Introduction

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the banking industry, driving a significant transformation and offering immense potential for improvement. With a focus on data, AI and ML technologies can harness valuable information generated from every transaction and interaction within a bank. This allows banks to launch new financial products swiftly, stay ahead of the competition, and enhance operational efficiency.

However, the integration of AI into finance comes with unique challenges that must be addressed for success. This article will explore the technical and business challenges faced by banks, as well as the approach and solution to embracing AI in financial operations. By understanding and overcoming these challenges, banks can navigate the transformative power of AI and achieve a more efficient and customer-centric financial ecosystem.

Background

Artificial Intelligence (AI) and Machine Learning (ML) are not mere trends in the banking sector; they are fundamental forces driving a significant transformation. With a focus on data, every transaction and interaction within a bank generates valuable information that AI and ML technologies can harness.

By doing so, banks are able to launch new financial products more swiftly, stay ahead of the competition, and enhance their operational efficiency. The automation of financial processes, once thought to be futuristic, is now a present reality.

Yet, a Corcentric survey reveals that nearly half of the companies have not automated their financial processes, despite the fact that 80% of financial operations could be automated according to Accenture. This automation could liberate employee time from routine tasks for strategic initiatives and customer satisfaction efforts.

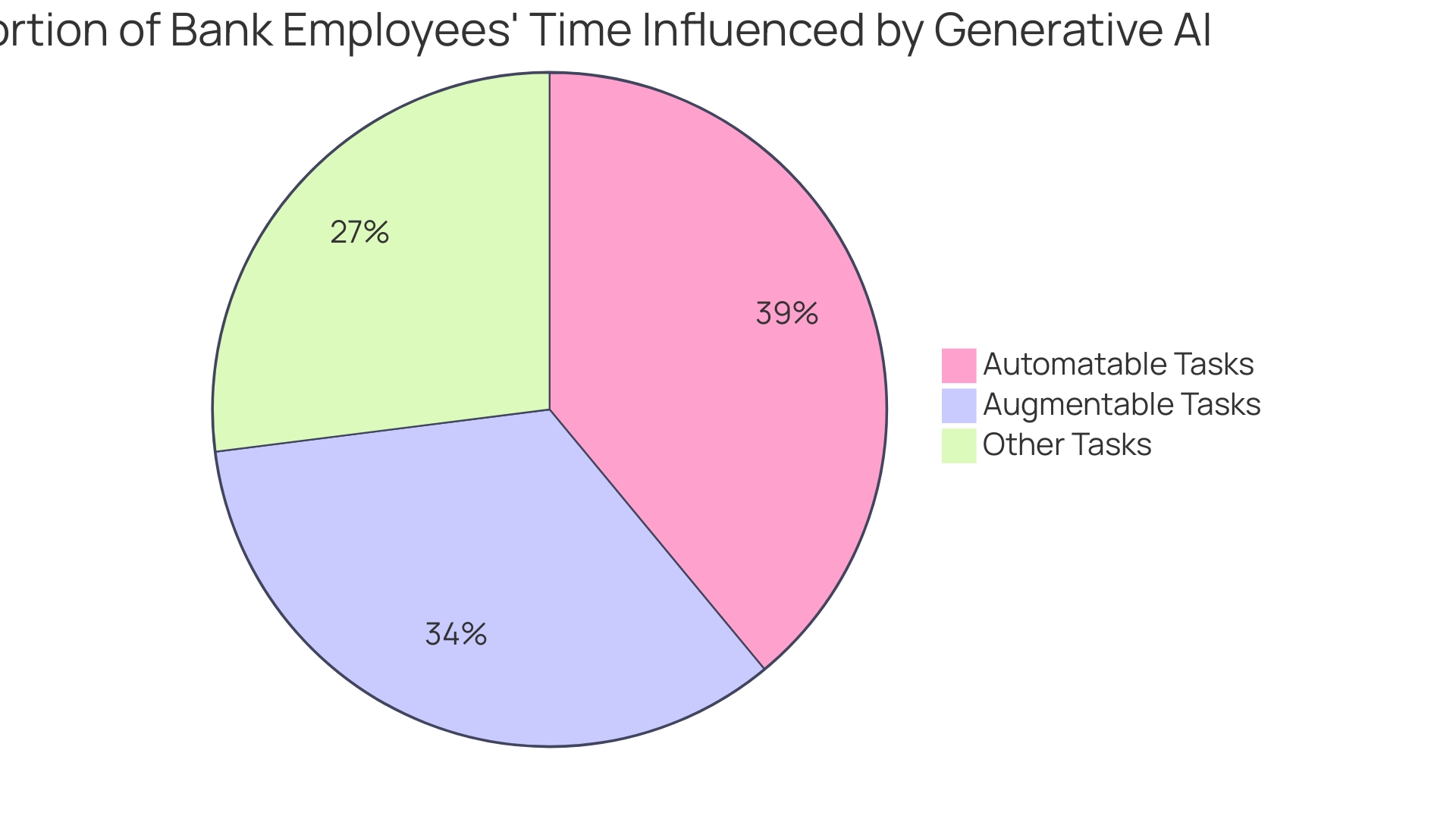

The potential for AI to impact the banking industry is immense. Accenture's analysis reports that 73% of the time spent by U.S. bank employees could be influenced by generative AI, with 39% of that time being automatable and 34% augmentable.

This technology is not just for the back office; it affects every part of a bank, from the C-suite to service frontlines. Moreover, roles that are traditionally data-centric, such as tellers, can experience a significant shift with 60% of their tasks being supported by generative AI. For those in positions that require a high degree of judgment, such as credit analysts or relationship managers, AI tools can empower them by enhancing their preparation and customer interactions. These advancements are not without their challenges, as the integration of AI into finance must address a set of unique hurdles to be successful. Yet, the benefits, such as improved data accuracy and streamlined regulatory processes through automation and interoperability, are compelling reasons for financial institutions to embrace these technologies.

Technical Challenges

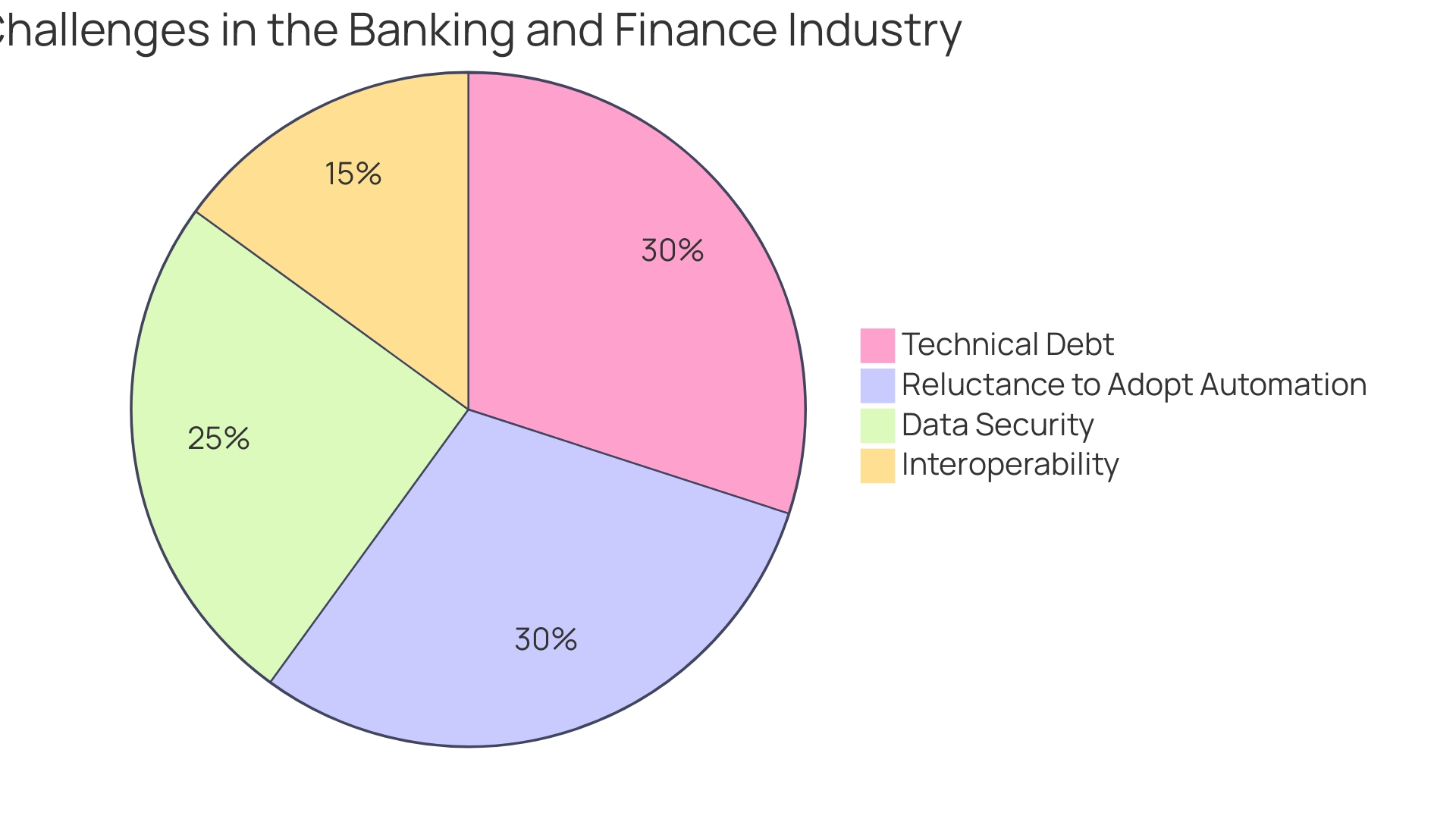

In the realm of banking and finance, technological advancement is not without its hurdles. Banks are tasked with the intricate challenge of melding automation tools into their existing systems, a process that is often hindered by the age-old legacy systems that dominate the industry.

Take Commerce Bank, for example, which grapples with technical debt as it strives to maintain high-quality customer service while transitioning to more modern functionalities. The bank's model of blending sophisticated banking products with a personalized approach underscores the need for a delicate balance between technological efficiency and human interaction.

Moreover, the banking sector is under pressure to maintain data security amidst the adoption of digital solutions. This concern is heightened by the emergence of tech giants like Amazon and Alphabet, who, while providing cloud services to banks, also flirt with the notion of competing directly in financial services.

The situation calls for strategic partnerships and platforms that align with a bank's vision and culture, as seen with TBC Bank's agile transformation aimed at reducing complexity and technical debt. Interoperability is another critical factor, as it ensures data accuracy and streamlines the sharing of information between financial institutions and regulators. This, in turn, fosters more effective regulatory processes. However, despite the potential for 80% of financial operations to be automated, as suggested by Accenture, nearly half of companies are yet to embrace such automation. The reluctance to adopt new applications swiftly, as seen in traditional financial institutions, contrasts with the agility of FinTech competitors, highlighting an existential risk in a rapidly evolving digital landscape.

Business Challenges

Banks are at a crossroads, facing the challenge of modernizing financial operations through automation while managing the resistance to change, training needs, and the evolving roles of their workforce. TBC Bank's ambition to become a digital leader meant tackling complex operations and technical debt. Their agile transformation, aimed at simplifying processes, was met with initial hurdles as the expected improvements in efficiency and customer satisfaction were delayed.

Commerce Bank's strategy to blend traditional banking with modern digital services encountered similar obstacles, particularly in managing outdated systems amidst fierce competition from fintechs. Accenture's analysis reveals that 73% of U.S. bank employees' time could be influenced by AI, with automation and augmentation offering to streamline 39% and 34% of tasks respectively. This underscores the vast untapped potential for automation in the financial sector.

However, the transition is not without its challenges. Roles heavily reliant on data processing, like tellers, could see 60% of their tasks automated, whereas jobs requiring personal judgment and customer interaction could benefit from AI-augmented tools. The introduction of automation, including the deployment of software robots at FAB, which saved 80,000 hours of labor while ensuring compliance, demonstrates the potential for AI to assist rather than replace human roles.

Yet, this technological leap demands a significant skill upgrade. The demand for advanced IT, data analytics, and soft skills like critical thinking and creativity is on the rise, with retraining taking precedence over hiring. With the right strategic partner and a shared vision for the future, banks can navigate these challenges, ensuring technology enhances human interaction and customer service, rather than diminishing it.

Approach

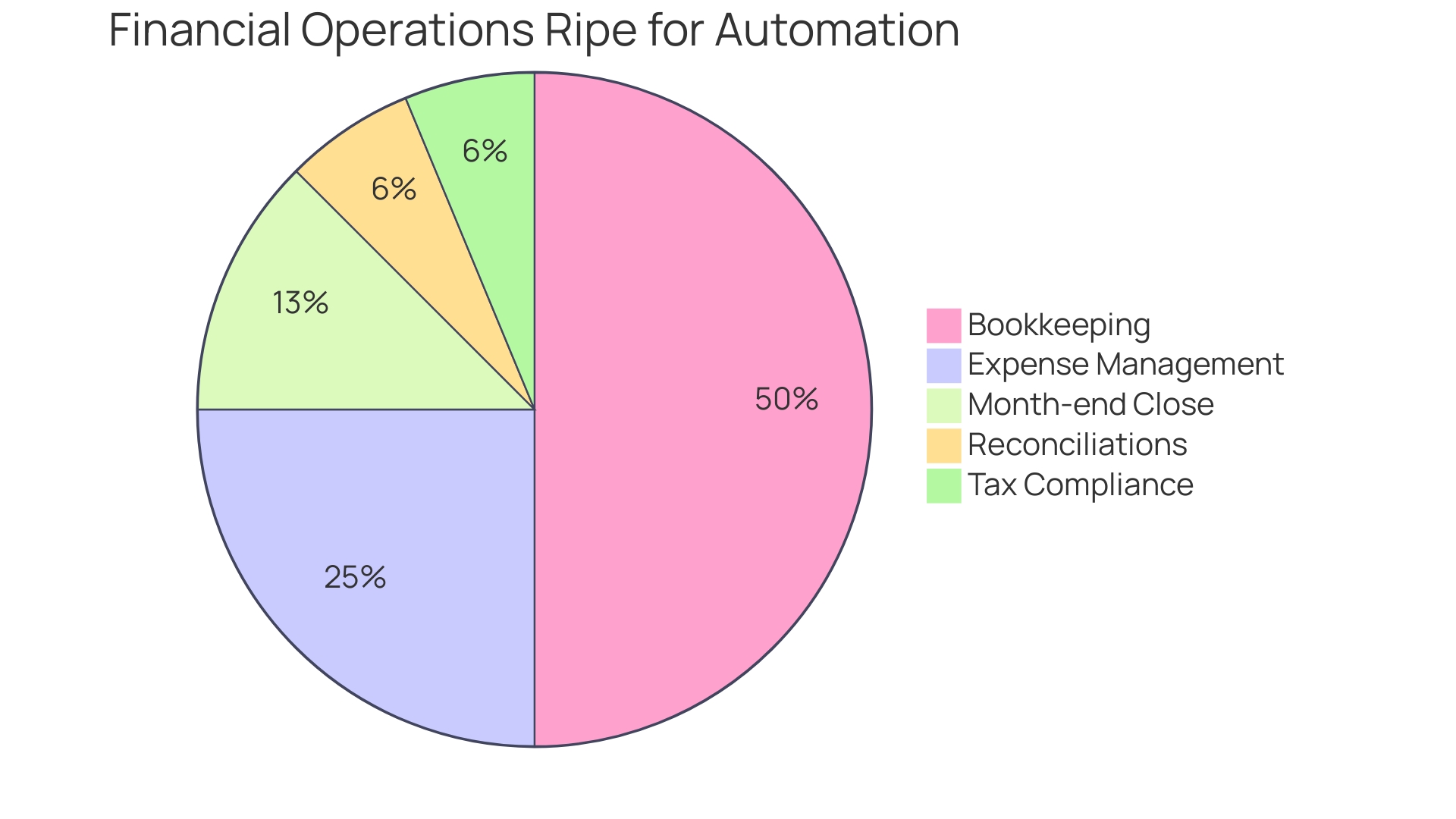

With 80% of financial operations ripe for automation, it's time to embrace the transformative power of AI and ML. These technologies can streamline key financial tasks, such as bookkeeping and tax compliance, ultimately freeing up valuable employee time for strategic efforts.

Despite the potential, nearly half of companies are yet to automate their finance processes. Implementing a financial automation strategy involves a thorough analysis of existing workflows to pinpoint inefficiencies and assess the potential impact of automation on employee productivity.

By conducting qualitative research and a cost-benefit analysis, businesses can identify and implement process automations that resonate with both customer needs and future demands. The integration of AI, as seen with NetSuite's new finance software features, is a testament to the industry's shift towards digital transformation, highlighting the importance of automating mundane tasks. As finance leaders aim to maximize employee time on high-impact tasks, the input of process experts is crucial for identifying the most beneficial areas for automation. In an economic landscape where agility and data-driven decision-making are key, the decision to automate financial processes is not just an operational change but a strategic imperative.

The Solution

Artificial Intelligence (AI) and machine learning are revolutionizing the banking industry by automating critical processes, enhancing efficiency, and improving the customer experience. For example, First Abu Dhabi Bank (FAB) harnessed the power of AI by deploying software robots to automate the verification of customer identities and passports. The result?

An astounding 80,000 hours of labor saved annually, enabling employees to focus on higher-value tasks. This strategic move not only streamlined operations but also ensured stringent regulatory compliance, significantly reducing the risk of costly fines. The impact of AI in open banking is equally transformative.

It consolidates financial data across multiple institutions, providing a real-time, holistic view of finances. This transparency empowers customers with improved financial planning and decision-making. AI algorithms delve into users' behaviors and preferences, offering personalized financial service recommendations, from credit cards to investment opportunities.

Moreover, the shift towards AI-driven open banking platforms has led to a more user-centric and secure financial ecosystem. This evolution in banking, highlighted by industry leaders, underscores the potential of AI to create deeply personalized and human-centric customer experiences. As businesses in sectors like banking continue to adopt AI, we can expect a surge in efficiency and a reimagined approach to customer service, where the mundane is automated, and the personal touch is enhanced.

Enhancement

The integration of AI in financial operations is not just a trend but a transformative force. AI algorithms are not only improving accuracy in financial tasks but also bringing real-time insights that drive informed decision-making.

Consider the insights from Shagun, an expert in financial automation, who points out that despite the common use of automation in consumer banking, such as direct deposits and bill payments, the finance departments within organizations lag behind. Yet, with 80% of financial operations ripe for automation, according to Accenture, there's a substantial opportunity to revolutionize how financial tasks are managed, freeing up valuable time for strategic initiatives and enhancing customer satisfaction.

AI's potential impact on the finance sector is staggering. A study shows that 73% of banking employees' work could be influenced by generative AI, with 39% amenable to automation and 34% to augmentation.

For example, roles like bank tellers could see 60% of their routine tasks automated. The promise of AI extends to improving operational efficiency, reducing overhead, and mitigating risks such as fraud.

Ai's continuous learning capabilities can adapt to new fraudulent tactics, detecting subtle behavioral anomalies that might escape human analysis. Moreover, AI democratizes access to financial services, making personalized investment advice accessible to more individuals. However, embracing AI must be done with an eye on ethical considerations, particularly in data protection and compliance with regulations like GDPR. As the financial industry continues to integrate AI, it will be paramount to navigate the balance between leveraging customer data for insights and maintaining privacy to foster trust and avoid legal issues. The finance industry is on the cusp of an AI-driven transformation that promises a more efficient, secure, and inclusive financial ecosystem.

Conclusion

In conclusion, the integration of AI and ML technologies in the banking industry offers immense potential for improvement. By harnessing valuable data, banks can launch products swiftly, stay ahead of the competition, and enhance operational efficiency.

However, challenges such as technical hurdles and managing resistance to change must be addressed. A strategic approach involving workflow analysis and partnerships with providers who share the bank's vision is crucial.

The solution lies in leveraging AI to automate processes, enhance efficiency, and improve the customer experience. Examples like software robots for identity verification showcase the time-saving potential of AI.

Open banking platforms powered by AI offer real-time insights and personalized recommendations. AI has the power to revolutionize financial tasks by improving accuracy, driving informed decision-making, and democratizing access to personalized services. However, ethical considerations regarding data protection and compliance are essential. In summary, embracing AI in financial operations is a transformative force that can revolutionize how banks operate. By understanding and overcoming challenges while prioritizing ethics, banks can navigate towards an efficient, secure, and inclusive financial ecosystem powered by AI.

Harness the power of AI and ML to revolutionize your banking operations today!