Introduction

Robotic Process Automation (RPA) is revolutionizing the banking industry, enhancing operational efficiency, reducing costs, and improving decision-making. From streamlining loan processing to automating customer onboarding and improving regulatory compliance, RPA is transforming traditional banking practices.

This article explores real-life case studies that highlight the benefits of RPA in banking, such as significant time savings, cost reductions, enhanced customer experiences, and increased approval rates. Furthermore, the article discusses the future of RPA in banking, including the integration of AI and machine learning to personalize services and drive growth. As the banking sector embraces technological advancements, RPA emerges as a strategic investment for banks to operate with precision and agility in a competitive digital landscape.

Benefits of RPA in Banking

Robotic Process Automation (RPA) is transforming the landscape of administrative efficiency. A standout example is the reallocation of relationship managers, which, once mired in a week-long slog through various systems and thousands of record changes, is now a one-day feat.

This 88% leap in efficiency not only exemplifies RPA's power to enhance operational performance but also underscores its capacity to make significant cost savings—a staggering AED 210 million in one instance. Moreover, RPA's role in data management is indispensable for small businesses.

It can autonomously gather, organize, and update data, ensuring decisions are made based on the latest information, giving businesses a sharp competitive edge. With compliance and risk management being vital, RPA stands out as a reliable sentinel, programmed to adhere to regulations, thereby mitigating risks of non-compliance and the potential financial repercussions. It's clear that RPA is not just a technological investment but a strategic one, offering a swift return through reduced costs and heightened accuracy, as evidenced by the annual saving of 840 hours in process turn-around times. In a world where digital solutions are exploding and competition is fierce, RPA offers a solid foundation for businesses to build upon, ensuring they operate with precision and agility.

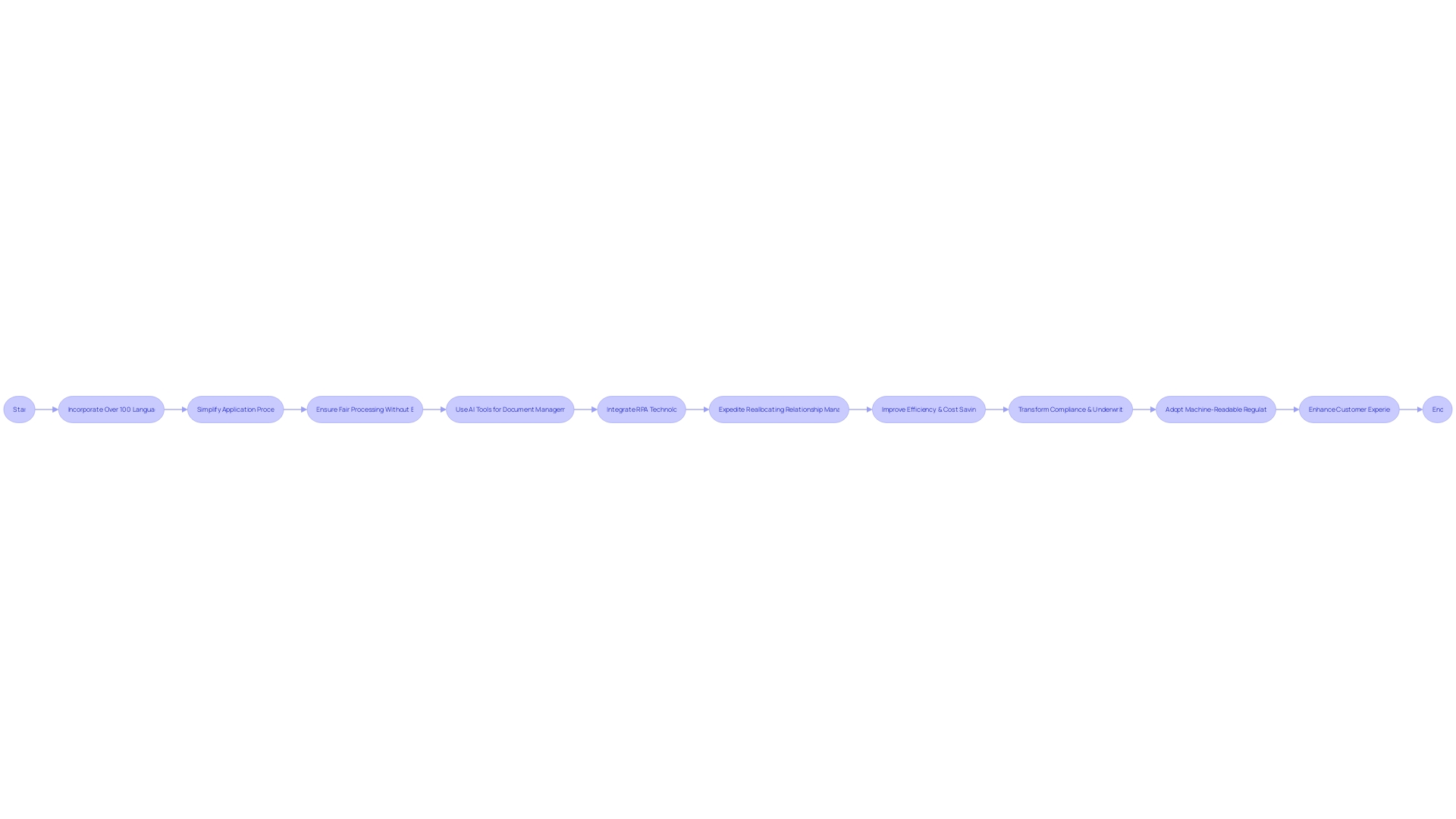

Case Study: Enhancing Loan Processing Efficiency

The lending landscape is evolving with AI technology at the helm, ensuring no borrower is left behind due to language barriers or complex financial situations. Bank XYZ, harnessing the power of AI, revolutionized its loan processing by incorporating over 100 languages and simplifying applications to just a few questions. This inclusivity increased approval rates by over 50% for certain ethnic groups.

Moreover, AI tools, neutral to loan types and borrower's intricate financial profiles, ensure fair processing without bias towards costly loan products. For instance, AI efficiently manages the documentation of borrowers with multiple jobs, a common trait in minority communities, which traditionally posed a challenge for loan officers. The technology's precision and safeguards reinforce the reliability of financial decisions, instilling newfound confidence among applicants.

In a striking case, RPA technology expedited a previously week-long, error-prone process of reallocating relationship managers into a single day, boosting efficiency by 88% and resulting in substantial cost savings. These advancements signal a transformative era for compliance and underwriting, where machine-readable regulations may soon streamline tasks that were once manual and susceptible to human error. The integration of RPA into Bank XYZ's operations not only halved the processing time but also enhanced the customer experience by leaps and bounds, setting a new standard in the lending industry.

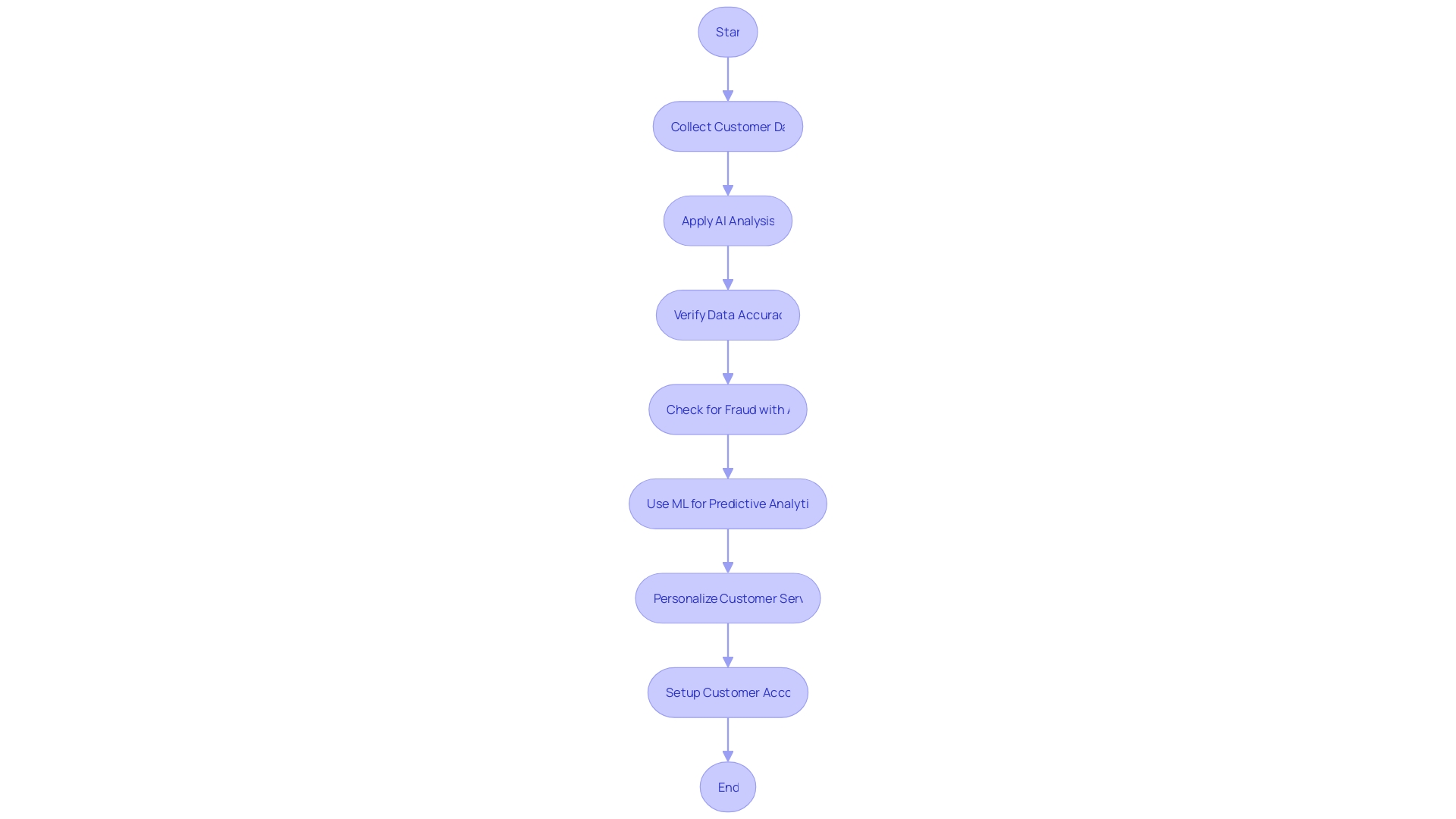

Case Study: Automating Customer Onboarding

Leveraging AI and machine learning, Bank ABC has revolutionized its customer onboarding process. By automating the collection, verification, and setup of customer data, the bank has not only slashed the time required to onboard new clients but has also significantly enhanced the precision of the data gathered. This approach mirrors the successes seen in diverse industries where companies like Delivery Hero managed to reduce the time their global workforce spent locked out of their accounts, from an average of 35 minutes to virtually zero, by automating identity verification and access restoration processes.

Such improvements are critical in a landscape where digital channels dominate customer interactions, and the expectations set by nearly 300 emerging neobanks drive incumbents to pursue wide-scale digital transformations. In this competitive environment, AI-driven customer service has proven to boost average order values by up to 47%, underlining the tangible benefits of integrating advanced technologies into customer-centric operations. Bank ABC's initiative is a testament to the power of AI in creating a seamless and superior customer experience, a strategy that aligns with the best practices observed across the financial sector.

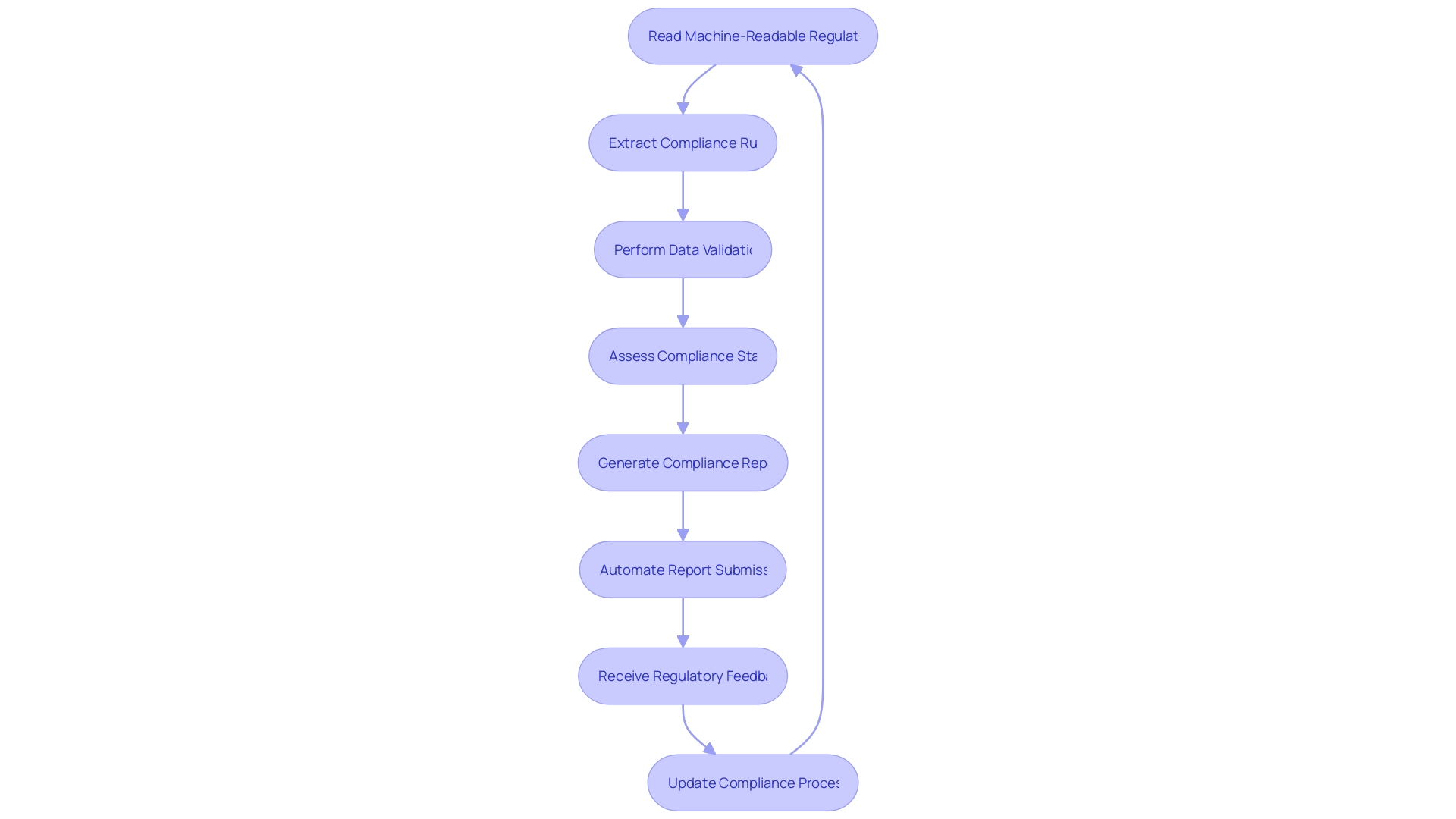

Case Study: Improving Regulatory Compliance

In the realm of financial compliance, accuracy and efficiency are paramount. Traditional methods of compliance checks and report generation, often fraught with human error and inefficiency, are being transformed by the advent of regulatory technology. Bank DEF has embraced this evolution, automating compliance tasks with machine-readable regulations that minimize the risk of error and expedite processes.

This automation extends to data validation and report generation, enhancing the accuracy of compliance and reducing the laborious efforts traditionally associated with regulatory reporting. The Financial Services Regulatory Authority of Ontario exemplifies a response to the rapidly changing commercial and consumer environment, advocating for a flexible approach to regulations that aligns with the automation capabilities of modern technology. Similarly, as site reliability engineers use advanced analytics to monitor and improve customer experiences, Bank DEF leverages these innovations to ensure their compliance measures are not only effective but also agile in adapting to new regulatory landscapes.

The result is a seamless compliance process that meets the stringent requirements of various regulatory frameworks, from the rule-heavy regulations of the US Commodity Exchange Act to the principles-based approaches of the UK, all while maintaining transparency and integrity in the financial industry. By incorporating these technological advancements, Bank DEF has set a benchmark for digital banking, where the onboarding journey is not only compliant with regulations but also exceptionally swift, boasting one of the fastest times worldwide. This initiative underscores the significance of interoperability and uniform automation in regulatory reporting, yielding benefits that reverberate throughout the entire financial sector.

The Future of RPA in Banking

The integration of Robotic Process Automation (RPA) with AI and machine learning (ML) is transforming the banking sector, driving efficiency and enhancing decision-making. This powerful combination is not only optimizing back-end operations but also revolutionizing customer interactions by providing personalized services.

For instance, the reallocation of relationship managers, a process once bogged down by administrative burdens, has been streamlined by RPA. What took seven days now takes just one, showcasing an 88% efficiency boost and 840 hours saved annually.

With the advent of open banking, banks are leveraging these technologies to innovate and partner with fintech startups, creating more opportunities for RPA applications. Generative AI, like ChatGPT, has rapidly gained traction, with banking being one of the industries poised to benefit significantly.

Accenture's analysis indicates that 73% of the time spent by bank employees could be influenced by generative AI, with 39% ripe for automation. This shift allows banks to reduce operational costs and allocate human resources to more strategic tasks, fostering growth and competitive differentiation. Ai's ability to draw insights from vast amounts of data, including IoT and social media, enables banks to offer hyper-personalized products and services, potentially transforming the banking landscape. However, the challenge lies in balancing this technological reinvention with ongoing operations, necessitating a culture of innovation and curiosity. As banks continue to adapt, the role of generative AI will expand, impacting nearly every facet of the industry, from the C-suite to customer service, and driving growth by personalizing the banking experience for each customer.

Conclusion

In conclusion, Robotic Process Automation (RPA) is revolutionizing the banking industry by enhancing efficiency, reducing costs, and improving decision-making. Real-life case studies demonstrate the significant benefits of RPA in areas such as loan processing, customer onboarding, and regulatory compliance. RPA streamlines processes and increases efficiency by automating tasks that were once time-consuming and prone to error.

It enables banks to reallocate resources more effectively, resulting in cost savings and improved operational performance. Additionally, RPA improves the customer experience by simplifying loan applications, increasing approval rates for different groups, and automating data collection and verification. The integration of AI and machine learning with RPA takes banking to new heights.

By leveraging generative AI technologies, banks can offer personalized services and make data-driven decisions. This not only reduces operational costs but also allows for strategic resource allocation and the delivery of hyper-personalized products and services. Looking ahead, RPA will continue to play a vital role in the banking sector's digital transformation.

As banks embrace technological advancements, RPA emerges as a strategic investment for operating with precision and agility in a competitive landscape. By integrating AI and machine learning into their operations, banks can further enhance efficiency, improve decision-making, and provide exceptional customer experiences. In summary, RPA is a game-changer for the banking industry.

Its benefits include increased efficiency, cost reductions, enhanced customer experiences, and improved regulatory compliance. The integration of AI and machine learning with RPA opens up new possibilities for personalized services and growth. As banks navigate the digital landscape, embracing RPA is essential for staying ahead of the curve and delivering value to customers.

Embrace RPA and revolutionize your banking operations today!