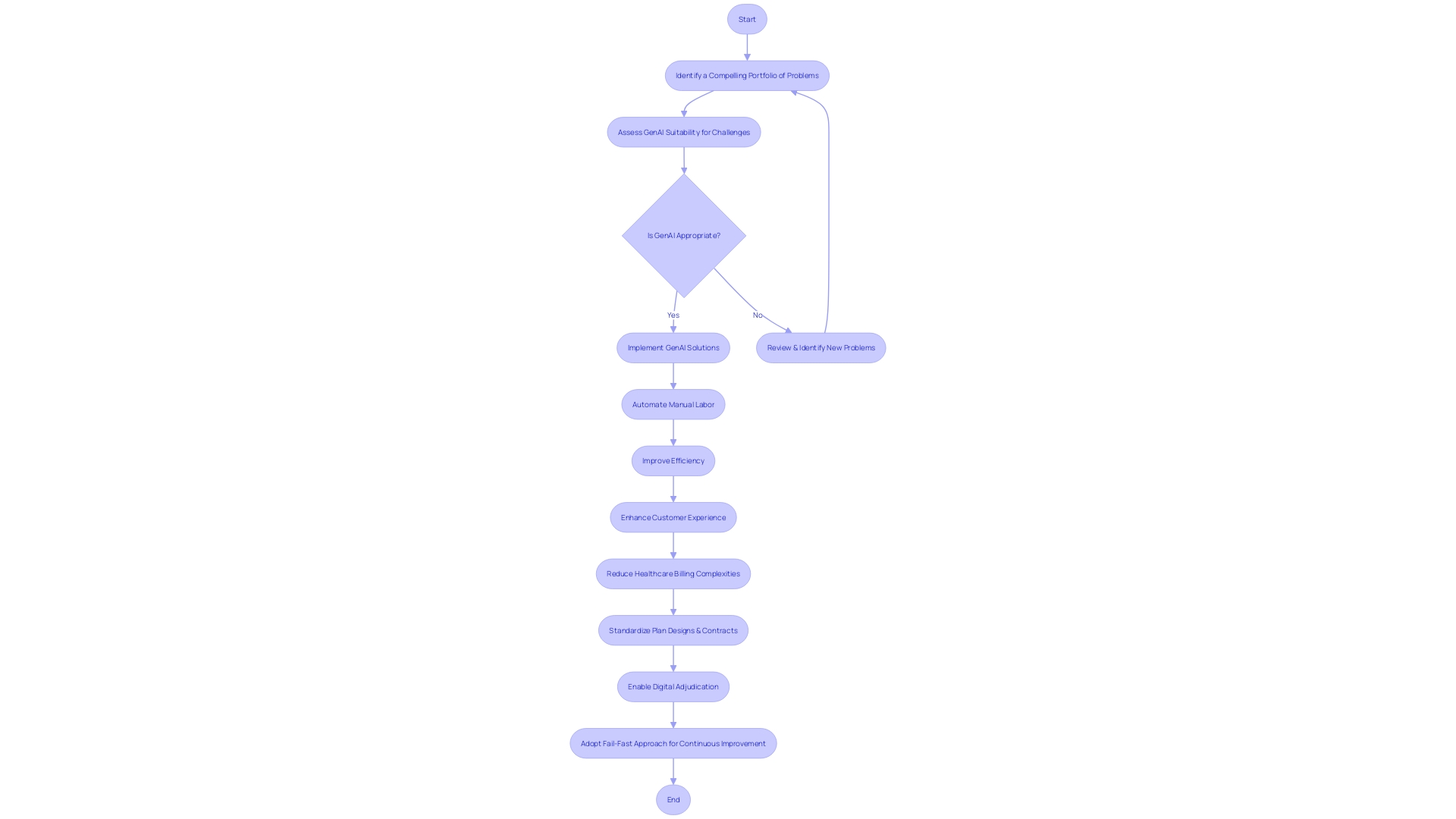

The landscape of insurance claims processing is undergoing a transformative shift, thanks to the advent of generative artificial intelligence (GenAI). Where previously heavy manual labor and time-consuming tasks dominated, AI is now catalyzing a sea change, alleviating these burdens and vastly improving efficiency. With more than 70% of companies still exploring how AI can benefit their operations, the commitment is palpable.

The curtain has been lifted, revealing the tangible improvements: internal process automation and enhanced customer experiences are just the beginning. At the heart of this disruption, large language models (LLMs) stand out as premier innovations. Their potential is not just speculative; practical applications are being fervently discussed—especially in reducing the decidedly complex and costly healthcare billing and insurance processes.

It's worth noting that this is no simple feat: the prerequisite for a successful LLM application is locating 'useful patterns' within data, and with the U.S. leading in healthcare administrative complexity, the challenge is significant. It's been reported that a straightforward primary care physician visit incurs an average billing cost of $20.49, highlighting the need for meticulousness. Meanwhile, the insurance industry grapples with navigating these complexities and strives for transparency.

Simplifying the market is the call of the hour, where standardization of plan designs, contracts, features, and administrative processes could pave the way for digital adjudication. There's a growing consensus that within this vast tapestry of insurance plans, any intricacy should be digestible by machines via clear, machine-readable formats, making adjustments a matter of toggling features on and off, rather than engaging in laborious manual manipulation. Today's industry leaders are steadfast in their resolve to lead rather than follow, embracing a fail-fast approach to ensure continuous technological advancement and subsequent operational excellence.

Implementation of RPA in Claims Processing

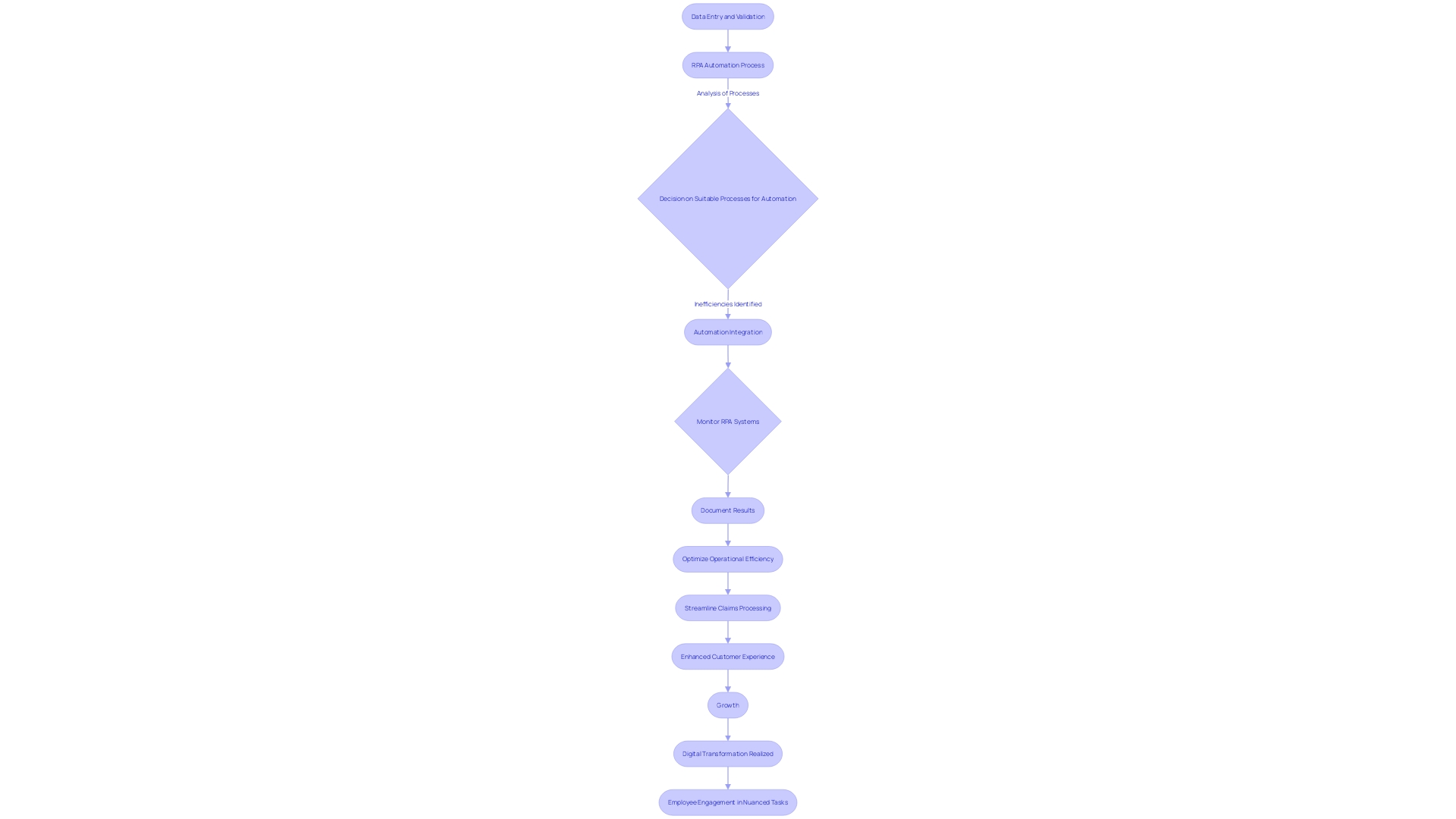

In a strategic maneuver to refine their claims processing workflow, an insurance firm embarked on integrating Robotic Process Automation (RPA). Careful consideration went into pinpointing operations ripe for automation—characteristically, those monotonous and time-intensive activities such as manual data entry and validation of documents.

After assessing the suitability of these manual processes for automation and acknowledging the inherent inefficiencies, RPA technology was employed to streamline them. This shift not only lightened the load of employees, freeing them for more nuanced tasks, but it also marked a step forward towards digital transformation.

Critical to the success of this venture was not just the implementation of technology but also the ongoing monitoring of these systems. Results were meticulously documented, providing a wealth of insights for future initiatives. The company's adoption of automation, reflective of broader industry trends, underscores the burgeoning recognition of Ai's potential to enhance operational efficiency — statistics indicate that while 91% of financial sector leaders have piloted AI projects, only 36% have managed to integrate AI comprehensively within their workflows. Adopting RPA, therefore, stands as a beacon of modernization, steering the insurance industry towards more informed, data-driven decision making processes.

Benefits of RPA in Insurance Claims Processing

Robotic Process Automation, or RPA, has substantially modernized the arena of insurance claims, streamlining a previously labyrinthine system. By employing RPA technology, insurance entities observed a remarkable drop in manual workload, which paved the way for more swift claim settlements.

The crux of this revolution lies in RPA's adeptness at data handling and validation; a meticulous duty where human error can now be mitigated. This precision fostered an operational uptick in both efficiency and accuracy, ultimately contributing to heightened customer gratification through expeditious responses and resolutions of their claims.

To discern such successful outcomes, it's pivotal for leadership to critically analyze the congruity of manual processes with automation potential, identify inefficiencies ripe for resolution via automation, and measure the investment against the value added. With 91% of financial services and insurance leaders experimenting with AI, but only 36% employing it broadly, it's evident that a strategic, measured approach is imperative. As property/casualty insurers iteratively adopt GenAI—and 70% still exploring its full potential—it's clear that while the journey isn’t without challenges, the rewards of RPA, when executed with precision, can transform claims processing productivity.

Real-Life Examples of RPA in Insurance Claims

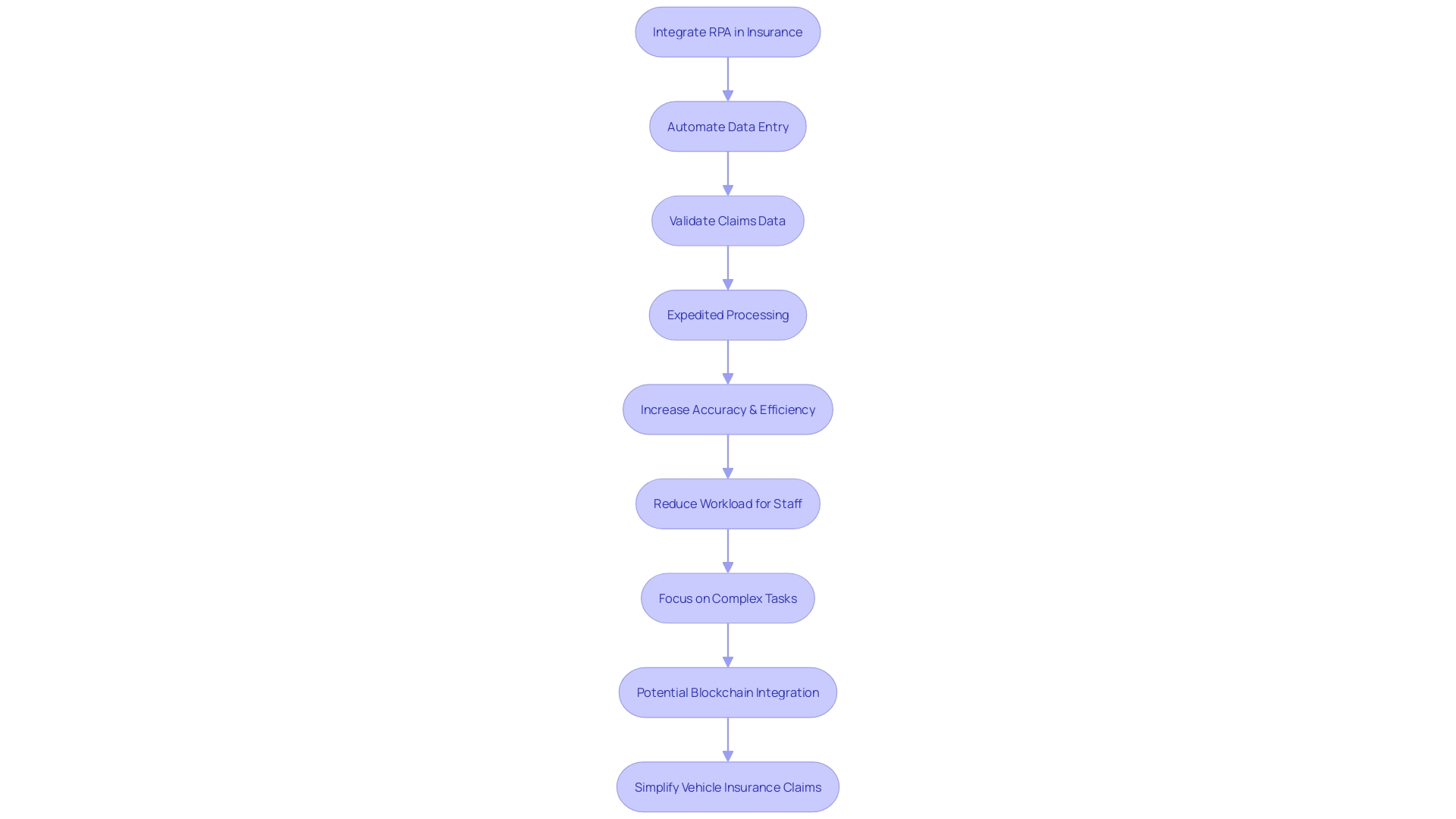

The progressive integration of Robotic Process Automation (RPA) into insurance is transforming how claims are handled. Rather than the traditional, labor-intensive methods characterized by extensive paperwork and manual data crunching, insurance companies are now adopting RPA to overhaul their medical claims process.

By automating the repetitive tasks of data entry and validation, one notable insurance firm managed to expedite claim processing significantly. The automation enabled the handling of larger volumes of claims without sacrificing accuracy, enhancing the efficiency of the claims process.

It directly addressed those manual procedures within the firm that were ripe for automation, as a result, lightening the workload of their staff. Employees could then allocate time and effort to more complex and nuanced tasks, thus making better use of their expertise and capabilities. It's a cutting-edge shift, illustrating the transformed landscape where blockchain technologies are equally poised to simplify vehicle insurance claims, promising seamless and user-directed experiences. While adopting such technologies can be challenging, with a prudent analysis of inefficiencies and clearly defined automation criteria, businesses are well-positioned to harness their extensive benefits, including considerable administrative cost reductions as reported in health care, without neglecting the imperatives of a complex billing environment.

Conclusion

In conclusion, the insurance industry is undergoing a transformative shift in claims processing with the adoption of generative artificial intelligence (GenAI) and Robotic Process Automation (RPA). Large language models (LLMs) are revolutionizing healthcare billing and insurance processes, while RPA streamlines workflows and enhances operational efficiency.

The implementation of RPA in claims processing has brought about significant benefits. Manual workload has been reduced, leading to faster claim settlements and improved efficiency.

With precise data handling and validation, RPA ensures accurate and prompt responses, resulting in enhanced customer satisfaction. Real-life examples demonstrate the impact of RPA in insurance claims.

Automation of tasks such as data entry and validation has not only expedited the processing of claims but also freed up employees to focus on more complex responsibilities, making the most of their skills and expertise. By embracing AI-powered claims processing and RPA, insurance companies can transform their operations.

These technologies streamline processes, improve efficiency, and deliver superior customer experiences. Furthermore, as the industry continues to explore blockchain technologies, simplified and user-directed experiences can be expected in areas like vehicle insurance claims.

While the journey towards automation and digital transformation presents challenges, the rewards are substantial. Insurance leaders need to analyze manual processes strategically, identify opportunities for automation, and assess the value of implementation. By doing so, insurance companies can stay at the forefront of the industry and achieve remarkable claims processing productivity. In summary, the future of insurance claims processing lies in AI-powered solutions like GenAI and RPA. These technologies offer immense potential for optimizing workflows, reducing costs, and elevating customer experiences. By embracing these innovations, insurance companies can solidify their positions as industry leaders in a highly competitive landscape.

Experience the power of RPA and elevate your customer satisfaction today!